views

Budget 2024 brought significant changes to the new tax regime, making it more attractive for many taxpayers. Finance Minister Nirmala Sitharaman announced the revision of tax slabs under the new tax regime while presenting the Union Budget 2024 in Parliament. She also announced an increase in the standard deduction limit to Rs 75,000.

The new tax slabs under the new income tax regime will be effective from April 1, 2024. (Assessment Year 2025-26).

Also Read: Budget 2024 Income Tax Slabs: Changes In New Tax Regime And What Happens To The Old Regime Explained

Should You Opt for the New Tax Regime Now?

The changes introduced in Budget 2024 have made the new tax regime more appealing to a larger section of taxpayers. However, it’s essential to calculate your tax liability under both regimes based on your specific income, deductions, and financial situation.

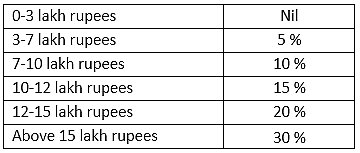

New Tax Regime Announced in Budget 2024

What Expert Says?

Dipesh Jain, Partner at Economic Laws Practice, said, “While the base exemption limit of INR 3 lakhs has remained unchanged, which was expected to be increased marginally, the 5% tax slab is proposed to be expanded by INR 1L ie INR 3L – 7L from the existing slab of INR 3L – 6L.”

“The highest tax slab of 30% continues to be status quo ie more than INR 15L. Accordingly, there would be a marginal relief of INR 17,500 for individual tax-payers opting for the new regime. This would further enhance the attractiveness of the new tax regime as compared to the old tax regime, where there are no relaxations proposed.”

- The slab rate reduction effect will be Rs 10,000.

- Standard deduction Rs 25,000 additional @ 30% = Rs 7,500Rs 10,000 + Rs 7,500 = Rs 17,500

Factors to consider:

Income level: If you have a relatively low to moderate income, the new regime is likely to be beneficial.

Deductions and exemptions: If you have significant deductions under the old regime, you might still prefer to stick with it.

Future financial plans: Consider your investment plans and long-term financial goals.

Stay informed with our comprehensive coverage of Union Budget 2024. Get the latest on new income tax slab rates for AY 2024-25 in Income Tax Slabs Budget 2024 LIVE Updates . Track the impact of Budget 2024 on the stock market in Stock Market Budget Day 2024 LIVE Updates. Watch Union Budget LIVE Streaming here

Comments

0 comment