views

To enhance transparency on loan information for borrowers in key facts statement (KFS), the Reserve Bank of India (RBI) on Thursday said loan processing fees, documentation fees, and other charges need to be loaded into the actual interest rates. RBI Governor Shaktikanta Das said this will provide customers with a clear idea of the actual annualised interest rate they pay on the loan.

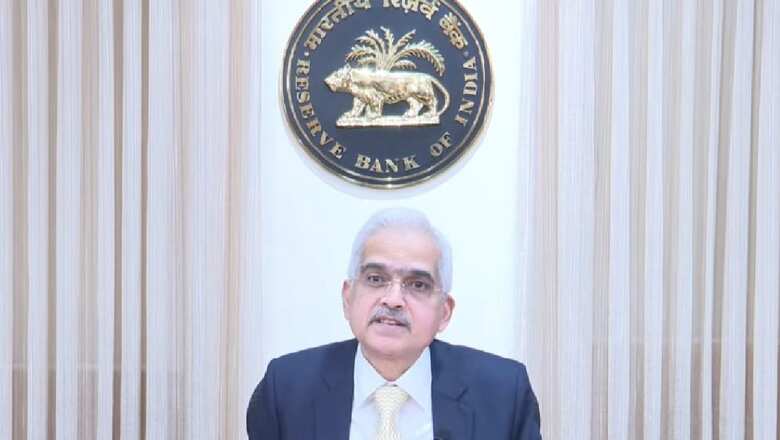

While presenting the sixth and last bi-monthly monetary policy of FY24, Das on Thursday said, “The customer knows that the loan carries an interest of so much percentage. But there are other changes and fees etc. which he pays upfront. Now that also needs to be loaded into the actual interest rate so that the customer has a clear idea that what is the actual annualised interest rate that he pays.”

“Customer-centricity is something on which the Reserve Bank pays a greater emphasis,” the RBI governor said.

Now, for greater transparency for the borrowers, the Key Facts Statement (KFS) must include details like processing fees, documentation charges, etc, Das said. He said the need for a KFS is being extended to all retail and MSME loans, which will bring transparency in lending.

“To enhance transparency in disclosure of such information on various charges, fees etc, the Reserve Bank of India had mandated crayon category of lenders to provide the borrower a Key Facts Statement containing essential information such as all-inclusive annual percentage rate and also details of the recovery and grievance redressal mechanism. The requirement of the KFS is now being extended to cover all retail and MSME loans. This measure will lead to enhanced transparency in lending and will enable customers to make informed decisions,” he said.

Vivek Iyer, partner at Grant Thornton Bharat, said, “Issuing key facts statements for borrowers will help them have complete information on their loan in terms of the amount of the loan, interest rate, interest type, details of collateral and all types of fees chargeable to them as customers across the loan life cycle. In fact, the RBI has specified a format of the same in its guidelines dated January 2015.”

He added that KFS is nothing but a simple disclosure document capturing all the financial parameters of their borrowing position such as interest, fees, emi, amount of loan, security of loan, type of loan etc. A total of 10 aspects are required to be disclosed as per the RBI format on KFS.

Atul Monga, CEO and co-founder of Basic Home loan, said, “This move will provides several benefits to borrowers, both existing and new. Firstly, there will be improved transparency. Borrowers will receive upfront and transparent information regarding all fees associated with their loans. This eradicates any hidden charges and allows for easier comparison between different loan options.”

Secondly, by gaining detailed insights into the costs, terms, and conditions of loans, borrowers can make more informed decisions. They will be able to select loan products that align with their specific needs and financial capabilities. Having a clear understanding of all the costs involved from the beginning will assist borrowers in better financial planning and budgeting for loan repayment. Also, the transparency in loan terms could potentially foster competition among lenders, resulting in more favorable terms and lower costs for borrowers. Further, this initiative guards against potential misleading practices, ensuring borrowers have full knowledge of the financial commitment they are entering into, he added.

Comments

0 comment