views

The Report of the Expert Committee on Micro, Small and Medium Enterprises has recommended to the Reserve Bank of India (RBI) for the implementation of a video KYC format to replace the current know your customer (KYC) methods and Aadhaar verification. This will be for micro, small and medium enterprises for the time being. This, they suggest, can be done via Google Duo on Android devices and Apple FaceTime on iPhones, for instance. The committee has been formed to recommend steps to improve the growth and development of the MSME sector. In a way, these guidelines could show the way for KYC norms for consumer facing services as well, including payment apps and digital wallets, at some point.

At present, the requirements of the KYC process rely heavily on manual verification and data handling, and also makes it mandatory for the new customer to be physically present at the time. This, the committee says, increases costs and stretched timelines in completing the required KYC processes. “As an alternative to enabling e-KYC, the Committee recommends video KYC to be adopted as a part of digital financial architecture as a suitable alternative to performing a digital Aadhaar-based KYC process towards enabling non – physical customer onboarding,” say the recommendations.

The proposed KYC method is designed to be simpler than what is followed at present.

The customer can sign up for the facility through an entity’s mobile app or website. At this point, the prospective customer can schedule an appointment with respect to preferred date and time on the application as a part of the sign up process. The customer then shares images of his/hers original POI (Proof of Identity)/POA (Proof of Address) which are OVD (Official Valid Documents) during the sign up process. Once this is done, the entity than then confirm an offer to the customer regarding a service, which then has to be accepted. The customer, through an OTP based click-wrap accepts the offer. The entity which is providing the service then reaches out to the customer as per the preferred date and time for initiating the digital verification process.

The recommendations state that the verification via video can be done via Google Duo for Android users and Apple Facetime for an iOS user. We assume it will also be expanded to include iPadOS and macOS.

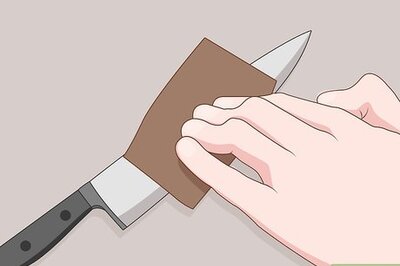

During the video call, the service providing entity’s authorized person will have to mandatorily identify themselves with their identity card. The customer is then requested to display the POI and POA documents, as shared in the earlier application. The entity’s authorised person verified the details on these documents with the documents shared in the application earlier. Then the photo on the identity proof is matched with the person who is on the video call. “On successful verification of documents, the authorized person then confirms the video KYC to be complete on the said date,” say the recommendations.

The customer will still also be provided the option of a physical visit for KYC, in case they are not comfortable with the digital process that involves a video call.

At present, it is a multi-step process, starting with the identification and verification of the documents by the employee of an entity. Then the PAN details are matched with the NSDL database for authenticity. At this point, a face match is done between OVD (Official Valid Document) provided and the customer image taken as a part of the process, hence validating the document holder is indeed the applicant—followed by a verification of the face match and then the OTP based confirmation.

While these recommendations are meant for micro, small and medium enterprises at the moment, we could easily see these being used for other services as well, including for mobile phone connection subscription and re-verification for mobile wallets. At the moment, mobile wallet apps are struggling to re-verify their users since the new RBI guidelines mandated them to re-do the KYC for all users. Apps such as Paytm roped in retailers to help with the physical KYC requirements, but data since then has suggested that this is turning out to be a costly affair, and not enough people are turning up in person to get the KYC done.

Comments

0 comment