views

Finance Minister Nirmala Sitharaman’s Union Budget 2021 on Monday proposed an Agricultural Infrastructure and Development CESS of Rs 2.5 per litre on petrol and Rs 4 on diesel. However, prices for petrol and diesel won’t change because or reduction in other duties.

Sitharaman said that such cess would not affect consumers. She said, “Consequent to imposition of Agriculture Infrastructure and Development Cess (AIDC) on petrol and diesel, Basic excise duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced on them so that overall consumer does not bear any additional burden.”

ANI quoted her as saying, “Consequently, unbranded petrol and diesel will attract basic excise duty of Rs 1.4, and Rs 1.8 per litre respectively. The SAED on unbranded petrol and diesel shall be Rs 11 and Rs 8 per litre respectively. Similar changes have also been made for branded petrol and diesel.”

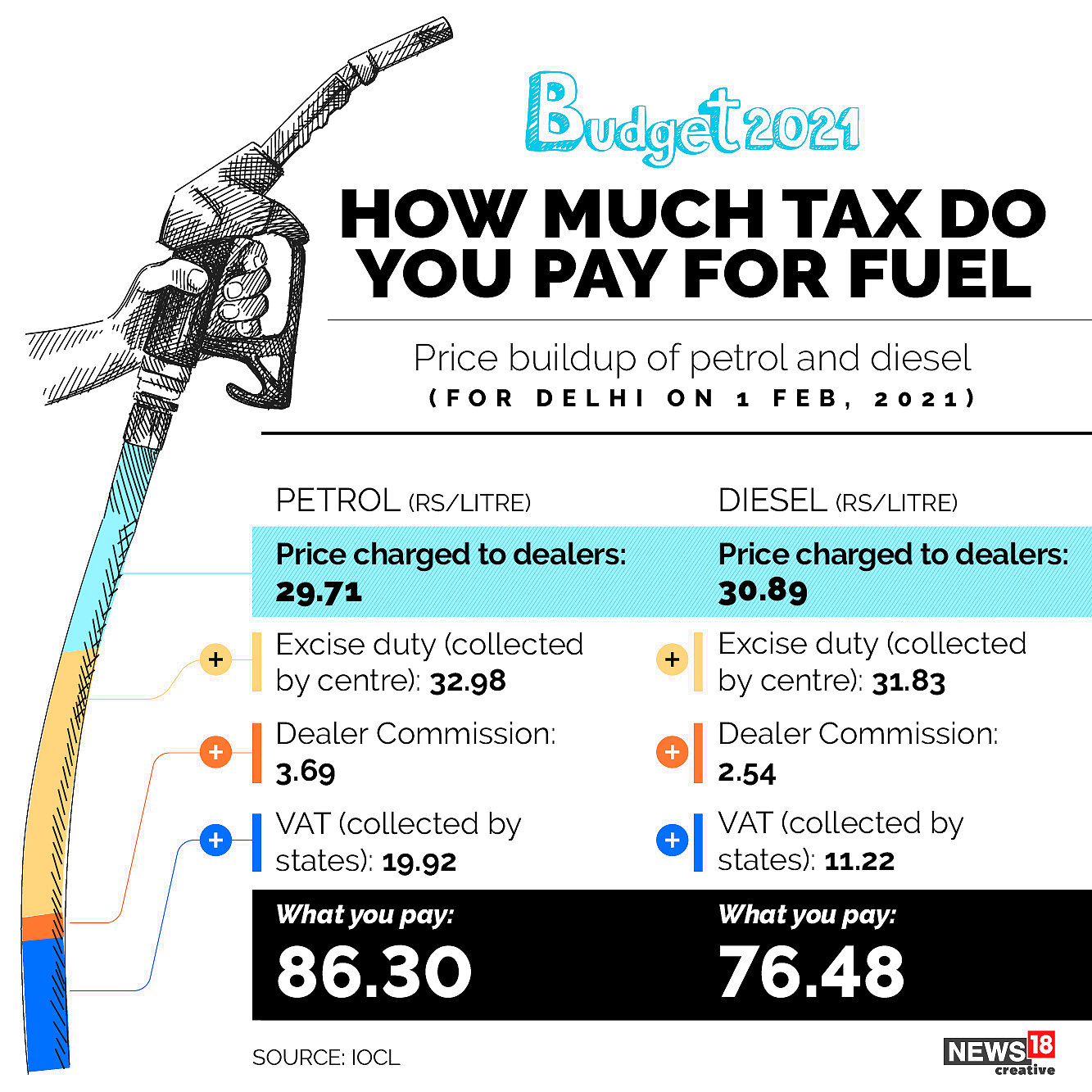

The graphic shows how much tax you pay for your fuel:

Branded or premium petrol price crossed Rs 100-mark in Sriganganagar town of Rajasthan as petrol and diesel prices were hiked last Wednesday for the second consecutive day. Petrol and diesel prices were raised by 25 paise per litre each across the country on Wednesday, according to a price notification from oil marketing companies.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment