views

New York/Singapore: Urgent messages flashed on cellphones, email alerts popped up and telephone extensions rang at the desks of a team at asset manager Legg Mason on Friday.

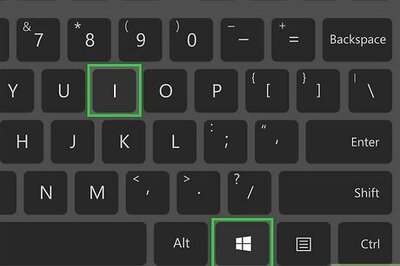

Dial in to a conference now, the 30-strong enterprise risk management team were told. A major event is underway.

This time it was just a drill, but what Maryland-based Legg Mason wants to be prepared for is any fallout if Greece leaves the euro.

Companies across the globe are on similar high alert this weekend as Greeks vote in an election on Sunday that could decide the future of the European single currency.

Fathers' Day celebrations have been cancelled for some and the head of a $1 billion Hong-Kong based hedge fund is among those dropping holiday plans to prepare for any disruption.

All eyes will be on first indications of a result likely to emerge early in the Athens evening - just before global markets open to a new week with the start of the Asian day.

"We really do not think anything is going to happen, but we would rather be over prepared than under prepared," said Joe Carrier, director of enterprise risk management at Legg Mason, which has $627 billion of assets under management.

Such war gaming has become routine for companies, particularly for those in financial services, as the euro zone crisis has intensified.

But the Greek vote has assumed greater significance.

Victory for leftist party SYRIZA, which opposes terms for an international debt bailout, could make an exit from the euro zone look more likely. SYRIZA is neck-and-neck with pro-bailout conservatives.

Asia wake up

In Asia, where markets will be first to react to the result, banks are calling in extra staff, some much earlier than usual.

"We're on code red. Asia is the first out of the blocks so across the region we've got IT and solutions staff in early," said Toby Lawson, Asia-Pacific Head of Financial Futures and Options and Cash Equities for broker Newedge.

"It's likely to be a lot more frantic given the volatility expected in the market," he said.

In Hong Kong and Kuala Lumpur, traders plan to show up as early as 2 a.m. - that is 9 pm in Athens (1800 GMT) - to be at their screens when the news comes in.

"I'll have to bring in some food because nothing will be open at that time of the morning," said one trader at a Canadian bank in Hong Kong.

New Zealand has a four-hour start on Hong Kong.

"We are going to throw more bodies on the ground at Wellington open on Monday and will have more people on call to handle client enquiries," said Jens-Scharff Hansen, managing director at Asia GFFX trading at Deutsche Bank in Hong Kong.

The Swiss National Bank has said it will intervene to prevent a huge appreciation of the Swiss franc if there is a flight from the euro to the currency seen as safer.

"From the first trading hour in Asia we're ready for action," bank spokesman Walter Meier said.

All hands on deck

Phil Orlando still expects to be sitting in the audience of his daughter Nina's graduation from Horace Greely High School in Chappaqua, New York, on Sunday night when the results come in.

The chief equity strategist at investment management company Federated Investors is confident he is prepared.

But he will be clutching his Blackberry and attempting to direct his team and plotting strategies with his trading desk.

"For the next two weeks it's all hands on deck," he said.

It is a similar tale for Bill Stone, chief investment strategist at PNC Asset Management Group, whose team held a scenario planning meeting earlier in the week to prepare their response to each outcome of the Greek elections.

Stone's team are not taking any vacations because of the Greek elections. They will be ready to dash for the office on Sunday night should the market take an extreme move.

Others are taking a more philosophical view. But while they aren't planning to be in the office on Sunday, they are braced for a period of further market turbulence.

"Our positions are decidedly risk-off already," Troy Buckner, managing partner at hedge fund NuWave Investment Management, said. "We anticipate a bumpy path and we're buckled in for the ride."

Big banks, including HSBC, Bank of New York Mellon and Citigroup said they were watching events carefully but gave no further details. Other banks contacted by Reuters declined to give any details of plans, although several said they were on red alert and had arrangements to deal with any eventuality.

Staff at one European investment bank will be watching the news more closely, but ready to send client notes from home.

"Plus, it's Fathers' Day on Sunday...Will we be cancelling that? Categorically not. At this stage, we all know there are two outcomes: in or out (of the euro). But are we expecting the whole world to crash on Sunday? Not really," the source said.

Corporate payments

Companies outside the world of finance are watching closely, but they don't expect immediate changes to trading after Sunday.

Drug companies such as Roche and Novo Nordisk have already had to adapt to asking for cash-on-delivery from some Greek hospitals as supplies run short and payment squabbles rage between local pharmacies and the state insurer.

Under moral pressure to avert a health catastrophe, drugmakers are weighing emergency plans to keep medicines flowing if Greece crashes out of the euro.

Xerox CEO Ursula Burns said the company's plans were around how to take care of its business, how to pay employees and how the financial infrastructure would run if Greece left the euro.

Burns said she did not think she was alone among chief executives in not expecting a European Armageddon. She would not be stuck to her TV screen on Sunday.

"I'll read about it in the paper the next morning. There is nothing that needs to be done that urgently," she said.

In Greece itself, bankers told Reuters preparations were being made to avoid any shortage of cash at branches or ATMs. Needs would be closely monitored and the central bank would be ready to dispatch armoured cars with cash if need be.

Even in Britain, one bank said it had a plan for staff to be ready to give extra reassurance to depositors on Monday.

Credit card and payments firms are making contingency plans and Visa Europe said it was working with authorities to put systems in place in case any country left the euro.

"Visa would work with all relevant parties to help ensure a swift transition to a new currency with the minimum possible disruption to consumers and retailers," it said in a statement on Friday.

Many of those asked said that even if the Greek election result does point towards a likely exit from the euro, this wouldn't happen immediately and there would be time to prepare.

Even Legg Mason's Carrier thinks Sunday's election results may take days to figure out.

Despite his preparations, he still plans on spending Fathers' Day with his wife and three children watching the Greek election results on the news.

Comments

0 comment