views

X

Research source

Obtaining an Employer Identification Number (EIN)

Visit the IRS website. A decedent's estate is a separate taxable entity from the decedent him or herself. Therefore, the decedent's estate will need to obtain a tax identification number before tax returns can be filed. An estate's tax number is called an EIN. An EIN will come in the format of 12-345678X. As the executor of a decedent's estate, you will be responsible for obtaining an EIN. To learn about EINs and apply for one, visit the IRS website.

Choose your preferred application method. EINs can be obtained using various application processes depending on your personal preference. If you have access to the internet, the easiest thing to do is to apply online. If you apply online, your application will be processed immediately and you will receive your EIN as soon as you submit the application. However, if you do not have access to the internet, you can get a copy of IRS Form SS-4 and fax it or mail it to the IRS. Finally, if you are an international applicant, you can apply for an EIN over the phone.

Complete the application. Regardless of the method you choose to apply, you will need the same information in order to complete your application. If you complete it online, you will submit it directly through the IRS website. If you submit your application by fax, your application will be processed within four business days. If you submit your application through the mail, your application will be processed in about four weeks. IF you apply over the phone, the application will be processed immediately. To complete the application, you will need to provide the IRS with the following information: The name of the estate requesting the EIN The name of the executor (i.e., your name) Your address The Social Security number of the decedent The reason you are applying (i.e., for an estate's income tax return)

Receive your EIN. Once you answer all of the required questions and submit your EIN application, the IRS will process your request. As soon as your request is processed you will receive an EIN. The EIN will be a number (e.g., 12-345678X) and you will use it on the estate's income tax return. The EIN is used by the IRS for tax and identification purposes.

Paying Quarterly Estimated Taxes

Determine if you need to make estimated payments. Not every estate needs to pay estimated quarterly taxes. According to the IRS, only estates expecting to owe $1,000 or more in taxes each year will have to make quarterly payments. In addition to the $1,000 threshold, the estate will only need to make quarterly payments if the estate's withholding and credits are expected to be less than the smaller of 90% shown on the present year's tax return or the tax shown on the prior year's tax return. Estimated payments are not required if, among other reasons, the estate had a full tax-year last year and was not required to pay any taxes.

Obtain IRS Form 1041-ES. Because estate income taxes can't be collected in the same manner individual income taxes can be (i.e., through paychecks and withholding), you will usually need to pay estimated quarterly taxes in the same manner an independent contractor would. To make estimated quarterly tax payments on behalf of the estate, start by obtaining a blank copy of IRS Form 1041-ES. The form can be found online by visiting the IRS website. In addition, you can call the IRS and they will send you a copy in the mail. IRS Form 1041-ES is used to help you calculate your estimated tax liability for the current tax year. The form itself will not be submitted to the IRS but the attached payment vouchers will be. After your first year of paying estimated quarterly taxes for the estate, you will receive pre-printed payment vouchers to use in following years.

Calculate your estimated tax liability. By filling out the form according to the directions, you will calculate your estimated tax liability, including how much you will owe each quarter. You will start by inputting the estate's estimated adjusted total income expected in 2016. You will then input any deductions and exemptions and add them together. Subtract the sum of your deductions and exemptions from your total expected income. This number is the estate's taxable income. Next, using the tax rate schedule provided on the form, you will figure your tax. After you subtract any credits, you will be left with your estimated tax. You will then make one more calculation, which is specified on the form, and you will be left with your required annual payment. This is what you will owe over the course of the year to fulfill your quarterly estimated tax payment obligations. For example, assume the estate's taxable income is $8,000. Using the tax rate schedule, the tax on this amount of income would be $1,806.50 (28% of the amount over $5,950 plus $1232.50). Assuming you have no credits or other taxes, your estimated tax would be $1,806.50. Next, to determine your minimum payments due, you need to multiply your estimated tax by .9, which will equal $1,625.85. Assuming the estate's tax liability the previous year was more than $1,625.85, you required annual payment will be $1,625.85.

Make payments in a timely manner. The estate must make payments every quarter in an amount equal to 1/4 of the required annual payment calculated. In most circumstances, the payments will be due in the middle of April, June, September, and January (of the following year). Payments will be made using the payment vouchers attached to IRS Form 1041-ES. On the payment voucher you will write the estate's EIN, the name of the estate, your name and address, and the amount you are paying. You will submit this voucher, along with a check or money order made out to "United States Treasury", to the applicable address (found on Form 1041-ES). For example, if your annual payment is $1,625.85, you will pay $406 every quarter. This amount is rounded to the nearest dollar after you divide the annual amount by 4.

Filling out IRS Form 1041 and Attachments

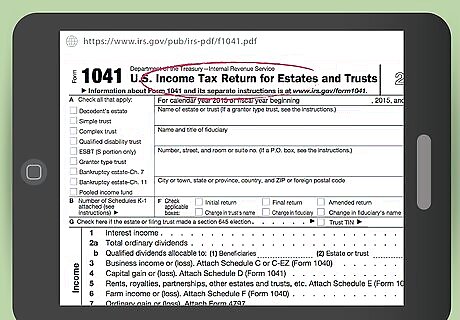

Determine if you are required to pay federal income tax on the estate. You will be required to fill out IRS Form 1041 and any applicable attachments if the estate has a gross income of $600 or more or a beneficiary who is a nonresident alien. If you meet one of these thresholds, you will need to obtain IRS Form 1041 and the instructions that go with it.

Insert personal information. Form 1041 requires you to provide your name and address, the estate's EIN, the name of the estate, what type of return you are filing (e.g., initial or amended), and the number of Schedule K-1s you are attaching. Schedule K-1s are used to inform beneficiaries of the amounts they need to include on their own personal income tax returns. This is the case because an estate is a "pass-through" entity, which means the beneficiary, and not the estate, pays income tax on any distributive share. Therefore, any income that has been distributed to beneficiaries can be deducted, which will reduce the estate's tax liability.

Calculate the estate's income. An estate can accrue income from various sources. Income sources will usually include interest from bank accounts, loans and bonds; dividends; business income (e.g., profits from decedent's business); capital gain; rents (e.g., if the decedent was renting a home); farm income; ordinary gain (e.g., profits from selling a business); and other income, which might include distributions from pensions, annuities, and insurance contracts. When you add all of these sources of income, you will get the estate's total income. For example, assume that, after compiling all of the estate's income data, you have a total income of $13,000.

Make allowed deductions. Deductions help to reduce your tax liability by adjusting your income downward. Your income will be adjusted downward in relation to how much the estate paid in fiduciary fees, taxes, attorney and accountant fees, and how much the estate donated to charitable causes. Once you add these deductions together, you will subtract them from your total income in order to get your adjusted total income. Next you will add together the $600 exemption every normal estate receives and your income distribution deduction, which is calculated on Schedule B. Don't forget to attach your Schedule K-1s to evidence this income distribution. You will subtract this amount from your adjusted total income in order to get your taxable income. For example, assume your initial deductions equal $1,500. When you subtract this number from your total income of $13,000, you get an adjusted total income of $11,500. Next, assume you have the $600 deduction as well as an income distribution deduction of $1,900. When you subtract these numbers from your adjusted total income, you get your taxable income, which is $9,000.

Calculate your tax liability. The final section of Form 1041 requires you to calculate any tax you owe or payment you are due. You will start by calculating the total tax, which is done using Schedule G. In general, this amount will be calculated using a tax rate schedule and your taxable income. Next you will enter the amount of any estimated taxes you paid throughout the year. Finally, using the numbers calculated earlier, you will determine whether you owe taxes or whether you will get a refund. You will enter that number in the appropriate box. For example, assume your total tax from Schedule G is $2,093. Also assume you paid $1,624 in estimated quarterly taxes and did not have any other payments. Based on these numbers, the estate would owe $469 (the difference between the total tax and total payment). If the total payment was larger than the total tax, you would be owed money (i.e., you would have overpaid for the estate).

Sign the form. Once IRS Form 1041 is complete, you will sign it to verify that the information you provided is true and accurate. At this point, you will be done filling out forms for the estate's income tax return.

Submitting the Return

Gather all of your documentation. Once the tax return has been filled out, you will need to submit it to the IRS. The estate's return must contain not only IRS Form 1041, but also any Schedules (e.g., Schedule K-1s) and other forms you used to complete the return. Make sure you have signed every form as necessary and then paperclip this information together.

Know when to file. The estate's income tax return, just like an individual's tax return, must usually be submitted by April 15th. If you need more time to complete your return, you can file IRS Form 7004 to apply for an automatic five month extension.

Determine where you need to file. You will send your completed return to a location determined by where the estate is located and whether you are enclosing a check or money order. Your required submission location can be found within IRS Form 1041's instructions. For example, if the estate is located in California and you are enclosing a check or money order, your return will be sent to a location in Ogden, Utah. If the estate is located in Indiana and you are not enclosing a check or money order, your return will be sent to Cincinnati, Ohio.

Send in your tax return. To complete your filing, place the estate's income tax return in an envelope along with any required payment and send it to the required address. Keep an eye out for a confirmation email or letter stating the IRS received your return.

Comments

0 comment