views

Hire key members of your team prior to speaking with investors.

Having an organized team shows you’re ready to start or grow your company. Make sure you have solid operational and financial leadership in place before you try and get financing from investors. In addition to having key members hired already, be ready to communicate your plan in terms of future employees to investors. For example, you should have at least the basis of a customer service team in place and ready to go before you actually start selling any products or services to customers. If your company is a startup, you should have at least the key figures on board. For example, if you’re starting a software company and you’re the CEO, you might have a CFO, a marketing director, and a head programmer signed on. A leadership team with a background in successful ventures looks great to potential investors.

Do industry research before you pitch to investors.

Investors want to see that you know the industry you’re getting into. Research your competition to understand where your company fits into the market. If you’re producing a product, find out the costs of materials and production. Decide how much you have to pay employees and how much things like office space cost. Come ready with facts from market research and industry experts that you can quote to potential investors. For example, if you’re starting a software company, you can say something like: “Last year alone the software industry grew by $3 billion, which shows the exponentially growing market demand for new software products.” This information can help you quantify your company’s business opportunities and prices to investors. While you're at it, conduct some research about potential investors before you talk to them. Dropping some facts about them and their prior ventures shows you’ve done your homework and helps score points.

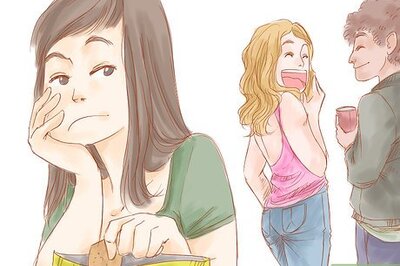

Try to soft-sell your idea at networking events.

This allows you to speak with potential investors in an informal setting. Attend networking events within the local startup, entrepreneur, and investing community. Mention your startup or existing business naturally and let a conversation develop organically. If a potential investor is interested in your idea, chances are they’ll keep asking you about it. If you speak to someone who you think might be interested in investing in your business, ask them if they would be open to meeting one-on-one some time and exchange contact info. Then, you could try to set up a casual lunch to discuss your needs for financing further.

Apply to startup accelerator programs.

This can be a way for first-time entrepreneurs with startups to meet investors. Join a startup accelerator to build your network and take advantage of their mentorship opportunities. Even if you don’t meet investors through the startup accelerator, just being a part of one can make your business more appealing to potential investors. Startup accelerators are fixed-term programs that support startups through mentorship and education, as well as financing. So, if you get accepted to one, you should at least get some money to help develop your business while you look for investors.

Post your business on online fundraising sites.

This can help you get financing from people anywhere in the world. Create a profile with an executive summary of your business and fill in all the available fields with as many details as you can. Highlight your best metrics with real numbers about your business’s success so far or about your projections if you haven’t started selling anything yet. For example, if you have a new app and it’s live already, you can say how many customers downloaded the app within your first 3 months of operation. If you are developing an app that isn’t live yet, you can highlight members of your team by saying things like: “Our head developer, Pete Maggi, has previously helped develop 3 apps that were purchased by Google within their first 3 years of operation.” Include screenshots of your product or prototypes as appropriate.

Sell your company’s story to potential investors.

Real-life stories go a long way towards convincing investors to invest. Craft a story about you saw a problem in the market and how your company aims to solve that problem. Emphasize how people will benefit in real life from purchasing your products or services. For example, if you’re trying to get investments for a company specializing in boots for dogs in New York, explain how you heard people with dogs in the city complaining about how their paws got so dirty and muddy during the winters and tracked it all over their apartments. Then, go into your product description or demonstration to show how your dog boots will change lives.

Speak clearly, concisely, and audibly when you pitch to investors.

The way you present and talk gives investors a first impression. Make eye contact with investors and speak directly to them. Keep in mind investors are usually meeting with more people than just you, so if they don’t get what you’re saying it’s easy for them to write you and your business off and move onto the next presentation. You can use aids like a slide presentation to help you get your ideas across, but it’s still important to speak clearly and explain what you’re showing to potential investors.

Be transparent about your company’s circumstances.

Investors want to hear real, verifiable information. Be honest about the stage of development your company is at, your employees, and your investment needs. Potential investors look into businesses before committing funds, so if you’re dishonest you’re likely to blow an opportunity. If investors discover you’ve misrepresented something after already investing their money, it can even lead to legal action on their part, so honesty is always the best policy!

Explain how you plan to use the money.

This makes potential investors confident that their money will be put to good use. Give them details on how you will allocate funds between things like recruitment, operations, production, marketing, and other areas of your company. Mention specific milestones and timelines for putting the money to work. For example, if you’re asking for $50,000 to put into your taco truck, you may say that $20,000 will go towards purchasing equipment and refurbishing the truck you already have, $5,000 will go towards marketing, and the other $25,000 will cover operating costs including paying employees.

Show investors prototypes of your product or service.

Prototypes make your vision real for investors to see themselves. Use conceptual prototypes, such as illustrations, to show investors your product or service on paper. Create functional prototypes if possible to give potential investors a hands-on, personal experience of your product. For example, if you’re looking for investments for a hot sauce company, provide each potential investor with samples of the hot sauce you want to mass-produce and some tortilla chips or other bite-sized snacks, so they can try your sauce on the spot.

Highlight what’s unique about your company.

Investors have opportunities to invest in many similar companies. Explain what sets your idea apart from the competition or why it’s needed in the current market. If you’ve already begun selling, gather some real customer testimonials or reviews to show investors the potential for your product or service. For example, if you’re manufacturing chairs, don’t just show how they look. Explain concepts behind the design, such as how they’re made to reduce back pain or some other unique factor. If you already have sold some, ask customers to send you their opinions about how comfortable the chairs are.

Project realistic investment returns.

Investors only commit to projects they believe they can make money from. Provide sales and cost forecasts to show your expected profits and the investors’ expected return on capital. If you’ve already sold products or services, present real data on the cost of the transaction. For example, if you’re trying to start a shoe company, provide details on the production and marketing costs for the first 10,000 pairs, then show how much you can sell all those shoes for and explain how much return on their investments the potential investors will receive.

Commit only to what you can deliver on.

Be realistic about what investors stand to gain from giving you funds. Don’t over-promise on how much you can sell or overstate the potential for return on investments. Be precise with the numbers you show to investors and make sure everything adds up. If you oversell yourself when you’re talking to investors, there’s more of a chance of them backing out at the last minute when they see your company is not ready to deliver what you said it could.

Contact potential investors after you speak to them.

You probably won’t get immediate answers from investors. Reach out to people you presented your proposal to shortly after doing so and thank them for their time. Ask if they have any feedback that could help you sell your project more effectively. Don’t give up if you aren’t getting investors committed right away. Keep in touch with them and keep trying to sell your idea until they say either “yes” or “no.” Persistence also shows commitment to your idea and can help sway potential investors to join your project.

Comments

0 comment