views

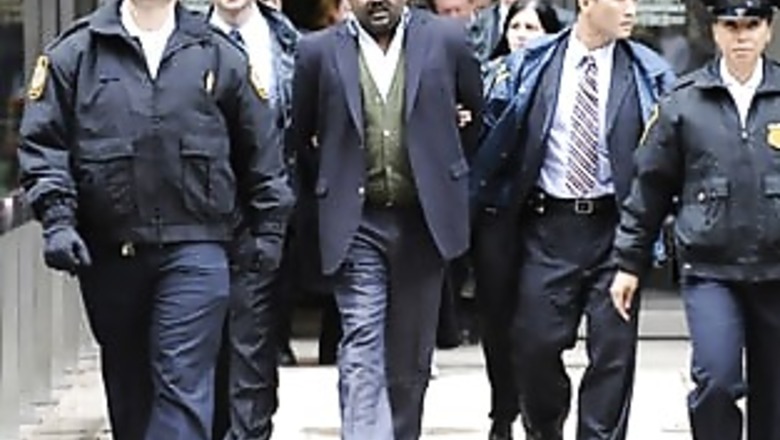

Colombo: A Sri Lankan-born billionaire's arrest in the largest US hedge fund insider trading case triggered new scrutiny on Monday in his native country over the possibility his money found its way to Tamil rebels.

US authorities on Friday charged Raj Rajaratnam, the 52-year-old founder of the Galleon Group hedge fund, and others with making up to $20 million in illegal profits through a network of secret informants.

The arrest sent ripples through Rajaratnam's native Sri Lanka, where he is at once viewed with admiration for his success and suspicion because of at least $5 million US records show he gave to the Tamil Rehabilitation Organization (TRO).

Rajaratnam has not been charged with any crime in Sri Lanka, nor has the United States charged him in the case of the TRO.

The TRO's funds were frozen in both countries after they were found to have been channelled to the separatist Liberation Tigers of Tamil Eelam (LTTE), defeated by the army in May to end a 25-year war.

But both the central bank, responsible for tracking financial crimes, and the Sri Lankan Securities and Exchange Commission said they were probing Rajaratnam and his dealings.

"The TRO investigations are continuing. It's not clear yet. The involvement of the Galleon fund with funding the TRO is also being probed," Central Bank Governor Ajith Nivard Cabraal told Reuters in Jaffna.

In a sign of Rajaratnam's influence on the Sri Lankan market, either as an investor or through Galleon Group, the Colombo Stock Exchange had its biggest intra-day drop in five years before recovering to close down 1.56 percent.

Higher economic growth hopes, more market liquidity, a $2.6 billion International Monetary Fund loan, an upgraded rating outlook and foreign inflows have all boosted investor confidence since the end of the war.

The Sri Lankan foreign ministry had passed an intelligence dossier on Rajaratnam to US authorities in 2007, around the time the TRO was being investigated by the U.S. Treasury, two Sri Lankan officials familiar with the matter said.

The United States, Sri Lanka and Britain all have put the now-defeated LTTE on their banned terrorist organisation lists.

The Sri Lankan stock market regulator said it had no suspicion of any untoward dealings by Rajaratnam in its market, but said it would investigate his trades nonetheless.

PAGE_BREAK

"We are looking at his recent transactions closely. Given what has unfolded in the US, in light of that, we want to look at his positions here," Sri Lankan Securities and Exchange Commission Director-General Channa De Silva told Reuters.

The Galleon Group has had as much as $7 billion in assets under its control. By comparison, the total value of outstanding shares on the Colombo Stock Exchange was $8.63 billion on Monday.

Rajaratnam's arrest in the insider trading case renewed earlier questions about possible links he may have had to the Tamil rebels. Rajaratnam has long denied any involvement with the LTTE, which operated extortion and fundraising networks that brought in an estimated $200-300 million annually at their peaks.

The Wall Street Journal this weekend reported that federal agents had identified Rajaratnam as "Individual B" in the indictment against the US head of the LTTE.

The indictment quotes letters among LTTE officials saying "Individual B" had a long-lasting desire to meet and discuss with the national leader," in reference to LTTE founder Vellupillai Prabhakaran, killed in the final days of the war.

However, a Sri Lankan military intelligence official told Reuters on condition of anonymity that Rajaratnam had a "very cordial relationship" with the present government. Last month, he pledged $1 million to help rehabilitate former LTTE fighters.

Comments

0 comment