views

Canceling Your Account

Call the Experian number for the service you're trying to cancel. You’ll need to have ready your account information (account number, etc.) and your personal information (social security number, credit card number, etc.). If you're trying to cancel Experian CreditWorks, or Triple Advantage, call 1 (479) 343-6239. If you're trying to cancel ProtectMyID, call 1 (866) 960-6943. If you're trying to cancel CreditCheck Total, call 1 (877) 284-7942.

Navigate the automated menu. Follow the telephone prompts to select the option that allows you to speak directly with an Experian representative. Listen closely. Depending on the service, you may press “1” for membership services, and then “1” again to reach billing and membership services.

Inform the Experian representative that you want to cancel your Experian subscription. Provide the representative with any required information to cancel your subscription.

Verify any terms and conditions associated with the cancellation. When you cancel any level of Experian subscription, you will not be eligible for any prorated refunds for the current month’s paid membership fee.

Cancel your account over email. This may take longer, since you will have to wait for a reply after each of your messages. However, it has the advantage of preserving correspondence in written form, so that you can prevent misunderstandings with Experian customer service. Email “[email protected]” if you are subscribed to Experian’s ProtectMyID service. If you do reach out to either of these email addresses, they may redirect you to cancel over the phone.

Dealing with Experian Customer Service

Be polite but firm. Explain that you would like to cancel your account, provide your personal and account information, and avoid the temptation to switch to a different Experian subscription.

Keep the phone conversation brief. Experian representatives are trained to inquire why you want to cancel your subscriptions so they can explain the benefits of the service in an effort to keep your business. The representative may try to keep you on the phone for longer than necessary, or try to explain the benefits of the service you are canceling.

Ask the Experian representative for information when you cancel your account. Make sure to find out his or her name, the effective cancellation date, and a confirmation number. This information can be helpful in the event you are charged after cancelling your subscription and you need to provide references to Experian. Also have this information sent to you over email.

Deciding Whether you Need an Experian Account

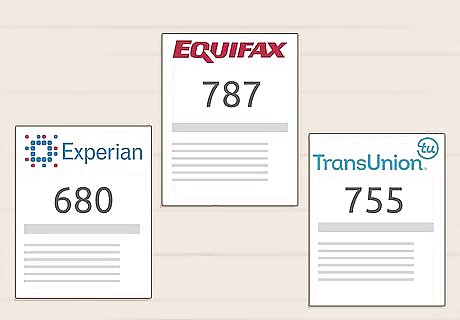

Know the value of your credit score. Although the concept of a credit score can feel abstract, it is valuable to understand credit and to know your score, especially if you are planning to apply for a loan or other significant financial step in the future (buy a car, buy a house, etc). Your credit score (or FICO score) is a 3-digit number between 300 and 850 which represents your success in borrowing and repaying money. A higher number indicates a better credit score. Credit scores are affected by many forms of financial transactions. Credit card payments and the number of credit cards that you use, loan payments (including student loans), the number of years you’ve been accruing credit for, and the amount of money that you owe all influence your credit score. A credit score is important to financial institutions and credit card companies; banks and credit unions will use your FICO score to determine your eligibility for loans.

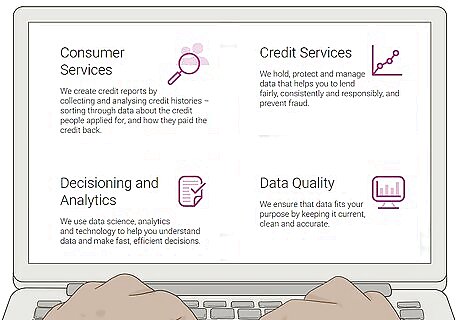

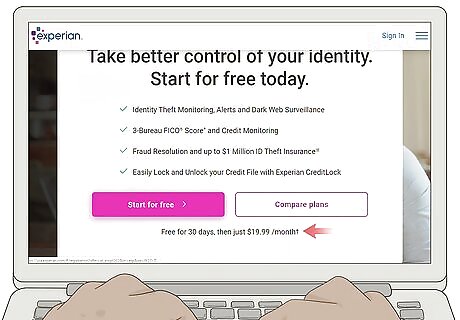

Understand Experian’s offered services. Many individuals sign up for a free 30-day trial or for a “one-time” $1 credit report, without realizing that Experian will roll these one-time registrations into a permanent subscription. While finding out your credit score is useful, many people don’t appreciate Experian’s automatic subscription policy. Always read the small print, especially when giving Experian money, or if they already have your credit card information. Many individuals sign up for Experian (or another credit-monitoring service) because they are concerned about credit fraud. You can do this yourself by watching your monthly bank and credit card statements; keep an eye out for suspicious charges or fees.

Watch the timeframe of your Experian account. Experian frequently offers a free 30-day trial, or provides a 30-day reduced fee for first-time users. If you forget to cancel after the first month, you will be charged between $19.95 and $29.95 a month, until you do cancel the subscription. You can also cancel your trial account for free within the first 7 days. If you do not cancel within the trial period, you will be automatically enrolled.

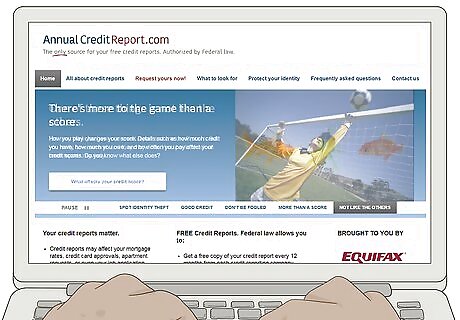

Find another method to track your credit score. Even if you have decided to cancel your Experian account, you may still need to check your credit score from time to time. Other credit-tracking services similar to Experian include Equifax and TransUnion. You can receive a free copy of your credit-score report through the Annual Credit Report website. Discover credit card provides monthly FICO credit reports to its cardholders.

Comments

0 comment