views

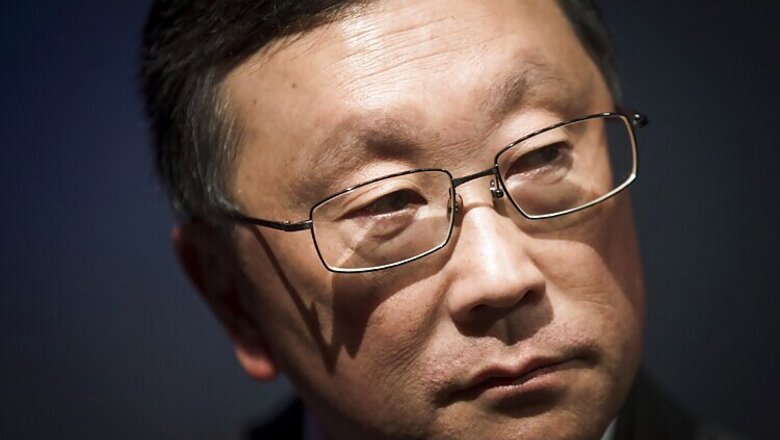

Waterloo: BlackBerry Chief Executive John Chen expressed confidence that he can make the company's trimmed-down handset business profitable by a self-imposed September deadline, as the smartphone pioneer posted results that beat expectations.

BlackBerry broke even before charges and writedowns in its first quarter and forecast a smaller-than-expected annual loss, helping to send its stock up 3.6 per cent.

The Canadian company has shifted focus from its once-dominant smartphones to software that companies and governments use to manage their mobile devices. Adjusted revenue in that business exceeded handset sales in the quarter.

Asked if devices would be a going concern, Chen pointed to outsourced manufacturing and know-how secured by thousands of patents.

"I think I can add value to the bottom line because I am attempting in hardware ... a very different model," Chen told reporters at the company's Waterloo, Ontario, headquarters.

"I have so much credibility and knowledge in how to build a handset, but I don't have to build it," he said, adding that the company was exploring licensing some of the handset technology.

Chen expressed frustration with the market's focus on BlackBerry's handsets, pointing to growth in software sales and cost-cutting that has improved margins.

"Despite my best efforts to tell the world I'm a lot more than just a phone company, every question I ever get is about phones," he said.

Adjusted software and licensing revenue was $166 million in the fiscal first quarter ended May 31, compared with $152 million for its device business. BlackBerry had annual software revenue of $527 million in its last fiscal year and is targeting 30 percent organic growth.

BlackBerry said it expects an adjusted annual loss of around 15 cents per share, compared with the average analyst estimate of a loss of 33 cents for fiscal 2017.

"They have not put figures behind some of their forecasts in quite some time, and hopefully that speaks to improved visibility," said Morningstar analyst Brian Colello.

The company posted adjusted profit of $14 million, or nil per share, on adjusted revenue of $424 million. Analysts, on average, expected a loss of 8 cents a share on revenue of $470.9 million, according to Thomson Reuters.

It reported a net loss of $670 million, or $1.28 cents a share, which BlackBerry said reflected a $501 million writedown on the value of the handset business and other charges.

Comments

0 comment