views

Paying For Braces Directly

Use a payment plan and pay over time with no interest. Many find using a payment plan offered by the orthodontist's office to be a good option. It usually comes with no interest, so you save money over going through a bank, but you still can pay the cost over time. The specifics vary from office to office, but many require a 25% down payment and spread the rest of the payments over the treatment time. Treatment times vary, but usually it takes around two years. Many orthodontists will be willing to make adjusts to the plan to fit your needs. Just ask, and they should be willing to work with you to find a plan that works

Go to a dental school for discounted costs. You can often save a sizable amount of money by getting your braces treatment through a dental school. The tradeoff is that you're getting care from a resident rather than a doctor. But the residents are always supervised by experienced orthodontists, so many find this to be a good way to save money. Usually you can save about a third of the cost of normal treatment with this method.

Pay for the whole treatment up front to get a discount. If you can afford the whole cost of braces up front, this may be an attractive option. Discounts for paying the whole cost at once vary from office to office, but they're normally around 3% to 7%. That's a sizable saving when you consider that braces treatment averages around $5000. If you decide to pay with this method, you'll make the payment during the visit in which the braces are put on.

Utilizing Your Bank and Insurance

Get a bank finance to pay over an extended period of time. If the payment plan offered interest-free from your orthodontist is out of your reach financial reach, you can use a third-party, such as a bank. The upside to getting a loan or a payment plan through a bank is that you can spread the cost over a greater period of time, sometimes over five to seven years. The downside is that it will come with interest, adding to the total cost. Talk to your orthodontist about third-party payment options. Many are offered through the orthodontist office itself. Alternatively, you can contact your bank and ask about their dental financing options.

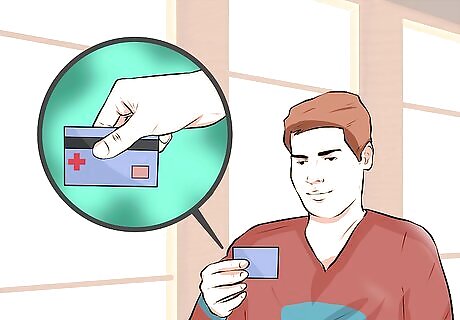

Use an HSA. An HSA is a Health Savings Account. They are accounts in which a certain amount of money from your paycheck goes. The HSA can be used to be for qualified medical expenses, and its primary selling point is that it's not subject to federal income tax, and unlike a FSA (flexible savings account), HSA funds roll over from year to year. In order to get an HSA, you first need a HDHP, or a High-Deductible-Health-Plan. In order to use your HSA to pay for your braces, your orthodontist must believe that braces will help you prevent gum disease. You can't use an HSA to cover cosmetic expenses. Contact your insurance company about whether you qualify for an FSA and how to apply.

Use an FSA. An FSA is a Flexible Savings Account. They can be acquired without having a High-Deductible-Health-Plan and the expected amount of the current year's contribution is available at the beginning of the year. These are two benefits of an FSA over an HSA. An amount of your paycheck is withheld to make up the FSA. So you get to pay for the braces in full upfront at the beginning of the year, then make the payments through your FSA without interest over the year. Contact your insurance company about whether you qualify for an FSA and how to apply.

Use insurance to help with the cost. If your work offers a dental plan, check with your benefits department to see what orthodontics are covered and the details of the discount. Often times, dental insurance will cover anywhere from 25% to 50% of the cost. If you don't have dental insurance, you can search for a policy through websites. This option involves paying an annual fee in order to get discounts at participating orthodontists.

Getting Help With Payments

Ask a family member for a loan. If you have grandparents or other relatives who have savings for such things, ask if they'd be willing to offer a loan. The benefit of getting a loan from a family member rather than a bank is that, being family, you'll probably get a better deal, interest-wise.

Use CareCredit. CareCredit is a credit card that can be used for medical expenses. It allows you to pay for the expense in full and then make payments on the card over time. One of the benefits of CareCredit over normal credit cards is that they have promotional financing options, which allow you to avoid paying interest if you pay off a certain amount within the promotional time period, which is either 6, 12, 18, or 24 months, depending on the option you choose. The steps for applying for and using CareCredit include: Apply online at http://www.carecredit.com/apply/. Check here http://www.carecredit.com/doctor-locator/ to find an orthodontist who accepts CareCredit. Choose a financing option. Make monthly payments.

Use a discount dental plan. Joining a discount dental plan will allow you to get braces at a reduced cost. Find discount dental plans in your area. Then you'll just have to pay around $100 a year to be on the plan. Orthodontists in your area who've signed on to the plan will then provide dental care including braces at a reduced cost.

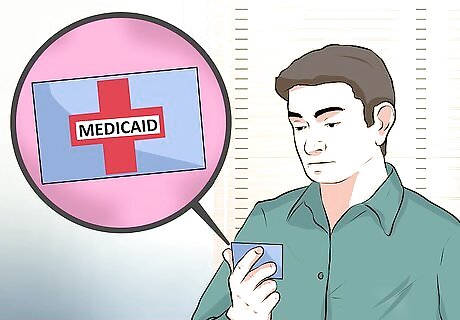

Utilize Medicaid if applicable. For low-income families, Medicaid can sometimes cover part of the cost of braces. Whether you or your child qualifies for Medicaid help with braces depends on your income and the state you reside in. Normally Medicaid will only apply for cases in which braces are deemed necessary for health purposes, not cosmetics. Check with Medicaid's official website to learn if you qualify.

Use a Dental Charity if you qualify. Two of the biggest charities for dental work are Smiles Change Lives and Smiles for a Lifetime. Smiles Change Lives asks for a $600 commitment cost, and then covers the rest of the cost themselves. For both charities, you can see if you qualify, and apply for braces financing through their websites. Note, both of these charities are for children 10-18 only.

Comments

0 comment