views

- It’s illegal to bypass a CVV code when a merchant requires it for a purchase. If a CVV code isn’t required, the transaction is probably not secure.

- Scammers may attempt to get your CVV code through phishing schemes or keylogging malware.

- Protect your CVV code by only entering it on secure websites, ignoring unsolicited requests for your personal information, and checking your card statements regularly.

- If you need your CVV code but can’t locate your physical card, call your card issuer. They can look up your CVV code after verifying your identity.

Is it possible to bypass a CVV code?

It’s illegal and impossible to skip a CVV code if a merchant requires it. The CVV code is a layer of security that proves you’re the authentic card holder when you make online or phone purchases (these are called card-not-present transactions). If you don’t provide the CVV when asked, the transaction is declined and you’ll have to either give the CVV code to continue or find another CVV-less method of payment, like a wire transfer or a money-sending app like Venmo. Ultimately, there is no legal way to make a purchase as yourself without providing your card’s CVV code.

If a merchant doesn’t require a CVV code, the transaction is unsecure. You may occasionally find yourself on a website that doesn’t ask for a CVV code at checkout. Be wary of these—CVV codes have been around since the 90s, so these sites are either very outdated or a scam to get your personal information. Similarly, if a scammer has your other credit card information, like the card number and expiration date, they can still use your card to make purchases on sites like these even if they don’t have the CVV code. If you’re setting up recurring transactions, the merchant may only ask for the CVV code for the first payment. All following transactions will be considered authorized. Watch out for software that claims to enable online purchases without entering a CVV code. These are usually malware schemes attempting to access your confidential information.

What is a CVV code?

Card verification value (CVV) codes add security to card-not-present transactions. They’re an anti-fraud protection layer that helps confirm that the legal cardholder actually has the physical card in their possession. CVV codes were introduced in the late 1990s to combat rising credit card information theft. All credit cards, including virtual credit cards, now come with a CVV code for fraud protection.

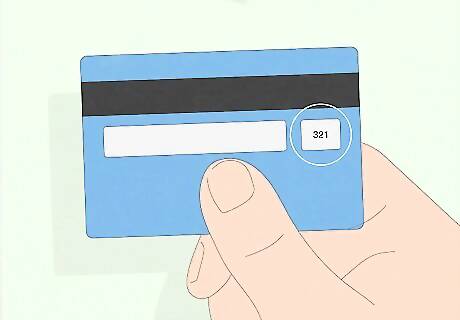

Most CVVs are 3-digit codes on the back of your card. Most card issuers, including Visa, Discover, and Mastercard, list CVV codes on the signature panel on the backside of their cards. American Express uses a 4-digit numeric code for its CVV and lists the code on the front of the card instead of the back. CVV codes may go by different names depending on the issuer: Discover: Card Identification Number (CID) Mastercard: Card Validation Code (CVC2) Visa: Card Verification Value 2 (CVV2) Most debit cards: Card Security Code (CSC)

CVV codes are not the same as a PIN. Personal identification numbers (PINs) are user-created, 4-digit codes that authorize cash advances (credit cards) or cash withdrawals and purchases (debit cards). Banks or card issuers may give you your card with a temporary PIN, but in most cases, you’ll have to change it to a customized number of your choosing for security. This is not the case with CVV codes, which are generated by the card issuer and which you can’t change.

Do I need my CVV code for every transaction?

CVV codes are linked to your card’s chip, so you only need them online. For card-present transactions (transactions where you physically swipe, insert, or tap your card), you don’t provide the CVV code separately since the card’s strip or chip provides the same information. The CVV code is necessary for card-not-present transactions, like online shopping or phone orders, where you can’t physically present your card to the merchant. Some cards may require you to enter a PIN to complete transactions in-person. Your PIN is a different code you choose instead of a pre-generated code from your card issuer.

How Criminals Access Your CVV

Criminals might gather your CVV code through phishing scams. A phishing scam is an attempt to trick you into giving out your personal information through false emails or text messages that appear to be from legitimate sources. Scammers can collect credit card numbers and CVV codes, passwords, Social Security numbers, and more this way. To avoid falling for phishing scams: Be wary of entering personal information through links sent to you in emails. Visit the company’s website without clicking the link or contact them directly. Don’t call any phone numbers listed in a suspicious email. Look for signs of fraudulence in emails like typos, logos that don’t match the real company’s branding, and wrong URL extensions (like an email coming from a “.org” address when the company’s website has a “.com” extension).

Scammers can use keylogging to track information on unsecure sites. Keylogging is the use of tracking codes or malware that records the keys you press while on a website. Scammers can store your credit card information this way and then use it to make fraudulent purchases. Insecure websites can be hacked by scammers for keylogging, or scammers can introduce malware to your computer through spam links to track your keystrokes. To avoid keylogging scams: Only enter credit card information on secure sites with a URL beginning with “https” and that show the padlock icon in the web address bar. Install strong, up-to-date antivirus protection on your computer, phone, or any device you use to make online transactions.

Finding Your CVV Code Without Your Card

Contact your card issuer if you need your CVV code. If you can’t locate your physical card, call and ask a customer service rep for your CVV code. You’ll likely need to provide your credit card or account number, confirm your phone number or billing address, or give other personal data like your birthday or Social Security number to prove you’re you. Then, a representative can look up your account information and provide your CVV code.

Keeping Your CVV Code Safe

Make online purchases on protected websites only. Check the URL of a website before entering any personal information like your CVV code. A secure URL begins with “https” (not “http”). Protected sites also have a padlock icon in the web address bar that indicates the data shared between the browser and the website is encrypted with SSL (Secure Sockets Layer) technology and can’t be read by third parties. Sites without these features aren’t automatically unsafe, but they’re much more susceptible to hacking or scamming. Secure, law-abiding sites are not allowed to store CVV information.

Ignore unsolicited requests for your credit card information. If a random email or phone call asks for your credit card info or CVV code, consider why they need it—if you weren’t the one to initiate the interaction, chances are the request is a scam. Similarly, avoid sharing photos of your credit card (even if you’re just texting a photo to a friend or relative so they can make a purchase with it). A leaked photo could lead to a fraudulent transaction on your account.

Protect your internet connection with antivirus software and secure WiFi. Install and use a virtual private network (VPN) on your devices when you’re away from home to keep your internet connection secure and prevent personal data from being recorded during online transactions while traveling. Make sure your home WiFi is password-protected to discourage hackers, and protect your computer with antivirus software to block keylogging or other malware.

Check your credit card accounts and statements regularly. Compare your monthly statements with your receipts and memories of purchases you made from the latest billing cycle. If you see any suspicious or unauthorized transactions, report the fraud to your bank or card issuer as soon as possible. By catching fraud early, you’ll minimize your risk of future unauthorized transactions as well as the amount of spent money you might be liable for.

Comments

0 comment