views

Finance minister Nirmala Sitharaman on Monday unveiled a spending plan worth more than Rs 5.5 lakh crore, the highest ever, as Prime Minister Narendra Modi’s government made its intentions clear on how it plans to revive the economy from a Covid-induced slump.

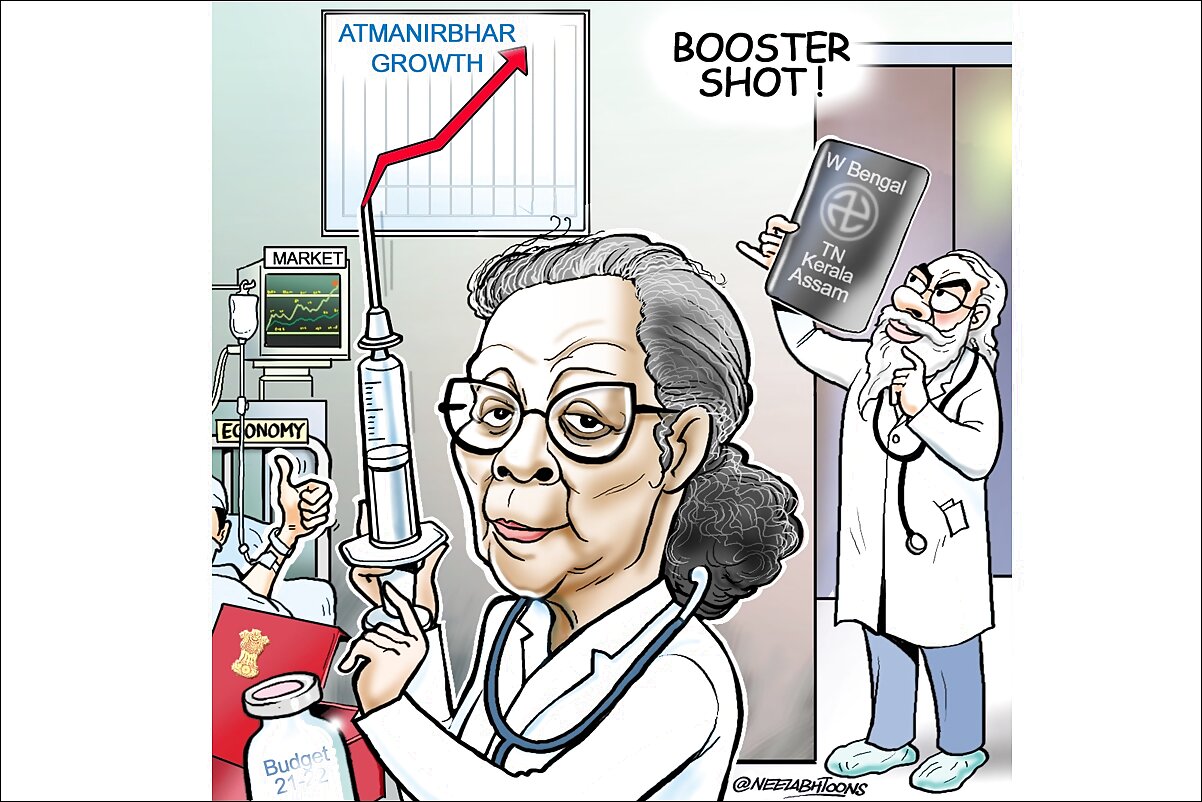

After taking supply-side measures through the Aatmanirbhar Bharat set of announcements through the last year, the 2021 Budget came out with a host of demand-side measures that were fuelled by borrowing, a larger-than-expected fiscal deficit, as well as privatisation of government assets.

The intention was mainly to create jobs, primarily through big infrastructure announcements. The budget speech was Sitharaman’s shortest yet, but it was not short on ideas on how to revive growth.

Apart from the highest-ever capital expenditure of Rs 5.54 lakh crore for FY22, the FM also announced a proposed development finance institution (DFI), and wide-scale asset monetisation by agencies like the National Highways Authority of India and the Indian Railways, as well as an asset monetisation pipeline.

“The government is fully prepared to support and facilitate the economy’s reset,” Sitharaman said, adding that the budget provides every opportunity for the economy to rise and capture the pace it needs for sustainable growth.

Illustration: Neelabh

But the FM stressed that the fighting the Covid-19 pandemic remains the Centre’s biggest priority as she boosted India’s healthcare spending by 135 per cent. Sitharaman proposed increasing healthcare spending to Rs 2.2 lakh crore to help improve public health systems and set aside Rs 35,000 crore for COVID-19 vaccine programme.

“The investment on health infrastructure in this budget has increased substantially,” she said as lawmakers thumped their desks in approval.

Delivering her budget statement to Parliament, Sitharaman projected a fiscal deficit of 6.8% of gross domestic product for 2021/22, higher than the 5.5% forecast by a recent poll of economists. The current year was expected to end with a deficit of 9.5%, she said, well up from the 7% expected earlier.

Prime Minister Narendra Modi said the budget was aimed at creating “wealth and wellness”, as he emphasised on the point that contrary to expectations the budget had not placed any additional burden on the common man through taxation.

While there were no big tax announcements – either reduction or an increase – in what must come as a major disappointment to the middle class hoping for increased exemptions, the Finance Minister did announce a reprieve for pensioners who are 75-plus, who will no longer be required to file tax returns.

She also provided an additional Rs 1.5 lakh tax deduction on loans taken to buy a house under the affordable housing scheme, with the deadline extended till 31 March 2022.

Sitharaman also announced a renewed thrust towards asset sales and privatisation after the false starts of the past few years, with a target of Rs 1.75 lakh crore. She said the initial public offering (IPO) of LIC will be completed in the coming fiscal, and the Centre had identified four sectors as ‘strategic’ in which the government will have a presence.

She also said the Centre will privatise two state-owned banks and a general insurance company, although stake in which banks and insurance firm will be pared was not announced.

The budgeted capex for FY22 stands at Rs 5.54 lakh crore. For FY21, the Centre had budgeted its own capital expenditure at Rs 4.13 lakh crore, which was later increased by Rs 35,200 crore.

The Finance Minister also announced the creation of a ‘bad bank’ to take on non-performing assets (NPAs) from the books of banks, and said banks will be recapitalised to the tune of Rs 20,000 crore in FY22.

The markets responded overwhelmingly positively to the expansionary stance adopted by the government, as stock indices surged to their best-ever budget day rallies, led by banking, insurance and auto stocks.

Unlike other countries, India had so far refrained from announcing a big stimulus, offering greater liquidity to firms instead, and holding off the fiscal firepower until curbs to contain the virus were lifted.

The government estimates the economy will contract 7.7% in the current fiscal year ending in March but then recover to show 11% growth in 2021/2022. That would make it the world’s fastest-growing major economy ahead of China’s projected 8.1% growth, but the government said it would take the economy two years to reach pre-pandemic levels.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment