views

Preparing to Draft the Amendment

Locate the original living trust agreement. Dig up your original trust agreement, as the amendment will need to refer to specific language and articles contained in the trust. The amendment will also need to be attached to the original trust agreement once it is complete.

Discuss with your spouse. If you and your spouse created a shared living trust, then both of you must agree to the amendment. Accordingly, you should get your spouse’s approval before beginning the amendment process. Both spouses will also need to sign any amendment to a shared trust, so it may be helpful to include your spouse in the amendment process.

Decide which items or articles you will amend. Review the current agreement to determine the item or article numbers in need of amendment and decide exactly how you wish to modify each. New articles may also be added to the trust through the amendment. For example, you may wish to add a new beneficiary to the trust. If you had a new child, you might want to add him or her as a beneficiary. You may not have to amend the trust if you purchased new property. A properly drafted trust should contain a clause giving you the right to add property to the trust after having drafted it. You do so by retitling the property to the trust and adding the property to the schedule list at the end of the trust. However, if you want to leave the new property to a beneficiary not named in the trust, then you would have to amend it. If you have questions about whether you should amend your trust, then contact an attorney.

Meet with a lawyer. You might want to talk with an attorney about making changes to the living trust. A lawyer can clarify when an amendment is needed and when one isn’t. If costs are a concern, then know that some attorneys now offer “unbundled” legal services. Under this arrangement, the attorney will perform limited, discrete tasks (such as answering questions), often for a flat fee. Unbundled services are not allowed in every state. Call an attorney and ask ahead of time if you are interested in meeting with someone to discuss amending your trust. Meeting with a lawyer is not required. However, you should probably meet with your lawyer if your trust is very complex or if you have made multiple amendments over the course of the past few years. If you have made multiple amendments, you may want an attorney to draft a “trust restatement,” which incorporates all of the amendments. This can make for a cleaner trust that is easier to understand and administer.

Drafting the Amendment

Create a new document. You will amend the trust by drafting an amendment, which is a separate document. Open a new document in your favorite word processor and choose a standard font, such as Times New Roman or Arial with font size 12. If you remember what font type was used in the original trust agreement, it is best to keep the same font style for your amendment. Do not tear sheets out of your trust document and type over them. Nor should you scrawl changes over the page. Doing so could invite a legal challenge on the grounds that the original trust is invalid.

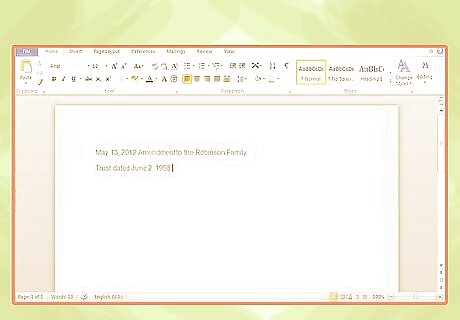

Title your document. You should call your document an “Amendment” and include the name of the trust the amendment will modify, as well as the date of the amendment. For example, if you are amending the Robinson Family Trust, which was executed on June 2, 1998, you might title the Amendment, “May 13, 2012 Amendment to the Robinson Family Trust dated June 2, 1998.”

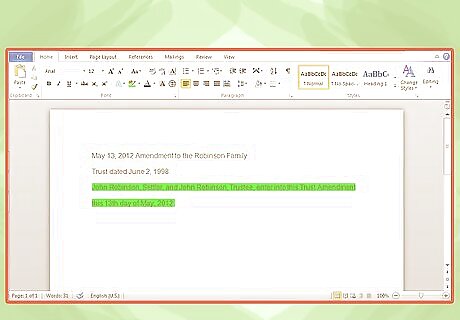

Name the parties and date the amendment. The parties to a trust include the settlor and the trustee. Generally, when the trust is first set up, the settlor is also the trustee. If this is the case, simply name the settlor/trustee as both, for example, “John Robinson, Settlor, and John Robinson, Trustee, enter into this Trust Amendment this 13th day of May, 2012.”

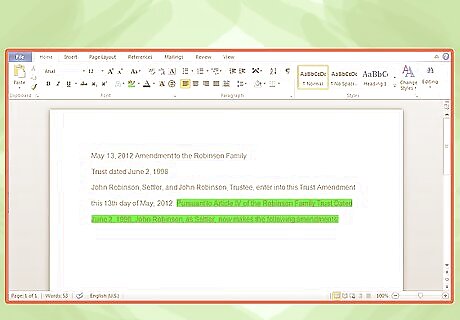

Identify the article that allows amendments. The original living trust should have an article that specifies the settlor may make amendments. You will want to state which article allows for amendments. For example, if Article IV allows the settlor to modify the trust, you will want to say something like “Pursuant to Article IV of the Robinson Family Trust Dated June 2, 1998, John Robinson, as Settlor, now makes the following amendments.” If no article in the original trust authorizes amendments, then you should consult with a lawyer. An entirely new trust may need to be drafted, which can require revoking the trust.

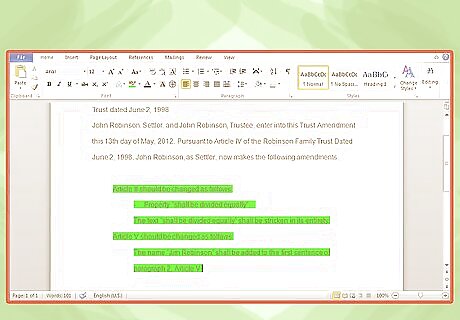

Describe the modifications. Be sure to provide enough detail that is it clear what exactly is being added or removed. Some guidelines to follow when describing modifications include: Use item or article numbers. Specify the item or article to be modified. A trust is generally divided into items or articles which are numbered in some way (e.g., Item I, Item II, Item III, etc.) When referring to the text, state the specific item or article to which you are referring and the paragraph and/or sentence number if necessary. You can type, for example, “Article II should be changed as follows:” Quote the original trust where necessary. When removing text, quote the part of the text to be removed. For example, you can state: “the text ‘shall be divided equally’ shall be stricken in its entirety.” Be specific about placement. When adding text, be very specific about where you are adding it. You can do this by referring to paragraph and sentence numbers. For example, “The name ‘Jim Robinson’ shall be added to the first sentence of paragraph 2, Article V.”

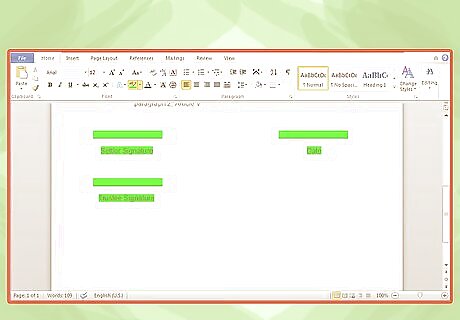

Create a signature block. A signature block includes a line for each party to sign, with his or her name and title (settlor or trustee) below the line. You should also add the date.

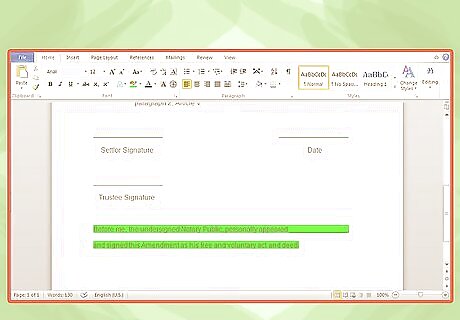

Include a notary block. The notary block should include a sentence stating that the settlor and trustee appeared before the notary and signed the amendment voluntarily. Include a line for the notary to sign and space for the notary’s stamp or seal. A common format for the notary statement is, “Before me, the undersigned Notary Public, personally appeared John Robinson, and signed this Amendment as his free and voluntary act and deed.” Search your state to find acceptable notary blocks.

Finalizing the Amendment

Have an attorney review. If you did not get a lawyer’s input before drafting the amendment, then you may want to have one look over your draft after it is finished. Try to give the attorney a week or so to look over the amendment.

Sign in front of the notary. Both the settlor and the trustee will need to sign in front of a notary. Have the notary sign and stamp or seal the amendment. You can find notaries in most courthouses, banks, or city clerk’s offices. You can also find notaries by visiting your state’s Secretary of State website, which should have a list of notaries or a search engine. Be sure to bring sufficient identification. Generally, a valid driver’s license or passport will suffice.

Attach the amendment to the living trust. Take the original and attach it to the back of your living trust. Store the living trust and attached amendment in a secure location, preferably in a safe deposit box or in a home safe.

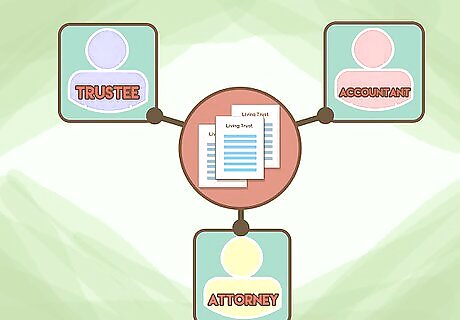

File and distribute copies, if necessary. If you had to file your original living trust document with your county records department, then file the amendment there as well. You should send a copy of your amendment to any party who has a copy of the living trust. People you may want to send it to include: the trustee your attorney your accountant anyone named as an agent in a power of attorney form

Comments

0 comment