views

A month after its launch and two weeks after the finance minister reviewed its functioning, technical glitches continue to mar the functioning of the new income tax portal as certain key utilities like e-proceedings and digital signature certificate are not yet functional, say chartered accountants. Also, some overseas firms have been facing problems in logging into the portal, they said. Even after two weeks of the meeting and over a month of the portal launch, users still continue to encounter multiple problems like unable to file I-T returns for past years, download intimation notice u/s 143(1) for AY 2019-20 and earlier years, and Form- 3 under ‘Vivad se Vishwas Scheme’ is not visible on the portal.

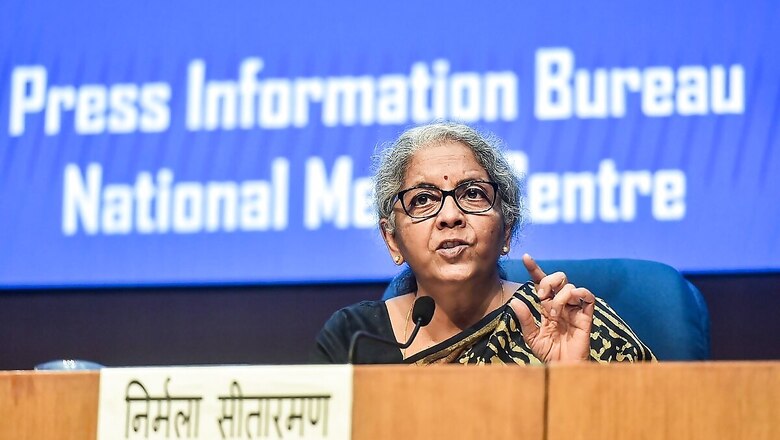

When contacted, the Income Tax department said it is continuously engaged with the developer Infosys to expedite resolution of issues like log-in and ITR filing on the I-T portal. The much-touted new income tax portal ‘www.incometax.gov.in’ had a bumpy start from the day of its launch on June 7 as it continued to face tech glitches, which prompted Finance Minister Nirmala Sitharaman to call a meeting on June 22 with officials of Infosys which has developed the new website.

The I-T department said presently, users are reporting some issues related to non-availability of Income Tax Return 3, 5, 6 and 7 and rectification functionality, issues in ITR filing, e-verification or login to the portal in certain cases or technical issues in filing of certain statutory forms. “The Department is continuously engaged with Infosys to expedite the resolution of any pending issues and to make available all balance functionalities at the earliest. The Department is also taking corrective measures based on feedback from taxpayers, tax professionals and representatives of ICAI to provide taxpayers with a smooth e-filing experience,” the Central Board of Direct Taxes (CBDT) said.

Senior officials in the Finance Ministry are having meetings and feedback sessions with team members from Infosys and external stakeholders such as ICAI on a regular basis. In response to queries on the glitches on I-T portal, Infosys said, We’re in our silent period. Clarity on the income tax matter was provided at our recently concluded AGM. Infosys in 2019 was awarded a contract to develop the next-generation income tax filing system to reduce processing time for returns from 63 days to one day and expedite refunds. BDO India Partner (Tax & Regulatory Services) Amit Ganatra said after the meeting of the Finance Minister with the Infosys team on June 22, it appeared that all the pending issues would get resolved quickly. While there has been improvement in the functioning of the site thereafter, it seems that the technology-related challenges still persist and it may take some more time to get the site up and running completely.

The e-proceedings tab is not fully functional, online rectification option is not available, JSON utility for filing tax returns in ITR 5, 6 and 7 is still not available and unlike the earlier website there is no tab for the VsV scheme for providing comprehensive information and no update of the pending actions tab, these are some of the functionalities amongst others that remain to be addressed in the new tax portal, Ganatra added. Dhruva Advisors LLP Partner Sandeep Bhalla said Form 15CA/CB utility (relating to remittances) is still awaited. While physical filing of the same is permitted, it is a time-consuming process. This is a time when companies declare and pay dividends and physically filing Form 15CA/ CB for remittance to each shareholder can be a task. “Also, the DSC is now required to be registered on the personal e-filing account of the authorized signatory. In the case of foreign companies having non-resident authorized signatories not having a PAN in India, it is unclear as to how this procedure will work. In fact, for such foreign companies, an error is being encountered even at the time of attempting to login onto the e-filing portal,” Bhalla added.

Industry chamber PHDCCI’s Direct Taxes Committee Chairman Mukul Bagla said the new income tax portal is expected to improve efficiency in tax return filing alongwith general tax administration. However, since the portal has major glitches even till date, the income tax work of taxpayers and tax professionals is seriously hampered. Listing out some of the glitches on the portal, Bagla said the taxpayer is not able to file ITR u/s 148 of the Income Tax Act for earlier years as download of utility is happening erratically and attachment of digital signature is not taking place consistently even though the return is required to be filed within 30 days of receipt of notice.

Also in many cases, OTP is not reaching the taxpayer for e-verification of ITR. In the e-proceeding tab, replies cannot be filed as OTP is not reaching to the authorised representative. This is creating major problems as proceedings are getting time-barred. In cases where tax demands have been raised, there is no option to send a request for obtaining intimation u/s 143(1). The taxpayer is not able to file applications u/s 154 for rectification of mistakes as tab is not available.

The modification of master data of the taxpayer is having major issues and Form No. 3 (certificate of declaration) under Vivad se Vishwas Scheme is not visible on the portal. “The tax portal serves as the depository of all documents filed with the income tax department. However, the taxpayer is unable to download most documents from the portal like forms filed in earlier years. The portal in the current form is very slow as compared to the earlier portal,” Bagla added.

Deloitte India Partner Saraswathi Kasturirangan said certain functionalities such as checking the status of e-proceedings, filing of grievance petitions etc were not initially operational, and are now enabled, clearly indicating that the utility of the portal is being expanded. “Functionalities such as online filing of rectification is yet to be enabled. From a practical perspective, filing of tax returns with the new JSON utility still has challenges which hopefully will be sorted soon,” Kasturirangan added. The CBDT in its response to .

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment