views

Calculating Your Benefits

Learn the details about your base-period wages. Base-period wages cover the first four of the last five calendar quarters you have worked. These amounts earned will determine your maximum and weekly benefits. This period begins from the day you apply, not the date you became unemployed. Your base-period wage will determine your: Weekly benefit allowance (WBA) Maximum benefit amount (MBA) You may qualify for an alternative base-period if you do not have enough funds in your standard base-period.

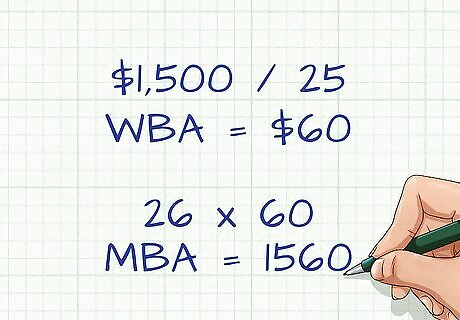

Calculate your expected benefits. Once you have gathered your base-payments, you will use them to discover your weekly benefit allowance (WBA) and maximum benefit amount (MBA). You will mainly be using the pay quarter with the highest wages earned. Take the following steps to learn what your benefits will be: Determine your WBA by finding the quarter with the highest wages earned. Divide the total wages earned in that quarter by 25, rounding to the nearest dollar. This will give you an approximation of your WBA. An example of a WBA would be $1,500/25, which is $60 for the WBA. Your MBA will be either 26 times your weekly benefit amount or half of your base-period wages, depending on which is the lower number. An example of a MBA would be finding 26*60=1560 and $4,000/2=2,000. Since $1,560 is lower, this is your MBA. Your claim is only valid for one year. If you have qualified before, you must earn at least six times more than your new WBA.

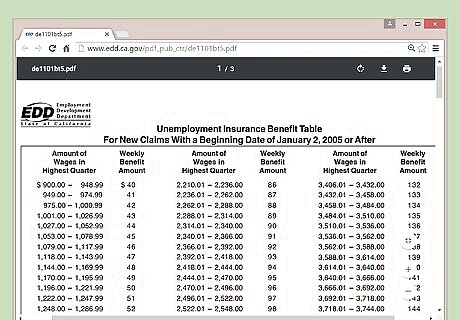

Use the unemployment benefit table. To learn the exact amount of benefits you can expect, you will need to consult the official Employment Development Department's chart. This chart uses your highest quarterly income to help you find your expected amount of weekly allowance. Follow this link, http://www.edd.ca.gov/pdf_pub_ctr/de1101bt5.pdf, to find the table. You will need to know the highest amount of wages earned and in which quarter you earned them. Consult the chart, searching for your highest wages earned. Once you find your highest wages earned, the chart will connect that to your weekly benefit amount.

Learning About The Qualifications

Meet the work search requirements. When you apply for unemployment insurance with the state of California, you will need to actively seek employment. You will also have to register with CalJOBS. Keep a record of your efforts and contact information of the employers you apply with in case of an eligibility interview. Register on line at www.caljobs.ca.gov . To register click "sign up" and enter the required information. Register as an individual. You will need your social security number and must create a user name and password. You must search each week for full time work. Searching for part-time work is also required. If you are in a union, you must inform them of your search and still seek full-time employment. You must be able and available to work.

Find if you might have been disqualified. Some circumstances or actions may disqualify you from receiving payments. While some of these circumstances may not necessarily exclude you from receiving payments, knowing which ones can will help you best plan ahead. Review the following list to learn what these disqualifying circumstances are: If you quit or were fired from you job. If a strike or lockout has resulted in your loss of work. If you refuse work. If you do not have transport. Not looking for work or filing your claim late. If your information provided was incorrect. If you are physically or mentally unable to work.

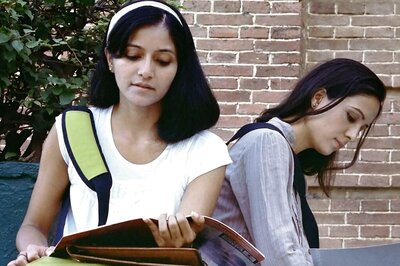

Understand that school employees might not be eligible. People who work for a public school, non-profit educational institution, or any other non-profit organization that provides services to a public or non-profit school, may not receive benefits based on those wages earned. Those in this situation may still receive benefits if wages from employers other than these educational organizations met the standard requirements. If you work for a public school or non-profit education organization, you may not receive benefits during recess. Additional non-education income may still qualify you for benefits.

Comments

0 comment