views

Paying Sales Tax as a Seller

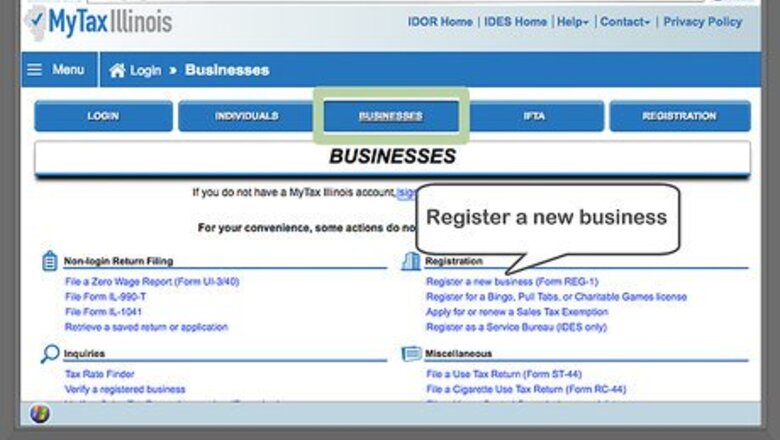

Register your business with MyTax Illinois. If you've started a business that sells goods or services, you must register with the Illinois Department of Revenue before you can conduct business in the state. You can register electronically on MyTax Illinois. Go to https://mytax.illinois.gov/_/ and click on the "Businesses" tab to get started. If you register online, your registration will only take a day or two to process.

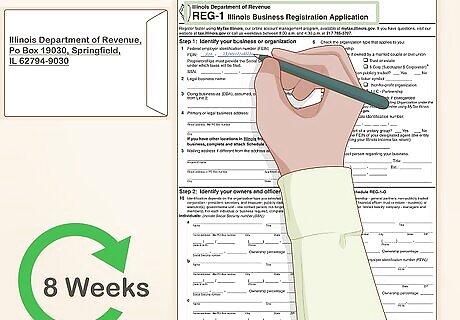

Complete Form REG-1. If you prefer, you can complete a paper registration form rather than registering online. The form can be downloaded at http://www.revenue.state.il.us/TaxForms/Reg/REG-1.pdf. In addition to the main application, you may have to complete additional schedules depending on the type of business you conduct. For example, if you sell alcohol or tobacco, you must complete additional schedules for those businesses. Once completed, mail your application to Central Registration Division, Illinois Department of Revenue, PO Box 19030, Springfield, IL 62794-9030. Allow 6 to 8 weeks for processing if you mail paper forms.

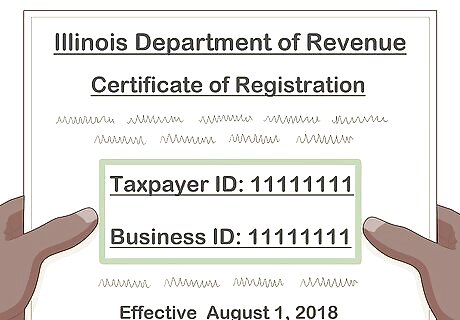

Receive your registration package. After the Department of Revenue processes your registration application, you will get a certificate of registration and taxpayer ID. This package will be sent to the address you listed on your application. Your certificate must be displayed in a prominent place in your business. You must have this certificate before you can make any sales or purchases, or before you hire any employees.

File Form ST-1 when due. Use this form to report to the Illinois Department of Revenue the sales you've had for the period covered by the form, and the amount of sales tax you collected. You can file this form through MyTax Illinois. When you register your business, the Department of Revenue will determine how often you should file sales tax returns. Depending on your volume of business, you'll be required to file monthly, quarterly, or yearly. When you first start doing business, the Department of Revenue may adjust the rate at which you must file your return depending on your sales volume. The initial rate will be determined based on average sales of Illinois businesses similar to yours.

Submit your payment. Illinois state law requires businesses to pay sales tax using electronic funds transfer (EFT) if their annual tax liability is $20,000 or more. Most businesses use this method to submit payments. If your annual tax liability is less than $20,000, you also have the option of mailing your payment to the Illinois Department of Revenue. To pay by EFT, you must provide an account and routing number for your business's bank account. Generally, it's a good idea to keep the sales tax you collect in a separate account from your business's operational account.

Paying Sales Tax as a Buyer

Determine when taxes are owed. If you purchase tangible personal property from an out-of-state retailer who does not collect Illinois state sales tax, you are responsible for paying that tax yourself. Generally, you can pay all sales tax at the end of each year. However, if you owe $600 or more, you must pay by the end of the month in which the purchase is made. Illinois state sales tax for general merchandise is 6.25%. Therefore, if you make $9,600 or more in purchases each year, you'd need to pay the sales tax before the end of the month in which you made each purchase. Otherwise, you can wait until the regular annual tax deadline.

Sign up for MyTax Illinois. If you don't already have an account with MyTax Illinois, set up an account so that you can pay your Illinois sales tax online. Go to https://mytax.illinois.gov/_/ and click the "Sign up Now!" button. After you provide information to identify yourself, you'll create a username and password to log onto the site.

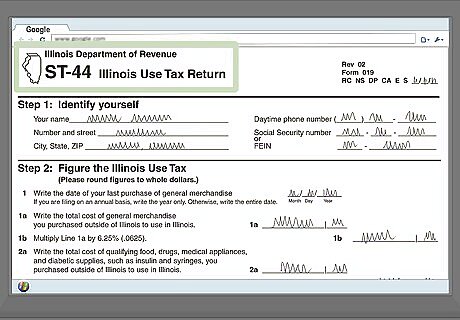

Complete Form ST-44. Once you've logged into your account, click the "Individuals" tab and select "File a Use Tax Return" from the options presented. Gather information about your purchases before you start filling out the form. If you're submitting a monthly sales tax payment, enter the exact date the purchase was made. If you're submitting the form for purchases made throughout the year, you only need to enter the year. You can download the form at http://tax.illinois.gov/TaxForms/Sales/ST-44.pdf if you want to look over it before you start filling it out on MyTax Illinois. You can also use this form as a worksheet to get your math right before you enter the figures online.

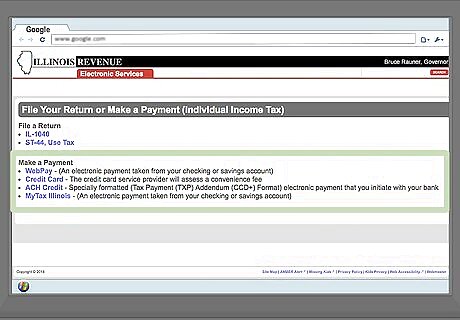

Submit your payment. Once you've clicked the button to submit your form, you can select your method of payment and enter the appropriate payment information. The Illinois Department of Revenue accepts credit or debit cards as well as electronic checks. If you pay using an electronic check, you'll have to provide the account and routing number for a checking or savings account. Once your payment is accepted, a confirmation page will be displayed that you can print for your records.

Comments

0 comment