views

Creating a Corporation

Form a corporation. Before opening a bank account for your charity, you must name it and register with your state as a corporation. A bank will not allow you to open an account that receives donations for a charity unless you have properly registered with the state. You must register in the state in which you plan to do business. Also, you must register in any state from which you plan to accept donations. The first step is to choose a business name that meets with your state's requirements. You can check your state's naming requirements online by going to the state's filing office website, which is usually the Secretary of State's office. Next, file the articles of incorporation. Your state should have separate articles of incorporation for nonprofit corporations. You can find the necessary paperwork, which is usually a fill-in-the-blank form, on your state's website. Before filing your articles, read the IRS tax exemption paperwork thoroughly. The IRS has specific requirements for organizations to qualify for tax exempt status. Also, their application process requires that your articles of incorporation include specific language. Familiarize yourself with this language ahead of time and include it in your articles of incorporation.

Get an Employee Identification Number. This is a unique number that identifies your organization to the IRS. You need this number even if you don't have employees. Complete form SS-4, which can be found online at IRS.gov. You can submit the form online, by mail or by fax. Under “type of entity” on this form, indicate that your organization receives donations by selecting church or church-controlled organization or other nonprofit organization. The EIN is different from your tax exemption number.

Apply for federal tax exemption. Once the state approves and returns your articles of incorporation, you can apply for tax exemption status with the federal government. The IRS has specific requirements to determine if an organization qualifies for tax exempt status. The size of your organization determines which forms you need to file to receive tax exempt status. Visit the IRS website to fill out an Eligibility Form in order to determine which documents to file. The eligibility form asks 26 questions about the size and type of nonprofit corporation you are forming. For example, it asks if you expect your annual gross receipts to exceed $50,000 over the next three years or if they have exceeded that amount in the past three years. The form also asks if your total assets are worth more than $250,000. Other questions have to do with your associations with foreign countries outside the U.S. and your affiliations with other for-profit and nonprofit organizations, such as churches and schools. If you answer “yes” to any of these questions, you must fill out Form 1023. If you answer “no” to all 26 questions, you can use the streamlined Form 1023-EZ. Larger groups must file the IRS Package 1023, Application for Recognition of Exemption. You can find instructions for this form by reading IRS Publication 557, Tax-Exempt Status for Your Organization. Smaller organizations may be able to file Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code online. You will need to include your articles of incorporation with you application for tax exempt status.

Choosing the Right Bank Account

Review your historical financial activity. Look over your financial information to learn about how money flows in and out of your organization. Determine your average monthly account balance, and understand which months are your slowest and busiest months. Evaluate the types of recurring transactions you will have on your account, such as the number of deposits, incoming ACH transactions and checks paid.

Project future financial activity. If you are a new organization just starting out, you may not have historical financial information to review. Instead, spend some time projecting how funds will flow in and out of your organization in order to determine the right bank account. Start by creating a budget of your monthly expenses. Then estimate how much you think you will receive in donations and other income on a monthly basis. Use this information to project your average monthly account balance. Factor in any seasonal influences on your financial activity, such as busy or slow months. Finally, project how you expect your business to grow over the next three to five years. Analyze how your monthly expenses and income are expected to change, and what specific plans you have in place to make those changes happen. The Wallace Foundation provides free templates and tools to help nonprofits build a budget, project cash flows and project revenue scenarios. The Foundation Center offers tutorials on creating a budget.

Evaluate the bank's services. Once you have a handle on your monthly financial activity, meet with a bank to determine if their services meet your needs. Compare different banks and find the one that is best for you. Be prepared to discuss the specifics of your financial activity with each bank. Most banks have three standard types of accounts. Basic checking accounts are for smaller organizations with minimal monthly activity. Commercial checking accounts are for organizations with a high amount of monthly activity. Balances in these accounts earn credit which is used to offset fees. Nonprofit checking with interest accounts allow organizations with varying balances to earn interest.

Consider treasury management options. These are services that can automate some transactions and offer your protections. Evaluate any of these options that the bank offers. Determine if they would benefit your organization. Remote deposit capture allows you to scan checks and deposit them anywhere you have internet access. Automatic Clearing House (ACH) is a system for tracking and receiving automatic payments. Overnight repurchase accounts automatically invest balances above a certain limit into overnight Government Securities. Fraud controls include positive pay, which protects your from counterfeit and altered checks, and ACH positive pay, which filters or blocks fraudulent ACH transactions.

Gather the required documentation. Once you have chosen a bank and a type of bank account, gather your documentation. Banks require specific documents in order to open an account that receives donations. The bank needs proof that you have registered with the state and that you have the required tax identification number. They will want to see a copy of your articles of incorporation. In addition, they will need your Employer Identification Number issued by the IRS.

Accepting Donations Online

Set up your website. Good website design leads to increased donations. Donors want a user-friendly experience, so make it easy for them to find the “donate” button. Also, give them different options such as using a credit card or using electronic check/ACH options. Include information about your mission, including the work you have done and your future goals. Also, provide details about how you plan to use your donations.

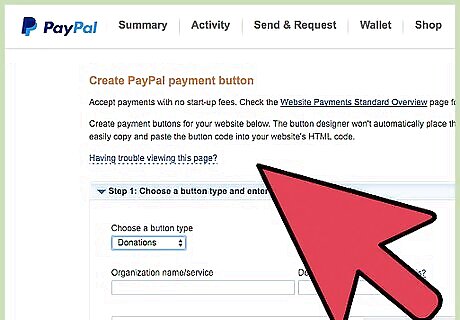

Choose an option for accepting online payments. In general terms, you have two options for setting yourself up to accept online payments. The first is to get a merchant account and payment gateway. These are two separate accounts with separate vendors that you would need to set up in order to be able to accept credit card donations. The other option is to go with a third-party payment processor, such as PayPal, that acts as a merchant account and payment gateway all in one. Option one requires more steps and more research to set up, so it is better for a larger nonprofit that may process hundreds of donations per month. Also, the transactions are transparent, meaning your company name appears on the transaction. Donors see your name on their credit card statements. Smaller nonprofits that don't want to pay for a merchant account and a payment gateway may opt for option two. When using a third party processor, donors will be redirected away from your site to finish the transaction. For example, if you use PayPal, donors will be redirected to the PayPal site to complete their transaction. Also, the name of your third party payment processor, not your company name, appears on the donor's credit card statement.

Open an online merchant account. This is separate from your organization's bank account. It is an account through which credit card transactions are processed and transferred into your bank account. Merchant accounts protect you because they hold the payment until the credit card company approves it. Once the transaction is approved, the funds are deposited into your bank account. Generally, you cannot open a merchant account until you have a business bank account. The merchant account provider will require your bank account and routing numbers and your EIN. Popular merchant account providers for nonprofits include Dharma Merchant Services, Payline, CDG Commerce and Host Merchant Services. They offer tools to help nonprofits process recurring transactions, donor outreach and event planning.

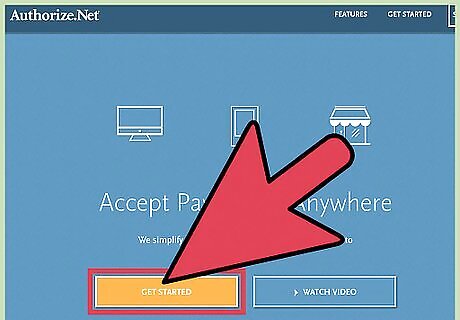

Sign up with a payment gateway. A payment gateway communicates between your donor and your merchant account. It is a software program that is the online equivalent of a credit card terminal you would have in a brick-and-mortar store. When donors click on the “donate” button on your website, they are communicating with the payment gateway. The payment gateway encrypts and authorizes the transaction. Then it transmits this information to your merchant account. Popular payment gateway accounts for nonprofits include authorize.net and PayPal Pro.

Use a third party payment processor. Many charities and nonprofits use Network for Good, Google Checkout or PayPal. They offer you a merchant account and payment gateway service all in one. They provide you with code to install a “donate” button on your website. Be aware, however, that when donors click on the “donate” button, they will be redirected away from your website to the third party payment processor's website. Also, the fees can add up to a significant chunk of your monthly donations. PayPal and other providers offer discounts for companies with documented 501(c)(3) status.

Fulfilling Reporting Requirements

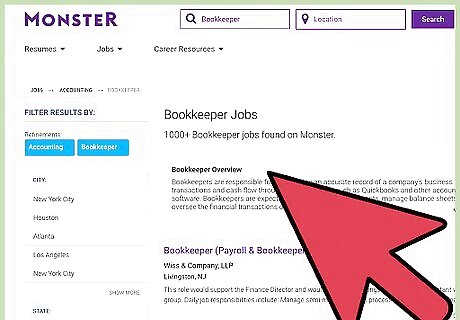

Hire a bookkeeper or accountant. Find a qualified bookkeeper or accountant who is familiar with the specific reporting requirements of a nonprofit organization. The Financial Accounting Standards Board (FASB) requires specific financial reporting from nonprofit organizations. You need someone who can prepare all of your reports accurate and in a timely manner. In addition, this person can file necessary tax returns. Also, the bookkeeper or accountant can manage other monthly financial responsibilities. These include reconciling bank statements and managing accounts payable.

Prepare a statement of financial position. This is similar to a balance sheet that a for-profit organization would generate. It reports your company's assets and liabilities. This report can be prepared monthly, quarterly or annually. This report provides a snapshot of the organization's financial position at a given point in time.

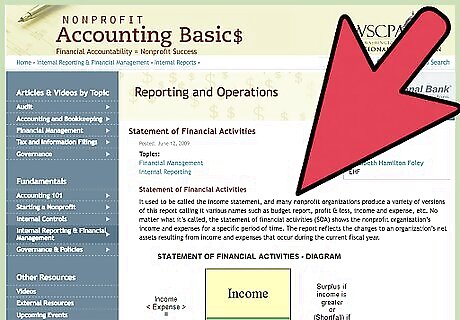

Create an income and expense statement. This report is also referred to as a Statement of Activity. It reports your company's financial activity over a certain period of time. For example, it can show activity for a month, quarter or year. It provides details about all of the income and expenses. Also, it calculates income minus expenses to show if the company earned enough to cover expenses.

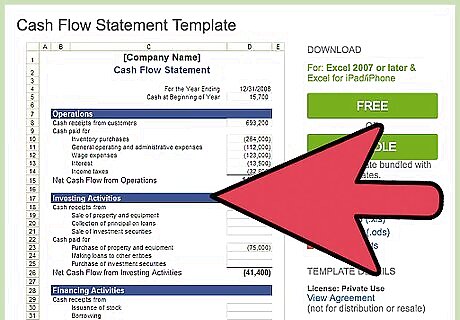

Develop a statement of cash flow. This report summarizes cash that became available to the company in a certain time period and how that cash was spent. Whereas the income and expense statement includes accruals such as accounts receivable and depreciation, the cash flow statement provides details about actual cash on hand. This is helpful information when planning for large expenses in order to anticipate any shortfalls.

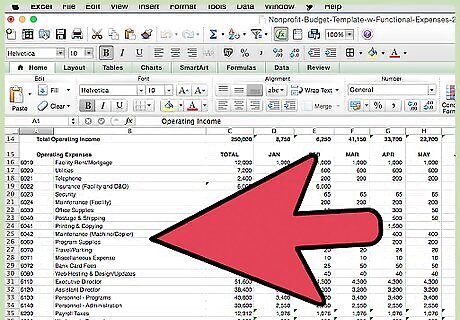

Create a statement of functional expenses. This reports expenses according to their function. Expenses are separated into functions such as programs, management and fundraising. Within each of these categories, expenses are separated into types, such as salary, rent or depreciation. The Financial Accounting Standards Board (FASB) does not require this report, but it is encouraged.

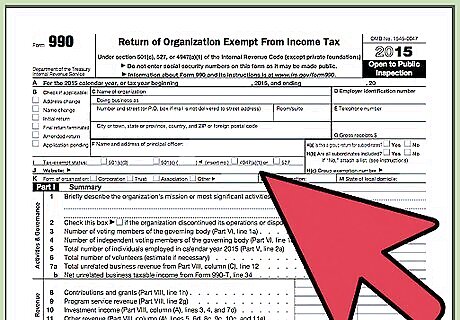

File required tax returns. Even though nonprofits are tax exempt, they still need to file a federal income tax return. This allows the IRS to evaluate the financial performance of the organization. The return also discloses potential conflicts of interest and how board members, if applicable, are compensated. Depending on the size of your organization, you can submit either Form 990, Form 990-EZ or 990-N.

Comments

0 comment