views

India is one the fastest growing automobile market in the world, with every other household either having a two-wheeler or a four-wheeler or both at their homes. Having said that, India is also highly traditional and cost conscience market where every buying decision is ruled by the value-for-money deal.

And when it comes to VFM deals, fuel efficiency plays a vital role. The 'Kitna Deti Hai' question has been the long-lasting parameter that makes or breaks a deal. This is the reason more than 50 per cent of Indians prefer Maruti Suzuki cars and Hero Motocorp is the largest two-wheeler manufacturer in India.

WATCH VIDEO:

While we have seen exponential increase in fuel prices over the decade, the last 15 days have been particularly heavy on the vehicle owners. Prices of fuel have increased exponentially, with both petrol and diesel touching Rs 80 in Delhi.

You will be shocked to know that more than 60 per cent of the fuel price goes to central and state governments in taxes, making fuel one of the largest revenue earners for the government.

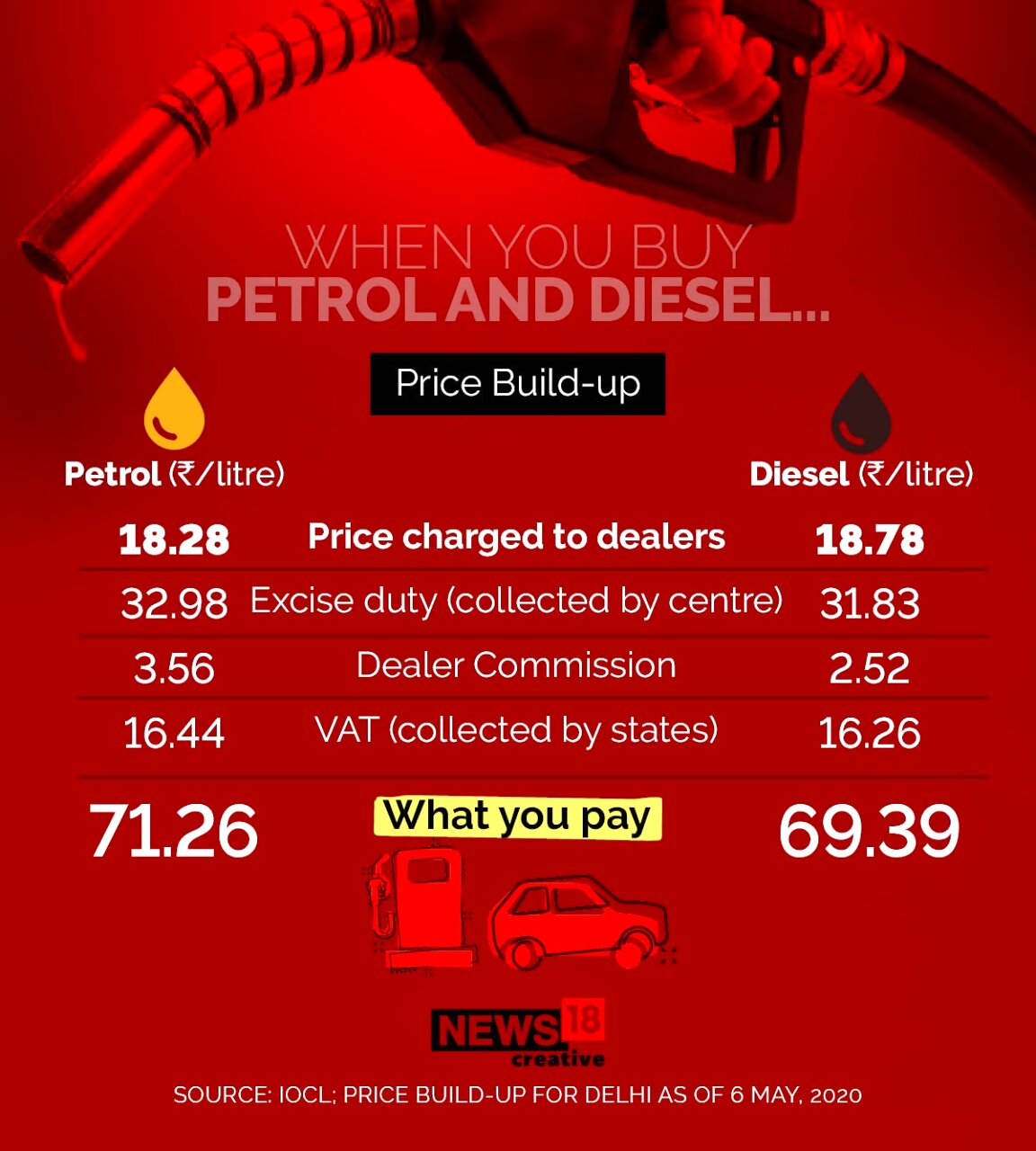

We did a calculation based on tax bifurcation available last month. Talking in terms of numbers, while the customers are paying Rs 71.26 for petrol and Rs 69.39 for diesel in Delhi (as on May 6), the base fuel price is actually Rs 18.28 a litre for petrol while diesel at Rs 18.78 a litre in Delhi.

That's more than half of the prices paid in taxes. Bifurcating it further, Central taxes (excise duty) on petrol and diesel stands at Rs 32.98 and Rs 31.83 per litre, respectively, while Delhi levies a VAT of Rs 16.44 per litre on petrol and Rs 16.26 per litre on diesel, effectively taking the total tax component on the two auto fuels to a staggering 75 per cent (approx).

Petrol Price to customer - Rs 71.26

Base price - Rs 18.28

Excise duty (Central) - Rs 32.98

VAT (State) - Rs 16.44

A small part of the fuel price also goes as dealer's margin and freight charges.

However, the 75% taxes are exceptional case due to the recently hiked Excise duty by the government to offset the losses suffered due to the Coronavirus crisis. The government hiked Rs 10 and Rs 13 per litre taxes on petrol and diesel respectively. In normal days, the ratio of taxes is usually 55% of per litre price charged to the consumers.

Also, the component of taxes is much higher in Maharashtra, Tamil Nadu and a few other states that keep petrol and diesel retail prices much higher for customers in these states.

"Even though petrol and diesel prices have been freed from the administered price mechanism, high level of taxes and the invisible control that the Centre exercises on public sector oil companies prevent market forces from taking over auto fuel pricing, keeping customers away from the gains that could have accrued in this market where crude prices have settled at just around $25 a barrel now," said an oil sector analyst with one of the big four consultancy firms asking not to be named.

While the government has kept the customers away from enjoying the real benefits of lower fuel prices, it has kept its tax collections strong. The Centre collected over Rs 2,14,000 crore from excise duty in the oil sector in 2018-19 and has already collected over Rs 1,50,000 crore in the nine-month period of the current fiscal.

The states have seen their VAT and sales tax revenues from the sector consistently increasing since FY 15, standing at over Rs 2 lakh crore in FY19 and Rs 1,50,000 crore in the nine-month period of FY20.

With Inputs from IANS

Comments

0 comment