views

Forming a Plan

Determine the reason for buying the land. Buying raw land is different than buying a home, and there are many questions a potential buyer needs to ask before starting the process. Some key questions include: Why are you buying this land? Are you hoping to build a home on the land? Are you planning to farm there, and set up a ranch house and agricultural plots? Are you buying it in hopes it increases in value over time? The answer to all these questions come with specific risks and considerations, and having specific plans for your land is necessary before you begin the process of looking. There are a variety of reasons people buy raw land, including: Farming/ranching. Building a house or home. Diversifying one's portfolio. Speculation (hoping the price will increase later).

Come up with a budget. Your budget will need to include money for several steps that most other land and home purchases do not, as well as the common expenses of purchasing land. Plan to include money for the following in your budget: Due diligence. You will need to conduct a lot of research regarding the land you want to purchase that is usually not necessary for developed land. Down payment. If you are purchasing the land to develop a farm or ranch, you may be able to obtain specialized loans, such as those offered by the United States Department of Agriculture Farm Service Agency. Down payments tend to be higher for raw land purchases because things such as houses that banks could use as collateral for the loan do not exist on raw land. Your down payment may range between 20-50% of the total price of the property. Conversion. This includes the costs for anything you will need to do to convert the land for your intended use, such as constructing a home, running sewer lines, etc. Carrying costs. This includes things such as the interest on your loan and any property taxes. Unlike residences, raw land is not considered to depreciate for federal tax purposes, so you can’t take a depreciation tax deduction for raw land. Just how much money does this work out to in dollar terms? Typically, for the down-payment and other costs, you should try to have about 20-25% of the purchase price available in cash as a rule of thumb. In addition, you should have a steady stream of income to cover carrying costs (like loan repayments). This will also help you qualify for any lending you may require. .

Begin your search for available land. Once you have determined what you want to use the land for and what your budget is, you can begin the search for available land in your price range that meets your requirements. There are a variety of ways in which to begin your search. Scan local newspapers, query farmers in local rural communities, and research evictions, bank foreclosures, and tax sales. Go through a real estate agent. This is a particularly good option when your search is somewhere out-of-state or far away from your current residence. A real estate agent may also be able to tell you whether there are any future zoning plans that could affect your own plans.

Investigate neighboring properties. You'll want to know what kind of properties you border, and whether industrial farming or agricultural practices will affect the value or livability of your land. You should also know whether the neighboring properties have any rights of way or easements on the land you’re considering.

Locating Your Ideal Property

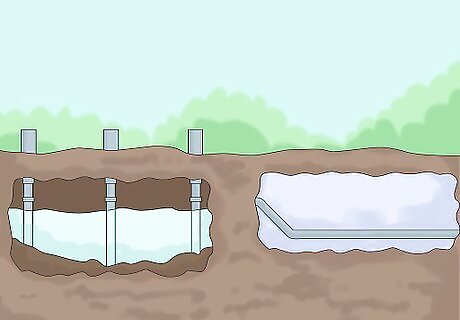

Ensure there's access to sewage and water. Two things that make land essentially useless are a lack of a septic system and/or a water source. These are the most important things to consider when investigating properties. Sewer systems are an important consideration. Off-the-grid land sometimes cannot be connected to a municipal sewer system, so when making purchasing decisions plan for a septic system. Make sure your property is not only zoned for septic, but has the space to install a septic system far enough away to avoid water contamination. Does your land have access to water? Trucking water is expensive and collecting rainwater is inefficient in most places. Make sure you have access and rights to water and, if you plan on digging a well, factor that into your decision as this can become quite expensive.

Consider roads and topography. The soil system of your land, and how/if you can reach it by road also determine its worth. Take topography and transportation seriously in the searching process. Does your property have access to a road? If not, you should be willing and able to build one as inaccessible land is also essentially worthless. What is the climate like? If you're buying in an area with cold, snowy winters considering the type of road, if any, leading to your land is particularly important. Once again, check carefully for any easements. An easement means you do not own 100% of your land, and it is possible that a utility company, or other landowner can regularly use your land. This could affect how you can use your land, as well as its success as an investment. Consider electricity. If your property is far off the grid how do you plan on getting electricity to your location? You can pay the power company to string a pole in your direction, which can be expensive, or use alternative sources like wind or solar. What is the topography of your land? Take notice of where water runs and if your land can support infrastructure. Watch for signs of flooding and know soil types and grade. Knowing your soil type also affects your ability to drill and set up a water source like a well, so make sure you factor in the added cost of drilling through something like rock as opposed to a softer soil like sand.

Know your rights, and be aware of environmental restrictions. Oftentimes, legal jargon and existing restrictions are difficult to comprehend. Unfortunately, certain restrictions based on zoning and environment can greatly impact the worth of your land and how you can use it. Secure your rights. There are various rights that go into the purchase of raw land. For example, do you have the right to anything found on the land, such as land oil, natural gas, gold, or other valuable materials? Make sure to look into this ahead of time to save yourself a long, legal battle and possible loss of money. Also, consider hunting rights. Owning property, in some areas, gives you a right to refuse hunting on that land. Look into this ahead of time, and consider your own comfort and concerns on the issue of game hunting. How is your land zoned? How and if the land is zoned affects your ability to build a home on your land. Check the land's zoning very closely before signing any paperwork, paying especially close attention to whether the land was previously zoned for anything that may depreciate its value over time. Industrial farming, for example, leaves chemical residues that sinks a land's value. Check any existing environmental restrictions, especially if you are buying very rural land. Waterfronts and wetlands especially have a variety of strict guidelines about use and building, which are limiting for owner's plans. These could include, for example, an endangered species habitat. In addition, if you are planning on farming in any way beyond a simple home garden, you need to make sure your land is zoned for agricultural development.

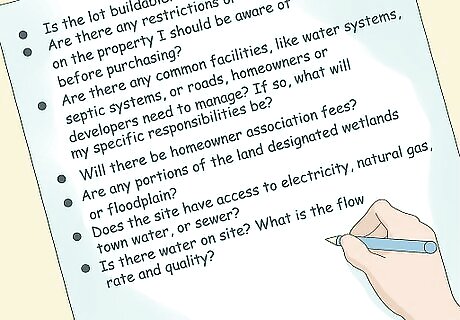

Prepare questions for the seller. Before you begin looking into properties and contacting sellers, prepare a list of questions to ask based around your specific needs and wants to ensure the land is worth viewing. A few general questions to ask the seller or seller's agent include: Is the lot buildable? Are there any restrictions or encroachments on the property I should be aware of before purchasing? Are there any common facilities, like water systems, septic systems, or roads, homeowners or developers need to manage? If so, what will my specific responsibilities be? Will there be homeowner association fees? Are any portions of the land designated wetlands or floodplain? Does the site have access to electricity, natural gas, town water, or sewer? Is there water on site? What is the flow rate and quality?

Make a trip to see the land. Nothing will clear up your ideas about what kind of land you want better than actually looking at some properties. You'll immediately realize what appeals to you, and what doesn't and you can weigh the pros and cons of purchasing that particular plot. Look for any structures on the property or on a neighbor's property that cross the property line, and check with your city or county records office about the legality of such structures and what easements neighbors might have. If you're working with an agent, the road you ride in on is likely the most attractive, easiest route to your property. However, it might not be accessible year-round or it may be prone to poor upkeep, plowing, and other services. Ask neighbors or those who live in the route you're taking, if it's always available, and whether it's cared for adequately. Talk to locals while you're there. Ask them if there is reliable cell phone reception in the area, what the seasons are like, what driving conditions are in the nearby roads and highways, and whether the area is prone to any specific environmental hazards. If possible, stay overnight. Ask your agent if setting up camp is possible, and if this is allowed consider pitching a tent for an evening. This will give you the best idea of the daily rhythm of the area, and neighbors, and traffic - if after 24 hours your enthusiasm for the place has waned, imagine being there for 24 years.

Buying the Land

Consult a lawyer. Because of the additional complexities of buying raw land, it is recommended that you consult with a lawyer once you’ve identified the property you want to buy. For one, a lawyer can help streamline communication between you and the seller so your rights as owner are clear. Additionally, your lawyer can help you interpret the findings of your due diligence and how it may affect your rights and use of the land. Find a qualified real estate attorney to help you navigate the pricing and other negotiations of the purchase process. Before finalizing the sale, ask your lawyer whether water and mineral rights are a concern in the area. The jargon in regards to such issues, and what your rights are in regards to materials found on your property, can be confusing. A third party can help clear up any uncertainty. Ask about what contingencies you should add to the bid offer, and how much time you need to address these contingencies. Contingencies are conditions that must be met before the closing will take place, such as financing, inspections, and insurance. Before finalizing your bid, ask your lawyer about building requirements and any permits you need, as well as whether there is a warranty deed. You should purchase owner's title insurance at this point. This is typically a seller cost, and requested in the offer as part of the contract.

Make an offer, but start low. A down payment for raw land generally falls between 20-50% of the overall price, and many lenders expect you to have made a down payment before they consider granting you a mortgage loan. Do not be afraid to bargain with the seller. You can significantly reduce the overall cost with successful bargaining. Your offer should include an option on the land for a small fee, so that you have the opportunity to do due diligence before completing the purchase. Essentially, this will put the land on “hold” for you while you do your inspections. Alternatively, your offer can include a closing date (the date on which the purchase is completed) far enough into the future to complete the due diligence process. Your offer should also include provisions allowing you to walk away or buy the land for a reduced price depending on the findings of the due diligence process. Cheaper properties make more financial sense when it comes to raw land as land tends to appreciate as it's developed. Look for relatively low-cost options that meet your needs as a buyer. Inquire as to particular property tax savings programs in the state you're buying if you plan to leave the land undeveloped for a significant period of time. These plans can save you a lot of money long term, as taxes and payments are reduced over time on uncultivated land.

Secure a loan. Taking out a loan for raw land is tricky and much more difficult than getting a loan for an existing home. This is especially true if you plan to wait years to build. Banks fear the building plans will not come to fruition or you will walk away from the land if it does not appreciate in value. You can minimize the risk of rejection by going in with a very specific plan, and proving you've done adequate research and practiced due diligence to assess the land for your personal needs. If you've contacted the above companies, departments, and professionals you're far more likely to look invested in your plans for the land and therefore be approved for a loan for a down payment. Work with local banks and credit unions. They're familiar with the area, and will know you're making a wise, well researched investment. Remember, your land is undeveloped so down payments and interest rates will be higher than for a typical home mortgage. Keep this in mind as you plan financially for your loan. Your credit score may also have to be higher to buy raw land as there is no building as collateral.

Consider owner financing. Owner financing refers to you financing your land purchase through the seller (or owner) of the land. This can be an attractive option for buyers if they are having difficulty obtaining a bank loan, or if interest rates are too high due to poor credit. For the seller, it may be attractive if they are having difficulty selling the property. If these conditions apply, consider approaching the owner and inquiring about owner financing. For example, assume you wanted to buy a plot of land for $1 million. You would pay a down payment to the owner, and then the owner would finance the property and allow you to use the land. You would then pay the owner back regular payments just as you would with a bank loan. Typically, once all payments are complete, the deed to the land would be transferred to you. Benefits of owner financing include lower costs for you (due to the lack of fees like closing fees, and a potentially lower interest rate), no qualifying required (since it is not through a bank), and fast closing of the sale (since there is no third party involved). There are a few risks to be aware of. Typically, these transactions will involve a relatively high down-payment of 20% or more. In addition, it is important to be aware of whether or not the seller still owes money on the land. If so, you are exposing yourself to the risk that the seller could go bankrupt and be unable to make payments. Bring this topic up with both the seller, and your lawyer, to fully understand the risks and what you can do about them. Always involve a lawyer when conducting this sort of transaction. Formal contracts will need to be created and signed, and a lawyer can help to make sure the transaction is fair to you and that the seller meets all their obligations. The lawyer can also assist with the financial aspects of the deal such as interest rates, amortization period, and documentation of the loan.

Doing Your Due Diligence

Practice due diligence. It's impossible to identify and assess every sort of risk and delay, but pursuing a program of due diligence can minimize that risk. This usually means hiring several experts to conduct inspections and make inquiries on your behalf. Due diligence takes time and money, which usually comes in the form of an inspection and feasibility study. Make sure to stipulate the amount of days needed to conduct the study and inspection in the offer. The details of this period, and what rights you have during the process, are negotiated between you, the seller, and both of your respective agents. You may be asked to put down some form of financial deposit, sometimes known as earnest money, typically about 1% of the purchase price.

Ask the seller to pay for part of these costs. Because due diligence is very expensive, you should request that the seller pay for at least part of your due diligence costs in case something comes up in the process that means you no longer wish to purchase the land. These requests are generally presented with the offer.

Hire a surveyor. Even if the seller or real estate agent offers a survey of the land, contract your own surveyor or civil engineer as well. Rural plots can be uneven in size and shape and uninformed buyers or agents might miss certain pitfalls when surveying the land. Know the soil, the topography, the potential value, and where and how you can build. If you have the property surveyed then you may purchase extended title insurance which will protect you against boundary issues.

Check the plat. A plat is a map, drawn to scale, of your land that shows the size, shape, and location of your property. Plats are not drawn by private entities, but public works departments and urban planning organizations. They are more informative and legally binding than the standard survey.

Be aware of any existing liens. Liens are notices attached to property that tell whether the owner owes money to a creditor. These are public record, and can be obtained from a county records office. A lien on a property can delay your purchase for months or years depending on the type of lien, so be aware.

Make a trip to the town or county offices of Building and of Planning and Zoning. These departments can address specific questions about the land you're considering buying, and give you insight as to whether your building plans would work for the area. Ask the Building Office whether the lot is buildable, if there are any existing restrictions on the size of buildings, whether roads surrounding the property are publicly paved and maintained, and what permits, fees, and costs are required. Ask the Planning and Zoning Office how and if the property is zoned, whether your planned use for the lot complies with zoning restrictions, whether there are any restrictions due to environmentally protected areas like wetlands, and how much lot coverage is allowed?

Go to the county Health Department. The health department can really solidify the specifics of any plans you have for wells and septic systems, and alert you to any potential dangers of installing them in the area. Ask if tower service is available and what the costs are, what kind of septic systems are permitted, what tests are required, and what time of year they can be performed. Look out for potential problems. Ask whether the area you're looking in has trouble with high water tables or poor soils for septic systems, and whether there are any known problems with water quality in your area.

Seek out utility companies in the area. Utility companies can answer questions about access to electricity and other modern amenities. Check if natural gas can be brought to the lot, and what the costs are. What are the options for cell phones, internet, and television?

Talk to the Department of Environmental Protection. Environmental restrictions can really throw a snag in building plans, so make sure you know of any going in. The DEP can answer these questions head on. You should also ask them to explain any former use of the land, specifically for environmental issues. If you plan to install a well, speak to more than one driller and then check with the DEP to see if there are any well water issues in your immediate surrounding area. Asks about costs, flow rates, depth of neighboring wells, labor and material costs, and if there are any well water problems in neighboring areas.

Close on the property. If your due diligence process does not reveal any major issues and your lawyer agrees that the purchase is a good one, close on your purchase. Depending on where you live, the procedures may vary, and your lawyer and real estate agent will walk you through them. In general, you can expect to see at least the following documents: A land contract. This lists the address of the property and includes a full legal description, including its location, any liens, easements, or other conditions, and the financial information such as purchase price, down payment amount, and number and amounts of monthly payments. The deed. This transfers the legal title to the property from the seller to you. You will sign this when you close on the purchase. A closing statement. An escrow officer or your lawyer can draft this document, which shows the debits and credits for you and the seller as agreed in the contract. For example, it may include an "amortization schedule" that specifies how many payments, in what amount, will pay off the amount you owe on the land.

Comments

0 comment