views

Figuring Out Whether Or Not a HELOC is Your Best Option

Know what HELOCs are useful for. Because HELOCs allow borrowers to borrow using their home equity, borrowers are often able to borrow a substantial amount of money. In some cases, borrowers can get up to 85 percent of the value of their home minus the amount left due on their mortgage. This allows them to use the HELOC to do things like: Make an addition to their home. Buy another property. Consolidate debt. Pay for higher education. Using a HELOC to consolidate debt can end up being financially destructive if you are not careful. Doing so may cause you to run up more debt than you had originally. Avoid this by paying the existing debt, closing those accounts, then paying off the HELOC. Only consolidate debt using a HELOC if the interest rate on the HELOC is favorable to that of your existing debt.

Compare HELOCs to traditional second mortgages. In many ways, the two types of home equity loans are similar. However, second mortgages require fixed payments (on both the principal and interest) that begin when the money is borrowed. HELOCs are different in that they allow for a draw period in which the borrower pays only for the accrued interest. Draw periods on HELOCS are usually 5 to 10 years, while repayment period are generally 10 to 20 years. Interest rates on HELOCs are typically higher than those on home equity loans. Because HELOCs are drawn upon as needed, they are more flexible than second mortgages. This makes them a better choice if you are unsure how much money you will need.

Think about repayment. Consider your realistic ability to repay the line of credit, particularly after the draw period. After all, paying a small monthly payment that takes care of the interest on your credit is relatively cheap. However, at the end of the draw period, the balloon payment for the value of the credit line is due. Borrowers then have the choice of either paying the balloon payment from their savings or taking out another loan to cover it. Consider how this will affect your finances before taking on a HELOC. Despite having the opportunity to repay only interest during the draw period, many HELOC borrowers choose to repay the principal, either partially or entirely, during the draw period.

Know the risks. If the balloon payment on the HELOC is not made, the lender has the right to foreclosure upon and seize your home. Additionally, a sudden drop in the value of your home may cause your lender to freeze your borrowing privileges. That is, you will temporarily be unable to borrow more money. Be aware of these risks before opening a HELOC.

Calculating Payments During the Interest-Only Draw Period

Determine at what stage you are in the life of the loan. For example, are you still in the first year or some other timeframe?. This is important because most HELOCs will allow interest-only payments for some period of time, such as the first 5 to 10 years.

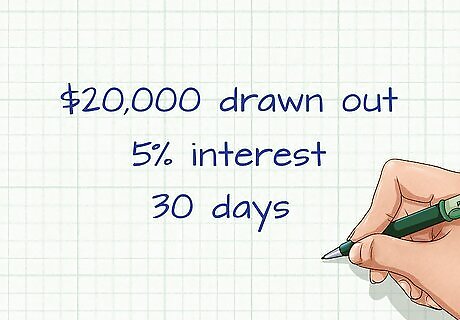

Locate the paperwork on your loan. This will give you the information you need to calculate your payments. This information includes your outstanding balance and interest rate charged. For example, imagine that you have a HELOC on which you currently have $20,000 drawn out. This HELOC charges 5% interest. You are currently preparing to receive a bill for the month of April, so you will be paying interest for 30 days (interest is calculated daily).

Find the outstanding balance on the HELOC. This not the maximum amount of the loan; it is only the amount you have used or your "draw". Specifically, this is the average daily balance for the month, which can be calculated by adding up every daily balance on the HELOC and dividing by the number of days in the month.

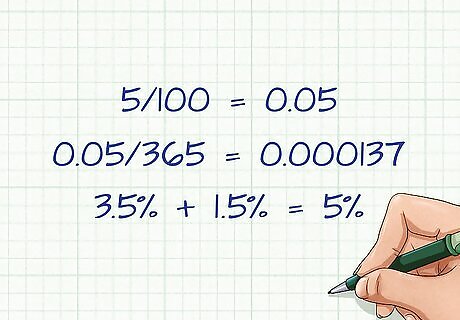

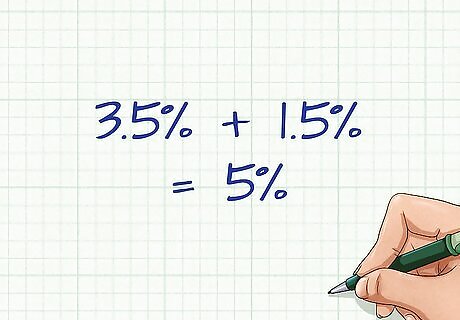

Find your daily interest rate. If listed as percentage (that is, 5 percent), start by changing it to a decimal by dividing by 100 (5/100 = 0.05). Remember that this is the annual interest rate. Divide by 365 to get the daily interest rate. In this case, that would be 0.05/365, or 0.000137. Your interest rate may be tied to a government-standard interest rate, such as the prime rate. If this is the case, your calculation of your interest rate is more complicated. You have to find out what the margin is on your interest rate (how much higher your rate is than the prime rate, for example) and add that to current prime rate. For example, imagine in this case that the prime rate is 3.5% and your margin is 1.5%. This sets your interest rate at 5%.

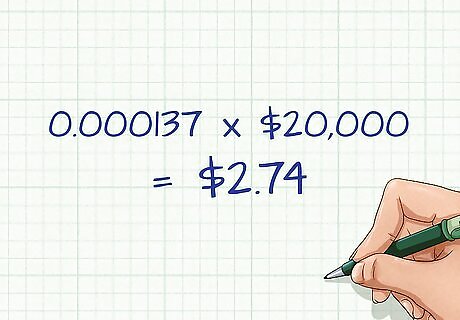

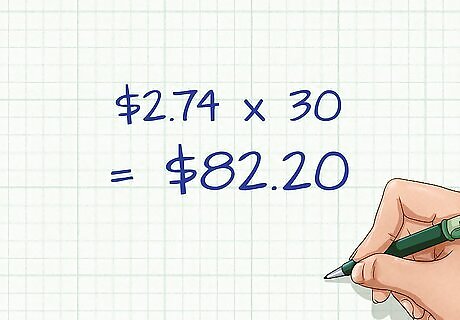

Calculate your daily interest payment. Multiply your daily interest rate by the total borrowed (or drawn). In the example, this would be 0.000137*$20,000, or $2.74.

Multiply the answer by the number of days in the month considered. This would be 28 for February, 30 for September, and so on. If you are still in your draw period, this is your monthly payment. In the example, your monthly payment for April would be $2.74*30, or $82.20.

Finding Payments For the Repayment Period

Calculate your annual interest rate. Many HELOCs charge variable interest that is set to another market rate, like the prime rate (an important bank rate). This means that your interest rate moves along with this market rate and can be vastly different between months or years. In addition, many HELOCs charge a higher interest rate than the market rate. The difference is called a margin. Your rate is calculated as the market rate (whichever one your HELOC is set to) plus the margin. For example, if your HELOC is tied to the prime rate, which is currently at 3.5% and charges a 1.5% margin, your annual interest rate is 5%. Note that this will have to be recalculated each month as interest rates will change.

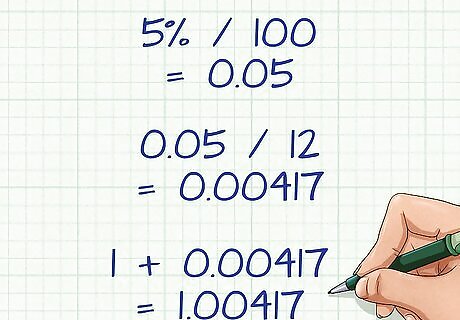

Convert your annual interest rate. First, divide your interest rate by 100 to get it in decimal form. In the example, this would be 5%/100, or 0.05. Next, divide your annual rate by 12 to get a monthly interest rate. This would be 0.05/12, or 0.00417. Finally, add 1 to your monthly interest rate. So, 1+0.00417=1.00417.

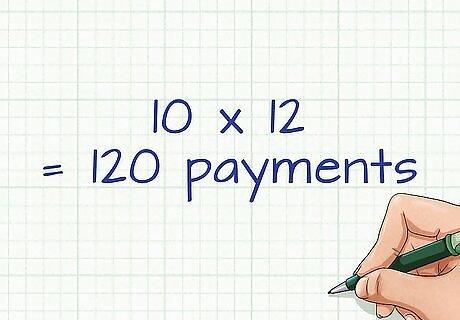

Calculate your number of payments. Start by determining how long you plan to spend repaying your HELOC. This could be as few as 3 years or as many as 20. In any case, settle on a number and multiply it by 12 to get the total number of monthly payments you will make. For example, imagine that you plan to pay off the HELOC for 10 years. You would have 10*12, or 120 payments.

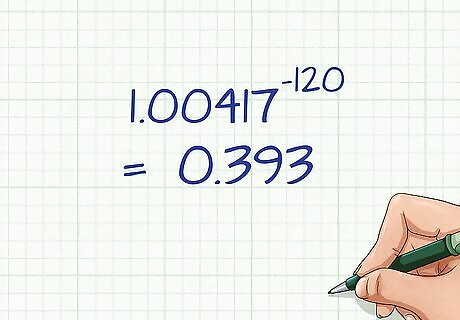

Raise your monthly interest rate to the negative power of your monthly payment total. This sounds complicated but it is simple to do on a calculator. Enter your converted monthly interest rate (1.00417) in the example first. Then press the exponent key, which usually looks like this: x y {\displaystyle x^{y}} x^{y}. Next, enter the total number of monthly payments you will make (120 in the example) with a negative sign in front of it (so -120). Press enter to get your answer. In the example, this will be 1.00417^-120, or 0.607.

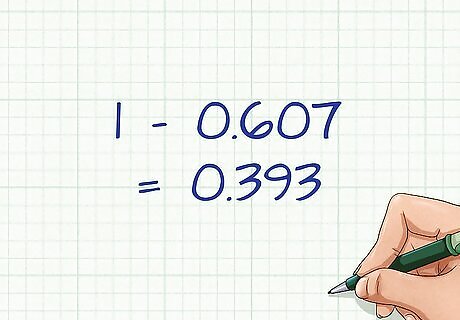

Subtract your result from one. Take your answer from the last step and simply subtract it from one. In the example, this would be 1-0.607, or 0.393.

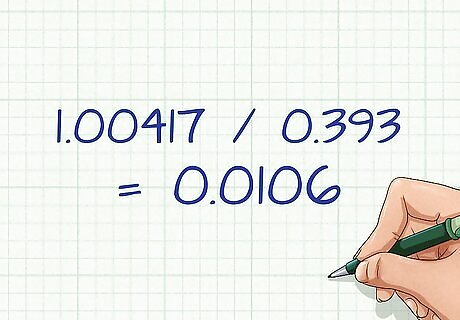

Divide your monthly interest rate by the result. That is, use your monthly interest rate (without the added one). So, in the example this would be 0.00417. Take this number and divide it by the result of the last step. So, 0.00417/0.393=0.0106.

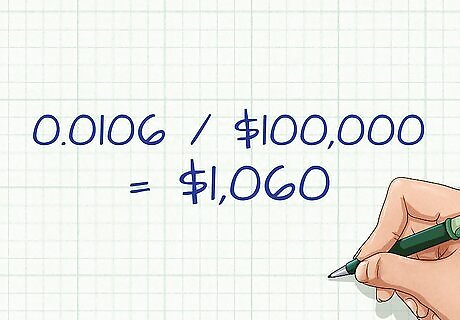

Multiply this result by your outstanding HELOC balance. For example, if you have a balance of $100,000 on your HELOC, your monthly payment during the repayment period would be 0.0106*$100,000, or $1,060.

Comments

0 comment