views

The Employees’ Provident Fund (EPF) is a retirement savings programme provided to salaried employees. In this scheme, a portion of their monthly income is deposited with the Employees’ Provident Fund Organization (EPFO). The employer also contributes a fixed amount of money to the fund. The corpus develops with time and will prove useful to the employee in the future, either during their service or in the post-retirement phase. EPF is typically connected with retirement and is a sluggish and time-consuming corpus but it may be useful when you most need it.

To cover specific financial unforeseen needs, such as medical treatment, a wedding, schooling, home loan, and house construction costs, the Employee Provident Fund Organisation authorises EPF members to make advance withdrawals from their accounts.

Although EPFO gives you this advance withdrawal option, you should exercise caution when making this choice. This should serve as your final resort after all other means have been exhausted. You may only move on with the application for an advance EPF withdrawal if you meet the requirements for receiving the benefit and present all required documentation.

Here is how you can apply for EPF advance withdrawal online

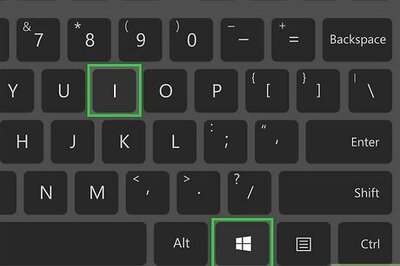

Step 1: Go to the e-SEWA portal of the EPFO. https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Enter your Universal Account Number (UAN), and password, and type in the captcha code to log in.

Step 3: Choose “Claim (Form-31, 19 & 10C)” from the menu by clicking the “Online Services” link.

Step 4: Enter your bank account information on the new page that opens and select “Verify” to continue. This information is linked to your PF account. Now, click on “Yes” to accept the terms and conditions.

Step 5: Click on “Proceed for Online Claim” and then choose the “I Want to Apply For” link to choose the claim you wish to submit. Depending on your situation, you may select a pension withdrawal, a loan or advance from your prior EPF, or a comprehensive EPF settlement. You must select “PF Advance (Form 31)” if you want to take the money out before you retire.

Step 6: After choosing the form, specify the justification for the withdrawal, the amount you require to withdraw and your address.

Step 7: Complete and submit your application. You might also need to submit scanned copies of documents like an Aadhar card, a PAN card, or a blank check that has been cancelled along with a proof of address and voter id card.

Step 8: When your employer approves your application, the money is deposited into your bank account within 15 to 20 days.

EPF scheme participants can withdraw amounts from their provident fund accounts by applying offline or online.

Read all the Latest Business News here

Comments

0 comment