views

Setting Your Goals

Identify your financial goals. Part of managing your money is not only covering your current expenses, but also paying off debt and saving for the future. If you don’t learn self-control and how to manage your money, then you will have to rely on others to manage it for you. Commission-hungry financial planners or well-meaning family members may not always have your best interest in mind or offer the best advice. Instead of relying on others, take the first step in planning a budget by setting realistic, specific goals.

Every financial goal you establish should be SMART. SMART goals are Specific, Measurable, Achievable, Relevant, and Time Framed. Separate your financial goals into short-term (less than a year), medium-term (one to five years), and long-term (over five years) goals. For example, suppose you have a medium-term goal of saving a $4,500 down payment for a car you want to purchase when you graduate from college in three years. This gives you 36 months to save for the down payment. Therefore, you must save $125 per month ($4,500 / 36 months = $125 per month). This goal is specific: You are saving for the car. This goal is measurable: You know you want to save $4,500. This goal is achievable: You know you need $125 per month. This goal is relevant: You are going to need a car. This goal is time-framed: You have 36 months to save.

Save for a house. If plan to own a house sometime in your future, you must start saving up. The bank will not lend you money without a down payment. You can’t borrow a down payment. You have to have it in savings. You will need at least five percent of the value of the house as a down payment. In addition, it would be smart to save an additional five percent to cover additional expenses when purchasing a home, such as closing costs and renovation expenses. This means saving a total of 10 percent of the value of the home you wish to be able to purchase. For example, if you wish to be able to purchase a $200,000 home, you would need to save $20,000 ($200,000 x .10 = $20,000).

Buy a car. In order to get a car loan at a reasonable interest rate, you need to save up a down payment for the car. Remember that any funds you borrow for purchases need to be paid back with interest. So those car ads that promise to waive your down payment aren’t doing you any favors. You will still pay that amount, plus interest, and you will likely have a higher interest rate than if you had saved up the down payment in the first place. Save up as large of a down payment on a car as possible, and consider buying a quality used car instead.

Build rainy-day fund. Although it sounds counter-intuitive, before you start paying down your credit cards, save up an emergency fund. Most people have at least one unexpected expense every year. If you have to keep using your credit cards to cover emergencies, then you will never pay them off. Begin by saving up at least $1,000 in your emergency fund. Later, when larger, high-interest debts are out of the way, you can begin building a larger emergency fund.

Get out of debt. One of your financial goals should be to aggressively pay off your credit cards. Once you have established your emergency fund, make a plan to pay off high-interest loans. Plan to pay more than the minimum monthly payment. Even an extra $50 per month would help. Also, plan to reduce your spending. Figure out the difference between what you need and what you want, and reduce spending until you get out of debt.

Pay for living expenses. Plan to cover all of your annual living expenses with cash. It can be tempting to refinance your house or get a line of credit to pay off high-interest debts or to fund a vacation. But it is smarter to avoid an endless cycle of debt. Save for these expenses in advance so that you do not have to increase your debt. Living expenses include your mortgage or rent, utilities, food, transportation, taxes, vehicle maintenance, home repairs, gifts and vacations.

Get insured. Disability insurance can replace a portion of your paycheck if you become injured or ill and cannot work. Life insurance will help your loved ones to cover expenses in the event of your death. It will offer them long-term security in the face of the loss of your income. Nobody likes to think about the possibility of these unpleasant events. However, responsible financial planning involves preparing for the unexpected.

Give back. Whether or not you have deep pockets, consider including charitable giving in your list of financial goals. Typically, people aspire to donate anywhere from three to 10 percent of their income to churches and other charities. Sometimes the recipient of charitable donations is influenced by the giver’s religious affiliations. However much you intend to donate, giving to charity requires planning. First, determine your monthly expenses and how much you want to put aside for savings. After your other finances are in order, you can determine how much you want to give to charity. You can make a monthly or annual pledge to the charity of your choice. If you need help determining an amount to give, try the Charity Navigator tool. It analyzes your income and tax bracket to calculate a reasonable amount to give.

Determining Your Income

List all of your sources of income. Employment is one source of income. People can have also have many other sources of income. When preparing a budget, it is necessary to consider all income in order to accurately budget expenses. Other sources of income include gifts and inheritances, child support payments, retirement plans, life insurance proceeds, compensatory damages, public assistance, scholarships, student loan disbursements and interest on savings bonds.

Calculate your monthly income from your hourly salary. For budgeting purposes, you need to know your net income, which is the amount you bring home after taxes have been deducted from your pay. You can use an online salary calculator such as the Salary Calculator. This will take your hourly salary, calculate your taxes and determine your net income. You can do the calculation yourself by looking at your pay stub. Suppose each week you earn $250 after taxes and you work the same number of hours each week. Multiply this amount by the number of weeks in a month to get your monthly income ($250 x 4 = $1,000). If you work a different number of hours every week and your net income is different every week, calculate your average monthly salary. For example, suppose over a three month period, you earned $850, $800 and $900. Add up the total ($850 + $800 + $900 = $2,550). Divide by 3 to get the average monthly amount ($2,750 / 3 = $850). For budgeting purposes, use $850 per month.

Calculate your monthly student loan disbursement. If you are living off of student loans that come in one disbursement per semester, calculate the monthly amount to work it into your monthly budget. For example, suppose the semester is 5 months long and you receive $10,000 per semester in student loans. First, subtract non-recurring fees such as books, tuition and fees. Then divide the remaining amount by 5 to get the monthly amount you can live off of. So if after one-time expense you have $5,000 remaining, you will have $1,000 per month for living expense ($5,000 / 5 = $1,000).

Budget with an irregular income. If you are a freelancer or do seasonal work and have a very irregular income, you may have to set up your budget differently. Begin by determining your baseline expenses, such as groceries, housing, transportation and medical. Use an online tax calculator to calculate your taxes. Add this amount to your expenses. Now you know the minimum amount you need to make each month to cover your expenses. Continue to plan for your "wants" once you've determined your "needs." Even on an irregular income, budgeting doesn't end once you've figured out how to cover your baseline expenses. When you find you have a surplus amount of money, decide how you want to spend it. Do you want to save a portion and divide up the rest between dining out and seeing a movie? Careful planning can help prevent you from blowing any additional earnings.

Identifying Your Expenses

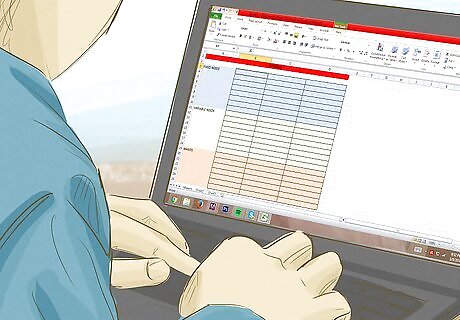

Categorize your expenses. Use a spreadsheet to track your expenses for one month. Separate your expenses into three categories: fixed needs, variable needs and wants. Fixed needs are necessary expenses that remain the same month after month. These include rent or your phone bill. Variable needs are necessary expenses that may fluctuate from month to month. These include gas for your car and food. Wants are nonessential expenses. These are things you could do without if you had to. These include take out coffee, cable and entertainment.

Save an emergency fund. Unexpected expenses happen to everyone. You don’t want to have to go into debt to cover repairs on your car or a medical bill. Save a little every month into a rainy day fun. Pay this fund before you purchase nonessential items. For example, if it’s a choice between saving in your emergency fund or going to the movies, opt to save until you have enough put aside.

Use tools to track spending. Get in the habit of recording your expenses each day. This will help you to build self-control. It will also reduce stress because you won’t be surprised by your checking account balance at the end of the month. Record all of your expenses in a notebook. Or, use an envelope system. Keep your budgeted amount for each category in a separate envelope. If you know how to use Excel and you have it installed on your computer, use one of their free budgeting templates.

Managing Expenses and Adjusting Your Budget

Compare your income and expenses. In a spreadsheet or on a piece of paper, list all of your income for the month and total it up. Then list all of your expenses and total them up. Subtract how much you plan to spend from how much you will earn to calculate the balance. Use this information to create a monthly budget. If you have a surplus, which is money left over at the end of the month, then you have some options about how to use that money—that's what's called discretionary spending. If you have a deficit, which means your expenses are greater than your income, then you have some difficult decisions to make. The wisest thing to do would be to reduce expenses in this case to avoid going into debt. For example, suppose in a given month you will earn $2,000 from working and receive $250 in child support payments. Your total income for the month will be $2,250 ($2,000 + $250 = $2,250). Total up all of your expenses for the month. First list your fixed expenses. Suppose your rent is $850 and your phone is $250. Then total up your variable needs. Say you estimate $500 for groceries and $310 for gas and $200 for household utilities (such as electricity and water). Then list your expenses in your "wants" category. Suppose you'd like to get take-out coffee every morning for $3.00 per day, for a total of $90 ($3.00 x 30 days = $90), and you want to go out with friends twice per month for $75 per evening, for a total of $150 ($75 x 2 = $150). Total everything up for a grand total of $2350. Compare your income and expenses. In this case, your income of $2,250 is $100 less than your projected expenses of $2,350. You are going to have to identify ways to cut expenses to stay within budget.

Reduce expenses if necessary. It will be easiest to stick to a budget if you build it around how you actually spend money. However, if you need to make some changes, look at your spending to determine what could be cut. Categorizing your expenses makes it easier to determine what can be trimmed if you need to. The first place you would cut expenses would be from the “wants” categories. While you might miss them, you can still meet your needs without them. Review your expenses out of your “wants” category to find any unusually high numbers. These may be the things in which you are overindulging. For each of these items, set a reasonable monthly limit to help you stay within your budget. For example, suppose you realize that $90 per month is just too much to spend on coffee. Try setting a monthly limit on the amount you will spend on take-out coffee. So, allow yourself to buy that latte twice per week, reducing your monthly expense to $24 per month ($3.00 x 2 days x 4 weeks = $24). This will save you $66 per month ($90 - $24 = $66). Then, plan to go out with friends once instead of twice, and then just have them over for an inexpensive potluck dinner one night instead of going out. Now your entertainment expense is only $75 instead of $150, for a savings of $75 ($150 - $75 = $75). By managing these "wants," you reduce your monthly expenses by $141 ($66 + $75 = $141). This will reduce your total monthly expenses to $2,209 ($2,350 - $141 = $2,209). This is more than enough to keep your expenses within budget. If reducing your wants weren't enough, you would then look into reducing your variable needs, such as walking instead of driving to save on gas or clipping coupons to reduce grocery expenses. If you still needed to reduce expenses after that, you would look into how you can reduce your fixed expenses in the long term. For example, you may need to find less expensive housing.

Apply surplus money towards your financial goals. in the above example, you reduced your monthly expenses so much that you will have $41 left over at the end of the month ($2,250 - $2,209 = $41). Put some of that extra money towards your financial goals. For example, put some in savings towards a down payment on a home or car. Stash some of it away in your rainy day fund. Pay down some of your credit cards with any extra cash. If you have some money left over at the end of the month, consider how you could make it grow. Index funds, certificates of deposits (CD's) and Individual Retirement Accounts (IRA's) are simple investment strategies for beginning investors.

Use tools to monitor your budget. Choose from a variety of free online tools to help you balance your budget. Budget Tracker is an online tool that allows you to keep track of all of your transactions and bank accounts from your computer. Track all of your accounts from one screen. Sync your transactions by importing them or inputting them manually. Keep track of your paychecks and other sources of income.

Comments

0 comment