views

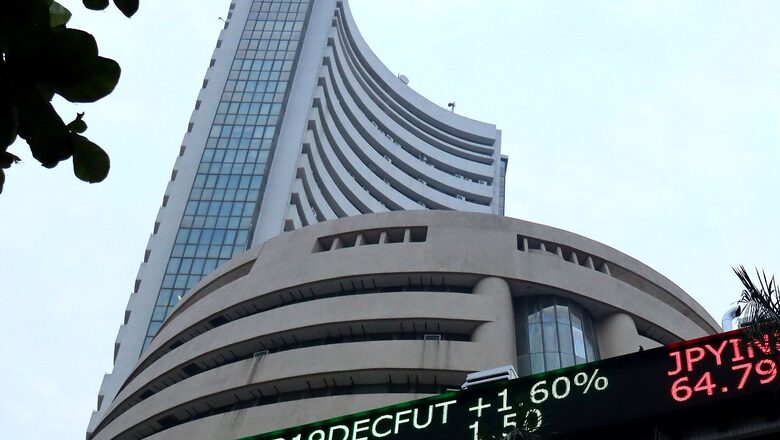

After having a dream run last week, the 30-share BSE Sensex on Monday opened in green and was trading at 60,271.64, up 223.17 points, up 0.37 per cent. The broader Nifty was trading at 17,913, up 63.80 points, or 0.36 per cent. On NSE, Tata Motors with 2.17 per cent was the top gainer, followed by ONGC, Maruti, Mahindra and Mahindra, HDFC Bank. However, Divis Lab, Wipro, Tech Mahindra, Cipla, Tata Consumers were among the laggards. Divislab scrip tanked 1.83 per cent. On BSE, Phoneix Ltd, MMTC, NELCO were among the top gainers. On the flip side, Gateway Distriparks, Mayur Uniquoters, Apollo Hospitals were the top losers.

Sectorally, On NSE, Nifty Realty was the top gainer. Nifty Bank, Nifty Auto, Nifty Financial Services, Nifty Media opened with gain in early trade. On the other hand, Nifty IT, Nifty Pharma, Nifty FMCG, Nifty Metal were trading the red. On BSE, BSE MidCap down 0.17 per cent and BSE SmallCap up 0.40 per cent.

“The relentless Bull Run which began in April 2020 has taken the Sensex beyond 60000 and is now poised to push Nifty to 18000 level today. The incredible return of above 130 per cent from the lows of March 2020 and above 60 per cent for the last 12 months has created phenomenal wealth for all kinds of investors -FIIs, DIIs and retail. After 60,000 for Sensex and 18,000 for Nifty, markets may consolidate for a while. After massive selling in July (Rs11308 cr) and tepid buying in August (Rs 2083 cr) FIIs have turned aggressive buyers in September with a buy figure of Rs 13536 cr up to 27th September,” Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services said.

According to him, this change in strategy of FIIs is likely to impart resilience to the market. On the macro front, rising tax collections and progressive reopening in economically significant states like Maharashtra are positives while brent crude at $ 79 is a clear negative.

On Friday, the S&P BSE Sensex crossed 60,000 for the first time as investors remain optimistic about the future of the domestic stock markets. The journey of Sensex from 50,000 to 60,000 is completed just in 8 months. Meanwhile, NSE Nifty 50 also hit an all-time high of 17,924.05 after Friday’s opening.

“Global equities witnessed decent recovery in the second half of last week after selling pressure due to concerns over Evergrande possible defaults. Notably, favourable FOMC meeting outcome as it did not mention about any timeframe of actual quantitative easing offered comforts to investors and all three key indices in the USA recorded weekly gains to the tune of 0.1 per cent-0.6 per cent. For the current week, no major economic event is scheduled globally. Investors will be keenly tracking developments on Evergrande seemingly defaults,” Binod Modi, Head Strategy at Reliance Securities said.

“Further, any possible announcements from Congress in the context of debt ceiling in the USA would be a focus area. Notably, Treasury Secretary has already warned Federal Government may run out of treasury by mid of October if debt ceiling is not increased, which could have a widespread impact of global financial markets.” he added.

The market opened with gains, taking mixed cues from global markets, the MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, after three consecutive weeks of loss. Japan’s Nikkei gained 0.4 per cent on hopes for further fiscal stimulus once a new prime minister is chosen.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment