views

Conducting Pre-Auction Due Diligence

Contact a specialized attorney or real estate agent. If you are inexperienced with the land auction process in your locale, it may be worth your time and money to hire help. Real estate attorneys and agents will be able to help you get your ducks in a row prior to the auction date. In addition, they will be able to help you reasonably value the property you are interested in so you do not overbid. If you are the successful bidder, attorneys and real estate agents will prepare closing documents and help with the transfer of ownership. To hire an attorney, visit your state bar's website and locate their lawyer referral service. This will allow you to talk to someone about your needs. In return, they will give you a number of qualified attorneys to contact. To hire a real estate agent, look online for brokers or companies that offer auction services. In addition, because you are looking for land, as opposed to residential or commercial property, try to find an agency that specializes in that area.

Find land auctions near you. Land auctions take place all around the United States and can be conducted by governments or private auction houses. Start your search by visiting county treasurer or tax collection websites. Public (i.e., government) land auctions are often conducted by the county where the property is located. In addition, check your local newspaper for auction notices in your area. Finally, find private auction houses in your area that sell land. These are particularly prevalent in rural areas. In recent times, land auctions have also gone online. Check with your county to see if they offer this service. For example, Palm Beach County, Florida offers an online auction service for their foreclosed properties.

Attend auctions as an observer. In order to get comfortable with the auction process and the auctioneer (e.g., private, public, or online auctions), visit multiple auctions and simply observe. See how the auctioneer runs their activities, assess the requirements regarding finances, observe other auction goers to get an idea of their demeanor, and analyze the typical lands up for auction. All of these things will give you a great idea of who you want to work with in the future.

Keep track of properties that come up for sale. As time passes, auction brochures will be placed online or at the auction house. These brochures will contain information about the land up for auction. The information will generally include: The parcel number The amount of land available The specific location of the land Access points, including right-of-ways Where you can find the survey (usually at the county recorder's office) Restrictions Other notes

Check the terms and conditions of the auction. Most auctions have a set of terms and conditions that go along with their sales. This document will lay out exactly what you can expect if you purchase land from that auction. For example, the Michigan Department of Natural Resources includes the following information: What types of properties are offered What the minimum bid prices are Whether there is a reserve on a particular piece of land (i.e., will it not sell if the bidding doesn't reach a certain price) The type of title that will be conveyed When property taxes will be due How and when you can get possession of the property Conditions of the sale

Schedule a tour of the property. Once you find a property that interests you, set up a time to view the land. If you are working with a private auction company selling land that is not subject to a forced sale (e.g., for delinquent taxes or foreclosure), you will usually be able to walk through the land and assess it. Call the private auction house you are working with and ask if they offer tours. If so, schedule a time that works for you. If you are looking at purchasing land that is going through a forced sale, you may not be able to gain legal access to the property. This is the case because the government or bank auctioning off the land does not yet have an ownership interest in the land. Technically, it still belongs to the borrower or delinquent taxpayer. If you are in this situation, you can still visit the property and view it from public space. Do not, however, walk onto private land without the landowner's permission.

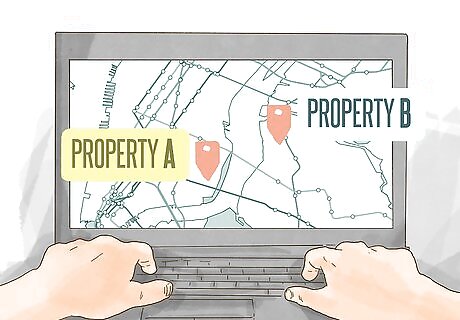

Study comparable properties. In order to get an idea of the value of the land you are interested in, you need to look at comparable pieces of land nearby. For example, if you are looking at buying farmland in South Dakota, you should look at the appraised value of the next door neighbor's land, or have an appraisal done on the land you are looking at. Do this with multiple properties nearby to get an estimate of what the auction land may be worth. It is important to accurately value the auction property as it will dictate how much you are willing to bid and how much financing you will need to have in place.

Secure financing. Once you estimate the value of the property you are interested in, you need to figure out a way to pay that amount (in case you are the highest bidder). Some auctions, generally private auction houses selling land at-will, allow you to finance your purchase (i.e., get a mortgage). However, a lot of auctions, usually forced sales, require you to pay the full purchase amount as soon as the auction is complete. Call the auction house with the land you are interested in and ask about their financing policy. If you are allowed to finance your purchase, get pre-approved for a mortgage. When you go to a bank, they will assess the likely value of the property, inform you of the max bid you could make, give you estimated closing costs, and determine your eligibility. If qualified, the bank will promise to finance your purchase if it goes through. If you cannot finance your possible purchase, you will need to gather the cash required to complete the purchase at the time of the auction. Regardless of your financing options, most auction houses will require a down payment on the land when you bid for it. For this reason, be sure you have enough funds to cover the down payment before you ever go to the auction.

Get title insurance. Different types of auction sales will convey different types of deeds. Usually, in force tax sales or foreclosures, the auction house will convey a quit-claim deed when you purchase the land. In other words, the individual or government only promises to transfer to you whatever ownership interest they have, if any. If the property comes with liens or other encumbrances, you will be responsible for disposing of them. If you will be conveyed a quit-claim deed, you need to purchase title insurance if you can. Title insurance will protect you against unforeseen problems that may arise after you purchase the land. In at-will sales, an auction house and seller may convey a general warranty deed. With this type of deed, the seller is guaranteeing against future problems and is insuring you against other issues. If the seller is conveying this type of deed, you may not have to purchase title insurance.

Attending the Auction

Confirm specifics with the auctioneer. A day or two before the auction, contact the auction house, or government agency responsible for the auction, and confirm the time, date, and location of the auction. Auction times can change depending on what is being put up for auction that day. If things change, you will want to know ahead of time.

Arrive early. Auctions are quick and if you do not arrive early, you may miss the action. In addition, before you can bid, you will need to register, sign in, fill out paperwork, and provide adequate evidence of your ability to pay if you win. These tasks take time and will need to be completed before the auction starts. Therefore, you should arrive at least 30 minutes early.

Make a down payment. A down payment is generally required to evidence your ability to pay if you win. The amount of the down payment will usually depend on what you are bidding on and what it is valued at. You will be required to pay a percentage (e.g., 5-15%) of the lands value before the bidding starts. If you are the high bidder, your down payment will go towards the final price you owe. If the auction allows financing, the down payment will usually be held in escrow until closing, at which time it will be added to your final payment. If you are required to pay in cash, your down payment will simply be subtracted from the final purchase price. If you are unsuccessful at the auction, your down payment will be returned to you promptly, in whole.

Bid on the property. Once the auction starts and the piece of land you are interested comes up for sale, the bidding will begin. The auctioneer will start the bidding with the minimum and the price will move up as individuals bid. You will either have a paddle with a number on it, or you will simply raise your hand, in order to bid. You should bid until the price reaches the maximum you are willing and able to pay, at which time you should let the property go. While you may like the property in question, you never want to pay more than it is worth. If you are the successful bidder, the auctioneer will take down your information.

Finalizing the Sale

Enter the closing period. Once the auction is over, you will be required to speak with an administrator about how to finalize your purchase. Depending on the auction house, you may be required to pay the final price immediately, or you may enter a brief period of closing. The closing period for land sales at auctions are generally between 45 and 60 days. During this period you will get your affairs in order and prepare to pay the final purchase price.

Finalize financing. If you were able to finance your purchase, you will have to go back to the bank with your pre-approval and sign a mortgage. When you sign your mortgage agreement, the bank will release funds to pay for the cost of the land. During the closing process, which includes finalizing the mortgage, you may be required to view or fill out some of the following documents: The closing disclosure, which lays out the conditions and terms of your loan An initial escrow statement, which lists the taxes and other payments the lender foresees having to pay during the first year of your loan A promissory note, which lays out how much you owe the bank and how it will be paid back

Pay the final price at closing. On the day of closing, you will transfer the purchase funds to the auction house, the government, or the seller, depending on how it has been set up. Once the full purchase price has been paid, you will receive possession of your land. If you bought it from an at-will seller, you should receive possession without issue. However, if you bought it through a forced sale, you may have to take further ejectment or eviction actions in order to gain possession. Depending on where you live, you may need to serve the holdover possessor with a notice of ejectment before you can bring a civil lawsuit to have the court help you. In other places, you may be able to file a lawsuit directly with your local civil court. At that point, you would serve the holdover possessor with a copy of your complaint and a summons.

Comments

0 comment