views

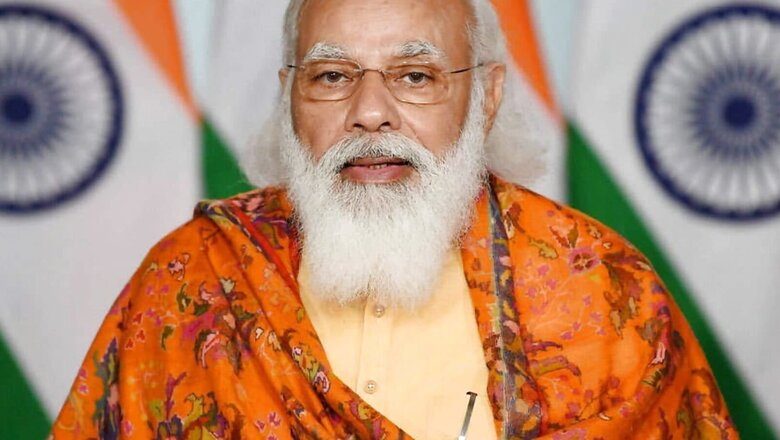

The founders of 22 startups along with renowned venture capitalists, in a written letter to the Prime Minister Narendra Modi requested permitting direct overseas listing of companies based in India, the Business Insider reported yesterday. The letter written by the CEO of Swiggy, Urban Company, Cred, Infra, Market, Byju’s and Unacademy along with partners from Sequoia Capital, Accel, Lightspeed and Tiger Global, among others, mentioned in the letter that direct listing in overseas market would be the single most significant, big bang reform for the startup ecosystem and will instantly pave the way for Indian companies to be on the global map. The founders of the start-ups and venture capitalists threw light on on how the start-up ecosystem is bringing a tech-wave in the country and making India equipped to produce globally competitive products.

“Given this trend of fast-paced growth, many such mature companies are now keen to tap stock markets to raise further capital as it will allow them to fuel their domestic and international expansion, generate employment and make India more efficient and competitive.” the letter read. The direct listing in overseas markets is the idea mooted by the industry leaders because the US capital markets and other overseas markets are bigger than India, making it an attractive place for Indian startups to list.

The matter of direct overseas listing in India has been in discussions since very long time. The companies have time and again requested the policymakers to give it a thought and strive to come up with the policy concerning direct overseas listing of the companies. According to media reports, the government is thinking about the same and the policy in regards to direct overseas listing of the companies may find place in the next budget 2022. Revenue Secretary Tarun Bajaj on August 25 said that direct overseas listing is under consideration of the government. “Direct listing for companies will need some issues to be sorted out for it to be a success,” Bajaj added.

In the letter, founders of start-ups explained the rationale as to why they are pitching for this idea. Clearing the fog around this, they said that direct overseas listing of the companies will help to access the greater pool of capital and will also help in raising the profile of the company. They also added that investors from international markets are more specialised in US and Singapore due to which they are able to place a higher valuation on these tech-companies.

“The current inability of unlisted companies to tap international markets for raising capital is hence an impediment to the growth ambitions of Indian startups, as their access to wider global pools of capital is blocked and serves up other disadvantages as outlined above,” the letter read.

In last September, the Companies (Amendment) Bill 2020 was passed by the Rajya Sabha. The bill seeks to amend Section 23 of Companies Act 2013, which deals with public offerings and private placements. The Centre along with RBI & SBI are working on the framework for such listings. A 2018 Sebi committee had suggested 10 permissible foreign jurisdictions for Indian companies to list overseas, including the US, the UK, HK, China and Japan. So far, firms can list their debt securities only through American Depository Receipt (ADR) or Global Depository Receipt (GDR).

With this direct overseas listing being considered by the government, if passed, will be a fresh impetus for already thriving startup ecosystem in India and will help startup ecosystem to compete on the global map.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment