views

Taking Precautions to Protect Your Card Information

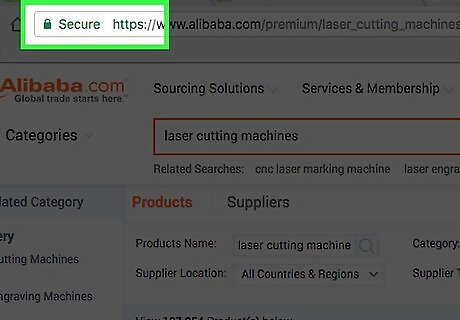

Look for signs the website is secure. Technology makes it easy for you to make purchases with your credit card online. Without proper security protocols, however, sensitive information like your credit card number can be swiped by cyber crooks. Most websites that take payments will have extra layers of security to block these thieves from getting your data. It’s easy to identify these sites: just look for an “https” at the front of the web address instead of a plain “https”. The “s” at the end of “https” signifies a “secure” website. The lack of an “https” doesn’t necessarily mean that a site is not legitimate, but it does show that the website creators have taken extra precautions to secure your data. You might also see certification seals like "Verisign," "TRUSTe", “Norton Secured,” or “McAfee Secure.” These are nice to see on a legitimate website, but they don’t necessarily prove that a site is legitimate--they’re actually just images that anyone can copy and paste into a site.

Don’t use your credit card on a public computer if you can help it. Computers used in places like libraries and internet cafes can mean easy access to those on the go or without a computer at home. However, since they’re public, it’s easier for thieves to lift data like credit card numbers off of the computer. Even if you’re careful to log in and out of your accounts, your data could still be at risk. It’s best to do your bill-paying and online shopping on your own computer if possible.

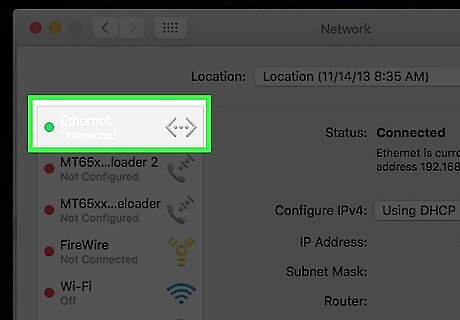

Avoid making transactions while connected to a public network. Even if you’re using your own computer, tablet, or other device, if you’re connected to an open, public wifi network (such as at a coffee shop), then your data is not 100% secure. Of course, most people aren’t crooks. But if you’re sharing a network, then you could also be “sharing” your sensitive data with a would-be thief. Try to save your online shopping and bill-paying for when you’re on a secure, password-protected, private network.

Turn down offers to save your card information. When you create an account to pay a bill or shop online, you may be asked if you want to save your credit card information to make future transactions easier and faster. While this is certainly convenient, keeping your information stored online heightens the risk that it will be stolen if the website ever has a security breach. If possible, just say “no” to these offers. The minor convenience of having to re-enter your credit card number each time will be well-worth your peace of mind.

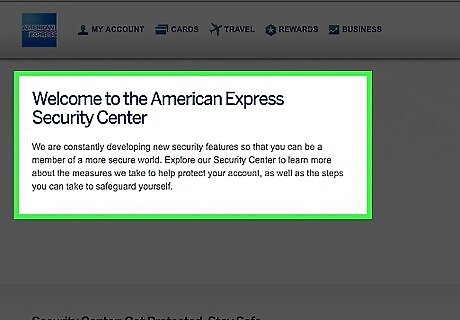

Ask your bank or card supplier about protection services. Increasingly, credit card companies and banks are offering customers options to shop more securely online. To use your credit card online as safely as possible, you may want to take advantage of these options, some of which may have extra fees. If you’re not sure what’s available for your card, ask the issuer about things like: Alerts for any suspicious charges. One-time-use credit card numbers. A new card number is randomly generated for you each time you make a purchase, making it impossible for thieves to steal a number and use it again. These are sometimes called “virtual account numbers.” Masked credit cards. These go one step further, offering the ability to protect other sensitive data, such as by using a fake name and an alternate address.

Shop with PayPal or similar services. Many merchants make it possible to pay for goods and services online without actually entering your credit card information on their site. Instead, you create a third party account through another service, and can then use this account to make payments at a variety of sites. PayPal is probably the most popular of these services, but there are others, such as Visa Checkout.

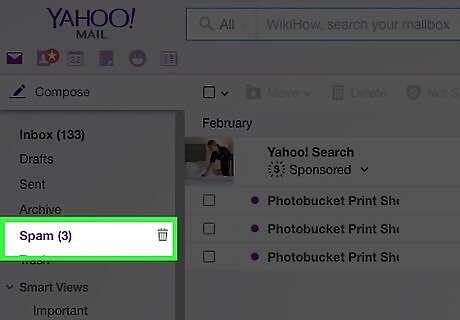

Be on alert for phishing attempts. If you use a credit card online, you should be on the lookout for malicious emails, or phishing scams, designed by criminals to make it appear as though they come from your bank or credit card issuer. In reality, however, they are attempts to steal your information. If you are ever in doubt about the authenticity of an email that appears to be from your card issuer, give them a call to verify. In general, however, know that card issuers will never ask you to do certain things via email, such as: Reply to an email with your credit card number Enter your credit card number in a form embedded in the email Click a link to get to your account (always go directly to the account website by typing in the web address).

Handling Card Issues

Check your bank statements and credit report regularly. Check that your credit report doesn’t contain any errors (such as accounts that you have closed), discrepancies (such as accounts you never opened), or other suspicious activity. Also, review your card statements or online account regularly to make sure that there are no charges that you didn’t make. Not only will this keep your credit report clear, it will also reveal if you have been a victim of fraud (such as a stolen card number).

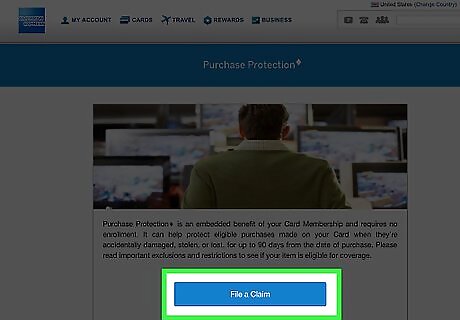

Report any cases of fraud. If you do encounter a confirmed or suspected instance where your credit card information has been stolen, don’t freak out. Call your bank or credit card issuer right away, and let them know what is going on. They will walk you through the next steps to report and deal with the fraud, which usually involves erasing any fraudulent charges, changing your credit card number, and monitoring your credit report for any future issues. In almost all cases, you will only be liable for up to $50 of fraudulent charges, if anything at all. Banks and credit card issuers offer protection from liability, and most customers are not help responsible for any fraudulent charges at all. Don’t be embarrassed if you are the victim of credit card fraud. Cyber criminals are clever, and online security is a constantly developing field.

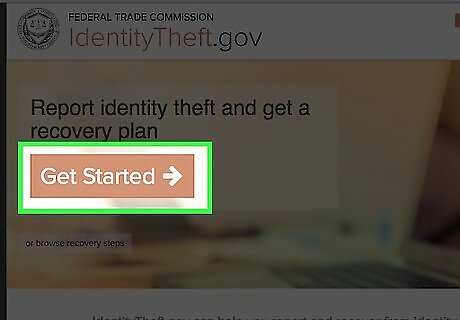

Take action to monitor and protect your finances. If your bank or credit card issuer does not already offer credit monitoring services after a case of fraud, make sure to do this yourself. Let the three major credit reporting agencies--Transunion, Experian, and Equifax--know that there has been a problem with your account. You can also visit the Federal Trade Commission’s Identity Theft Recovery website for more information about how to deal with any lingering issues.

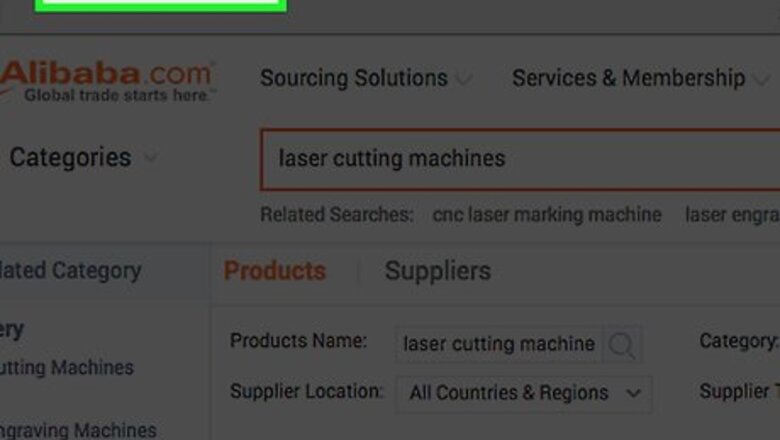

Using Your Card to Make Purchases

Use the right kind of card. When paying bills or shopping online, you will typically have the option to use several different kinds of cards: credit cards, debit cards, prepaid cash cards or gift cards, etc. While it is up to you to use the card that makes the most sense, keep in mind that credit cards typically offer more protection against liability for fraudulent charges. If possible, use a credit card for online purchase to ensure you are covered. Make sure you are able to use your credit card responsibly.

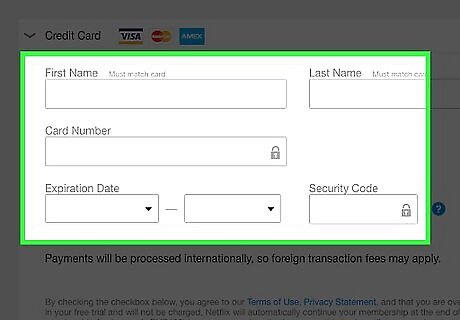

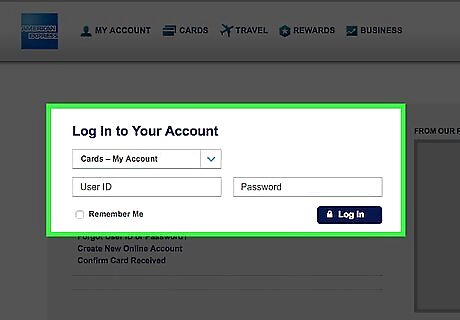

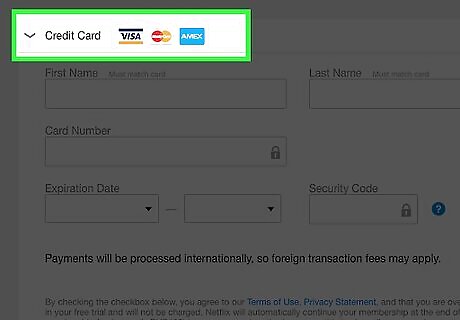

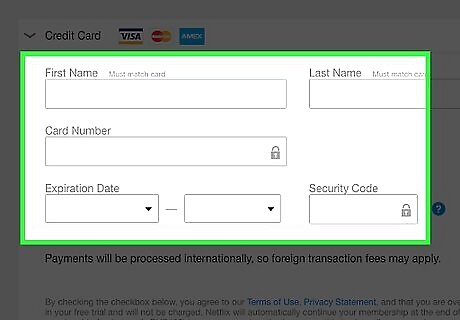

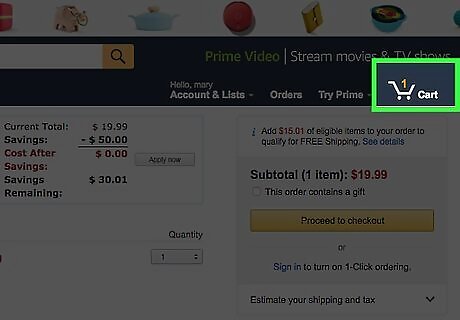

Enter your card information online. When you make a transaction using your credit card online, be prepared to enter the necessary information, which includes the credit card number, expiration date, and security code, as well as your name, billing address, and email address. Some merchants and services may require you to create a personal account, others may give you the option to complete the transaction as a “guest.” ”One click” shopping is another convenient method of buying online that some websites offer, allowing you to purchase something with the click of a single button, as soon as you see it on a merchant’s website. Just keep in mind that each of these “clicks” charges your credit card!

Know exactly what you are paying for. Sometimes, the convenience of buying online can get the better of us. It is a good idea to double-check the items you have in your “cart” before finalizing your purchase, to make sure you didn’t accidentally add items you don’t want, for instance. Most merchants will do this for you, by giving you the option to “review” your transaction before finalizing the transaction and charging your credit card. Expect honest merchants to send you a confirmation of your purchase via email or to show a confirmation on the website after you complete the transaction. Treat this like a receipt, and keep a copy for your records.

Comments

0 comment