views

Getting an Education and Developing the Right Skills

Study the industry by keeping tabs on it every day. To work for a hedge fund, you need to be dialed-in to what’s going on in the industry at all times. Subscribe to hedge fund newsletters and read articles about hedge funds every day. Some of the best newsletters include Insider Monkey, Market Folly, and Hedge Week. You can get their blog posts sent directly to your inbox every day by subscribing to their newsletters.Tip: You should also consider getting a subscription to the Wall Street Journal. While it’s not a hedge fund-specific publication, it will keep you up to date on the world of finance and ensure you’re always aware of what’s going on in the industry.

Complete a double major in a finance and non-finance discipline. While you will need a degree in finance or something similar, it’s also important to learn about something non-finance related because hedge funds love hiring worldly people with a vast array of skills. Earning a degree in public relations or information technology is a great way of expanding your skillset and showing that bring more to the table than just an eye for investments. Some finance-related majors include accounting, business administration, and international business. A public relations degree is so useful because you’ll learn how to write with a specific audience in mind. This will come in handy when you need to pitch a stock in order to land a job at a hedge fund.

Join a hedge fund club at your school to grow your network. While you’re in school, it’s a good idea to join a hedge fund club to meet like-minded people and keep yourself connected to the pulse of the industry. Take the opportunity to start building your network and learn more about hedge funds. Signing up for these hedge fund clubs usually involves paying a small dues fee.

Obtain an MBA or Ph.D in economics to learn more about the field. A master’s degree is a must if you want to work at a hedge fund. Since the field is incredibly competitive and filled with qualified people, apply to Ivy League business schools and other well-regarded institutions. If you go for a Ph.D, get a quantitative degree in a subject like mathematics, statistics, or economics. Master’s degrees in financial engineering or computational finance are fantastic ways to beef up your resume as well.Did you know? 75% of chief investment officers at hedge funds have been in a postgraduate program at an Ivy League school. This is why it’s so important to try and get your degree from a school of this caliber.

Hone your communication skills to stand out to hedge funds. One way to do this is to go out to a bar and strike up conversations with people around you. When you have these conversations, focus on listening intently and responding to specific things they say. Another method is to read books and articles to expand your vocabulary. Hedge funds want employees who are solid communicators with both clients and fellow workers. Even if you’re not part of the sales team which meets up with the clients, you’ll still have to interact with these people. At times, you’ll need to explain products to clients and tell them how these products will make your client money. The ability to take a complex idea and explain it in simple terms is a vital skill.

Develop risk-taking abilities to make yourself an attractive candidate. If you work as a trader before joining a hedge fund, this is the perfect opportunity to sharpen your risk-taking abilities. Everyone is bound to fail at some point, but it’s how you respond to those failures that’s more important. Try to reflect on what went wrong and what you can do better for the future. Then, completely forget about the failure and move on to your next task with a clear head. Even if you’re not with a hedge fund’s trading division, you’ll need to be on the same page as those people to come to a consensus on high-risk trades. This is why it’s so important to learn to work on a team.

Gaining the Proper Experience and Qualifications

Network with hedge fund professionals to find a mentor. Research your school’s alumni base to see if there are alums who currently work at hedge funds. One of the most effective ways to get a job at a hedge fund is to know someone already working at a firm. Reach out to that person by email and develop a relationship with them. Ask them thoughtful questions about their job, update them on your progress in school, and discuss current events with them. Do not reach out to a potential mentor with the purpose of asking them for a job right away. This can be very off-putting for a lot of people. Focus on getting to know them and how they got to their current position.

Complete multiple internships to boost your resume. Once you’ve spent a few months building a relationship with your mentor, ask them about potential internship openings in their firm or a different firm. Try to land an on-site internship, but don’t pass up a chance to work with a hedge fund even you have to work remotely during your internship. You can get a part-time internship even if you have a full-time job. Doing research for a hedge fund for 5-10 hours a week can be enough for you to learn about how a hedge fund operates. It’s okay to get internships in other financial sectors, like investment banking, because the knowledge you gain at these places will help you stand out during an interview at a hedge fund.

Work as a trader at an investment bank to get real-world experience. Hedge funds love to hire people who have worked in trading because of the wide skillset they gain from this experience. Traders have cross-market expertise, people skills, and “street savvy”, all of which are attractive qualities to hedge funds. Apply to jobs at investment banks and asset management firms. You’ll most likely start at a junior level and then work your way up. The better you perform, the more money you’ll be trusted with, and the more experience you’ll gain. This hands-on experience will stand out when you look for jobs at a hedge fund. Wherever you work before you go to a hedge fund, it’s important to stay there for a few years. If hedge funds look at your resume and see that you’ve bounced from job to job, they’ll have a tough time believing you’ll be able to stay at their firm for an extended period of time.Did you know? Many top traders will break away from their companies and form their own hedge funds.

Accrue multiple years of work experience to qualify for the CFA exams. You must become a Chartered Financial Analyst (CFA) to work at a hedge fund. In order to even take the CFA tests, you must have at least 4 years combined of professional work experience and education. Fortunately, there are many ways to gain this experience. You can work in economics, trading, or corporate finance. For this experience to qualify, at least 50% of your time must be dedicated to the investment decision-making process or producing something that directly impacts the investment decision-making process. Your work experience can be accrued before, during, or after you enroll in a CFA program.

Devote yourself to studying for the CFA exams. You must pass 3 levels of exams which cover economics, accounting, money management, ethics, and security analysis. The Level I exam is offered in June or December, while the Level II and III exams are offered only in June. It’s recommended you study for at least 300 hours for each of the 3 exams. The pass rates on each exam are below 50%, making this group of tests one of the toughest in the financial world. It takes about 4 years for someone to become a CFA.

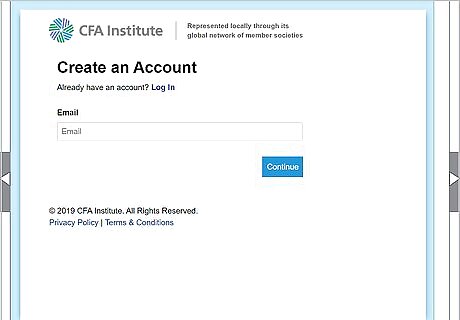

Join the CFA Institute to fulfill another requirement. You will need to join a local chapter of the CFA Institute before you take the tests. Go to the CFA Institute’s website and create an account. Apply for Regular Membership and send in your application. Once your application is processed and approved, go back to the CFA Institute’s website and activate your account. You will have to pay yearly dues to the main CFA Institute and your local chapter. It’s $275 for CFA dues and about $150 for your local chapter dues. Once you become a member, you’ll get a chance to join your local chapter of the CFA Institute. You can use this network to meet new people, discuss what’s going on in the industry, and potentially find a mentor.

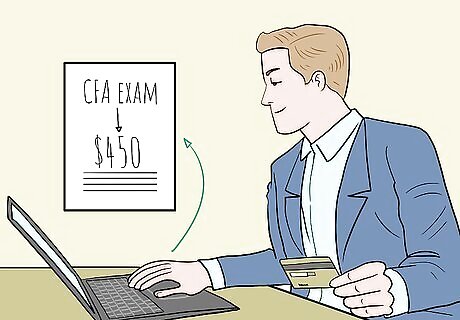

Pass the tests to become a CFA. Register for the tests online when you’ve met all the requirements. You must also have an international travel passport and live in a participating country. Go to the CFA Institute website to register for your first exam. You will have to make a one-time payment of $450 for the program enrollment fee, then pay an additional sum to take the test itself. There is an early, standard, and late registration fee. To save a few hundred dollars, pay the early registration fee before the deadline. For example, if you plan on taking the first test in June 2020, you’ll need to pay the $650 early registration fee by mid-October 2019. The standard fee is $950 and is due about 4 months before the test. The late registration fee is $1,380 and is due about 3 months before the test. The registration fee covers the curriculum you’ll study to get ready for the test and the practice tests you’ll have to take to prepare for the exam.

Landing a Job at a Hedge Fund

Put your most impressive accomplishments in your cover letter. When you write your cover letter, list the most impressive aspects of your resume right away to catch the hirer’s attention. Put down your business school, the name of the company you currently work at, and the position you’d like to land. Use the second paragraph to cover your relevant experience and best attributes as a person and employee. Talk about your best few internships or jobs and highlight skills like teamwork, financial modeling, or anything else that comes to mind. For your final paragraph, tell the company why you’d be a good fit and remind them that your resume is enclosed.

Contact your mentor to see if there is an opening at their firm. Hedge funds have to spend a lot of money to hire new employees. As a result, they love to hire internally or at the recommendation of a respected employee. Reach out to your mentor to see if a position is available at their fund. If nothing is open, ask your mentor if there are other firms that are currently hiring. People who work at hedge funds have expansive networks and usually know which firms are hiring at a given time. It costs an average of $100,000 – $250,000 to replace a member of the staff at a hedge fund.

Get in touch with a hedge fund recruiter to land an interview. While small hedge funds will hire almost entirely based off word of mouth, big hedge funds will use recruiters to find top candidates. Recruiters will come to job fairs and visit colleges to try and find the best applicant possible. If you’re still in school, take the time to see a recruiter if they come to your campus. Otherwise, go online to see if there are job fairs in your area. You can also visit a specific hedge fund’s website and see if they list their recruiters’ email addresses. Recruiters love to meet in-person with people whose resume stands out and matches what they’re hedge fund wants in a candidate. As a result, the most effective way to get a face-to-face with a recruiter is ensure your resume features relevant experience.

Cold-email multiple firms to secure an interview. Go online and look up the Chamber of Commerce’s listings to see which hedge funds are in your area. Then, cold-email the firm and include your name, resume, a stock pitch, and the reason you’re emailing. The stock pitch is the most important part of your cold email because it gives the potential hirer a glimpse of your financial acumen. The stock pitch should be between 5-8 pages. Email as many different hedge funds as you can. Often times, these emails will go unnoticed, so the more hedge funds you contact, the better your chances are of landing an in-person interview.Warning: Do not email multiple people at the same hedge fund. That will be noticed and it is not a good look.

Nail your interview by showing off your knowledge of the fund. During your interview, you’ll be asked a variety of questions. You’ll be asked to share your interests and experiences in the field, so make sure you can describe your previous work in a concise but detailed manner. The interviewer will also ask what you know about their hedge fund. Do your homework on the fund’s portfolio, history, and strategy to prepare yourself for this question. Dress in business professional clothing and speak in a clear, confident tone. If you come across as assured, relaxed, and prepared, you’ll stand out in a big way. Study the hedge fund’s website and create a cheat sheet with the most important notes and details you need for your interview. Take 10-20 hours to go over your cheat sheet and memorize it. During your job interview, try not to hesitate, stutter, or draw a blank. Other potential interview questions: Can you take me through your resume?What kind of hedge fund do you want to work for?Do you have a short and long investment idea to pitch to the firm?

Accept a position if you're offered one. Once you’ve gone in for an interview, you’ll have to wait a few weeks to hear back. During this time, the interviewer will sit down with their colleagues and go over your resume and their impression of you as a person. Don’t be discouraged if you don’t hear back within a week, as these things usually take time. If you get the job, you’ll likely receive a phone call with the offer after about 2 weeks. Make sure to email your interviewer the day after your interview to thank them for their consideration. To go the extra mile, mail a hand-written thank you note to the hedge fund. Little things like this help you stand out from a crowded, competitive pool of applicants.

Start as an analyst to begin your hedge fund career. This is the typical entry-level job at a hedge fund and the goal of an analyst is to evaluate company financials, market conditions, and previous investments in order to make future investments. You will also be asked to evaluate the risk of an investment and find other investments that line up with your hedge fund’s strategies to make as much money as possible. A lot of the job is attending meetings, making phone calls, and traveling. Another names for this job are investment analyst or research analyst.

Become a sales and marketing manager to bring money to the fund. People in this role must maintain relationships with clients and attract new investors. Sales and marketing managers pitch their fund’s strategy and highlight the potential returns to prospective clients. Employees who hold this role are persuasive, confident, and have terrific people skills. This work usually comes with a quota. For example, a sales and marketing manager might be expected to bring in at least $10 million during their first year at the hedge fund.

Work as a fund manager to maximize return on investments. This is one of the main jobs at a hedge fund and people in this role are required to select investments after spending weeks or months doing research. Fund managers must study stocks, bonds, currencies, and more to pick the best ones for the fund’s portfolio. They are responsible for making money on behalf of both the company and the client. Getting this job requires years of prior experience and a proven track record of investment success. Many fund managers will have at least a decade of work under their belt before taking this kind of job.

Comments

0 comment