views

Asking for the Money

Determine at what point you don't believe you will receive payment without asking. If your initial agreement didn't have a strict due date, then you will have to make that determination on your own. Decide how much you trust the person to pay without you directly asking. Take the amount owed into consideration. A small debt may not be worth pursuing right away, while a larger debt might take some time to collect. If you are owed money in the course of a business transaction, ask for it as soon as possible. Waiting on the debt will only make it harder to collect.

Inquire politely about the money. Once you have passed that date, make a request for the money. At this stage, all you want to do is make sure that the debtor is aware that their debt hasn’t been paid. Sometimes people just forget, and a friendly reminder is all they need. More formally, this is called an "inquiry contact." Don't demand payment, instead offer a reminder ("Do you remember the money you owe me?") that allows the debtor to save face. Include all relevant information when asking about the debt. You should be prepared to provide the amount given, when you received the last payment, the amount owed, any payment arrangements you are willing to accept, contact information for you, and a clear due date. If you are dealing with a company or client, it can be helpful to make this inquiry in the form of a letter. This gives you a paper trail if the situation escalates. For a due date, 10 to 20 days from the date the debtor receives a letter can be a good timeframe. It is in the foreseeable future but not close enough that the debtor feels panicked.

Decide if you will accept alternate forms of payment. It may not be worth it to you to wait for the full amount. If the amount is small, or you do not believe the person will be able to pay, consider letting them provide something else in return. Providing a service or other favors will work if that arrangement is acceptable to you. If this is the case, be clear about the offer and collect as quickly as possible. Don't be too quick to bargain, as this may send the message that the debt can be negotiated down, or that the debtor can take even more time.

Be more forceful in your payment requests. These are called "demand contacts." If the debtor does not respond to your request, you should be more direct. Make sure it is clear that you expect immediate payment or a definite commitment to payment, and provide clear instructions for making that payment. Your language here should be more direct, and show some urgency. Phrases like "You need to pay now," or "We need to come to an arrangement now" let the debtor know you are serious, and you are not willing to negotiate further. Include clear consequences for not paying. Let the debtor know what you plan to do if you do not receive proper payment on time, and be prepared to follow through.

Continue escalating the rigor of your collection activities. If you don't receive any payment resulting from the demand contact, then chances are that the debtor either doesn’t have the money or just doesn't feel like paying. It’s your job to make them prioritize you through multiple contacts by phone, letter, e-mail, or in person, so that they decide to pay you before they pay someone else (or head for the hills).

Hire a collection agency. Hiring a third party to conduct your claim lets the debtor know you are serious, and can free you up from the hassle of contact and arranging payment. Collection agencies will charge as much as 50% of the payment for their services, so you need to decide if the partial payment is better than nothing. If the payment for a collection agency is too steep, you may consider skipping this step, and going to small claims court.

Know what you cannot do. If you are collecting your own debts, there are certain practices that may be illegal in your state. There is a federal law that may apply to you if you could be considered a debt collector under the federal Fair Debt Collection Practices Act. In all likelihood, you will not be subject to that law but you will still need to comply with the laws of your state. While each state's laws will differ, you should generally stay away from the following tactics: Calling at unreasonable hours; Adding additional fees; Purposely delaying collection in order to add more fees; Telling the debtor's employer about the debt; Lying about the debt owed; Making false threats to the debtor.

Taking Legal Action

File a lawsuit in small claims court. Check your state’s statutes or state court's website to determine if you can file a claim. Dollar limits can range from $2,500 to $25,000, depending on the state. You can locate your state court’s website and statues by following the correct link from the National Center for State Courts’ [state court directory]. If you do go to court, prepare for your hearing. If you have a contract, promissory note, or any other documentary evidence of the debt, make enough copies that you can provide the Judge and the debtor, or his or her attorney, with a copy. You should also make copies of any other evidence you wish to submit in the same manner. This can be a drastic step. Make sure the amount owed is worth the hassle of appearing in court. If the debtor is a friend or relative, this can definitely have a negative impact on that relationship.

File a lawsuit. If you fail in small claims court, or are not allowed to file claim there, go to the state court. Consult or hire an attorney, file the proper forms, and prepare for your court date with as much necessary paperwork as you can gather. This option is generally more expensive, considering court and attorney fees, but if you are successful, it may be worth it more than using a collection agency. The threat of a suit may be enough to bring someone to pay, but you should not make such a threat unless you intend to follow through.

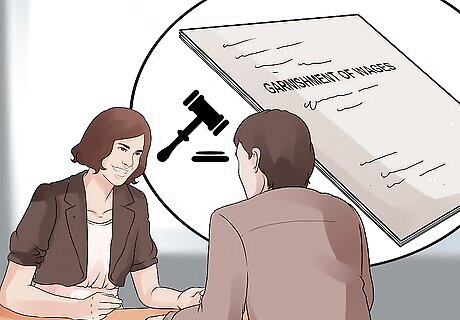

File a Petition for Citation. Once you have obtained a judgment against a debtor, you may file a Petition for Citation, for contempt of court, if they still fail to pay it. Filing a Petition for Citation along with a Notice of Hearing will cause the court to set a hearing, forcing the debtor to return to court and explain why they have not paid the debt. At the hearing, you should ask the court for permission to garnish the debtor’s wages.

Receiving Payment

Collect your money. After some process of inquiring, demanding, and suing for your debt, the debtor will be forced to pay. Sometimes it will be as simple as asking. In other cases, you may need to take additional court-ordered steps, perhaps a Writ of Execution, or a Lien, in order to receive proper payment. If the case has gone to court, and you have employed the services of an attorney for that purpose, you should consult with them on the best course of action.

Locate the debtor’s employer. Once you have received the permission of the court to garnish the debtor’s wages it will be up to you to determine where the debtor is employed. The easiest way to do this is ask the debtor. If he or she is unwilling to tell you, you may need to send a set of interrogatories, which are questions that must be answered in writing and under oath. Check your state court’s website for interrogatory forms.

Send interrogatories to the debtor’s employer. Once you believe you have found the debtor’s current employer, you will need to send interrogatories to the employer for confirmation that the debtor is employed and his or her wages are not already being garnished up to the limit.

Ask for a garnishment order. Upon receiving confirmation that the debtor is employed, you can ask the Court for an order of garnishment, which will be sent to the employer to begin garnishing the debtor’s wages. Individual states have different laws on wage garnishment, so make sure you are clear on the laws where you reside.

Comments

0 comment