views

New Delhi: The Reserve Bank of India on Monday raised the withdrawal limit for depositors of Punjab and Maharashtra Cooperative Bank Ltd to Rs 40,000 from the earlier limit of Rs 25,000. This is the third such raise in the last month.

The initial limit imposed on the harried customers of the bank was Rs 1,000, which was subsequently raised to 10,000 and Rs 25,000 after protests. The limit was raised after finance minister Nirmala Sitharaman, who had faced protests by irate depositors at the BJP office in Mumbai last week, met RBI Governor Shaktikanta Das on Monday afternoon.

"The RBI governor has assured me that he will keep the interest of customers in mind, and at the earliest try resolve it...I had discussion with RBI Governor this afternoon and I am closely monitoring it," she said earlier in the day.

The RBI said that with the latest increase, about 77 percent of the depositors of the bank will be able to withdraw their entire account balance. In a press statement, the central bank also said the move to increase the withdrawal cap to Rs 40,000 has been taken "after reviewing the bank's liquidity position and its ability to pay its depositors".

"The financial position of the bank has been substantially impaired due to fraud perpetrated on it by certain persons. As soon as the matter came to the notice of the Reserve Bank, action was taken in appointing an administrator and ensuring that the bank's available resources are protected and not misused or diverted," the RBI said.

PMC is in bad health allegedly due to its exposure to near-bankrupt realty player Housing Development & Infrastructure Ltd, to which it has loaned over 70 per cent of its Rs 9,000 crore in advances. The bank was put under "directions" by the Reserve Bank of India (RBI) last month due to weak financial health, wherein the central bank has capped the deposit withdrawals.

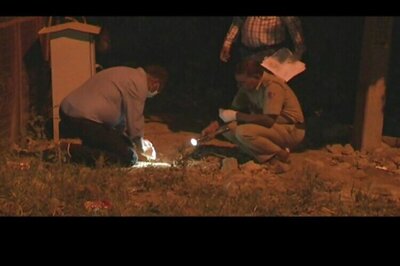

The Enforcement Directorate on Monday, meanwhile, said it has seized and identified assets worth Rs 3,830 crore in the PMC Bank money laundering case. The central probe agency said it is valuing a number of properties of Housing Development and Infrastructure Limited (HDIL), its directors, promoters, Punjab and Maharashtra Co-operative (PMC) Bank officials and others.

The identified assets will soon be attached under the Prevention of Money Laundering Act (PMLA). The ED case is based on an FIR filed by the Economic Offences Wing (EOW) of Mumbai police. The central agency had conducted raids in the case early this month.

Comments

0 comment