views

Mumbai: The Indian rupee on Friday fell for the second day and depreciated by 17 paise to end at nearly one-month low of 61.72 against the greenback on sustained dollar demand even as local stock indices surged to new highs.

The rupee resumed lower at 61.61 per dollar as against the yesterday's closing level of 61.55 at the Interbank Foreign Exchange (Forex) Market.

Later, it slipped further to 61.83, before concluding the day at 61.72 per dollar, reporting a loss of 17 paise or 0.28 per cent. This is its lowest close since ending at 61.83 per dollar on October 16, 2014.

On Friday, it moved in a range of 61.60 per dollar and 61.83 per dollar during the session.

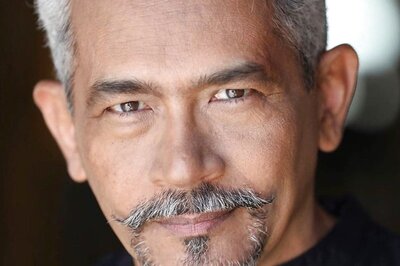

"Rupee depreciated sharply in last hour of the trade marching towards 62 after breaking 61.75. US dollar index also inched higher suggesting strength in USD against major world currencies. Most Asian currencies remained weak against US dollar," said Kiran Kumar Kavikondala, Director & CEO, WealthRays Securities.

In New York market, the pound continued to move lower against the dollar during the North American trading day yesterday, reaching its lowest level since September 9.

The US dollar rose higher against its major rivals. It ruled at a fresh seven-year high against Japanese yen, bolstered by rising Japanese equities.

The dollex index was quoting higher by 0.22 per cent against major currencies in the global market. Meanwhile, the Indian benchmark Sensex rose by 106.02 points, or 0.38 per cent, to all-time closing high of 28,046.66 on fresh buying in select counters due to fall in inflation.

Comments

0 comment