views

- Domestic partnerships are a legal alternative to marriage and are recognized in select states including California, Maine, Nevada, Oregon, and Wisconsin.

- Unlike marriages, domestic partnerships are not recognized by the federal government, so partners cannot jointly file taxes or inherit each other’s Social Security benefits.

- Similar to married spouses, domestic partners can get insurance benefits from their partner’s employer and may be entitled to family and medical leave.

What is a domestic partnership?

A domestic partnership is a legal alternative to marriage. Domestic partners are often two people who are in a committed relationship. They may live together and be romantically involved, but they’re not married. Domestic partnerships were originally created to extend the rights of married couples to same-sex couples before same-sex marriage was legalized. Now, domestic partnerships are an available option to all people in certain states.

Differences Between Marriage & Domestic Partnerships

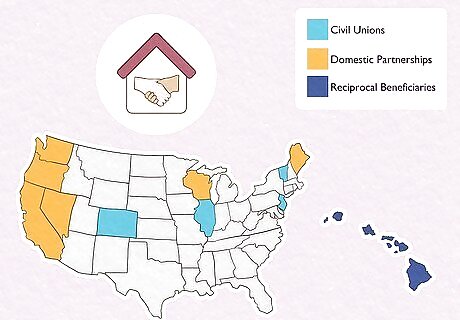

Domestic partnerships aren’t recognized in all states. Civil marriage is a legal status that’s recognized throughout the United States. However, only a few select states recognize domestic partnerships and the rights of domestic partners. Also, depending on the state, a domestic partnership might also be referred to as a civil union. The following states recognize civil unions and domestic partnerships: Colorado, Illinois, Vermont, and New Jersey allow civil unions. California, the District of Columbia, Maine, Nevada, Oregon, Washington, and Wisconsin recognize domestic partnerships. Hawai’i permits a similar relationship called reciprocal beneficiaries.

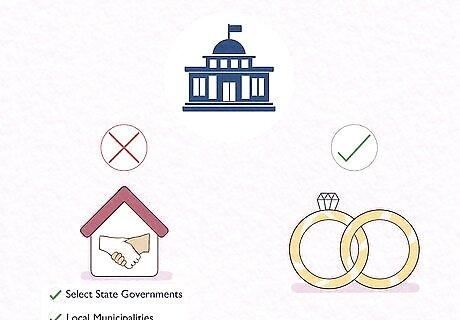

Domestic partnerships aren’t recognized by the federal government. Domestic partnerships are recognized mainly by select state governments and local municipalities (city, county, etc.). Unlike marriage, there’s no national law that recognizes or sets up a specific framework for domestic partnerships.

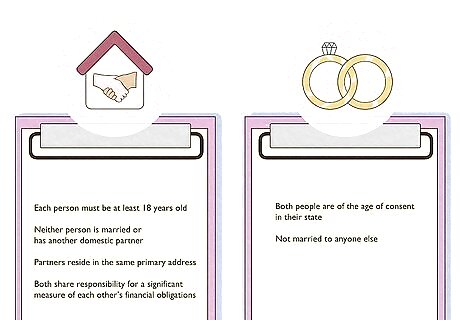

Requirements to file for a domestic partnership are different. When registering for a marriage license, it’s usually required that both people are of the age of consent in their state and are not married to anyone else. Some requirements for domestic partners are the same, but there may also be some additional items. For example: Each person must be at least 18 years old Neither person is married or has another domestic partner Partners reside in the same primary address Both share responsibility for a significant measure of each other’s financial obligations

A person can’t petition for the naturalization of their domestic partner. Unfortunately, because domestic partners aren’t recognized on a federal level, one partner can’t petition for the naturalization of the other. Two people can still register for a domestic partnership regardless of their immigration status. However, this partnership might be considered evidence of a person’s intent to stay in the U.S. permanently, which could potentially become a problem if they have a non-immigrant visa. For those who aren’t U.S. citizens or permanent residents, it’s advised to speak with an immigration attorney before registering for a domestic partnership.

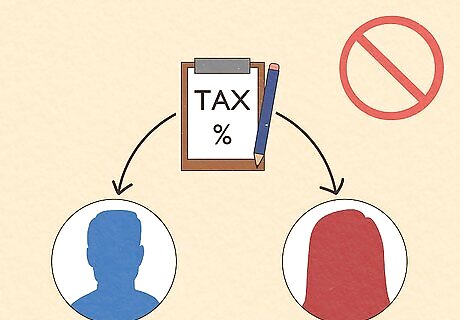

Domestic partners can’t file taxes jointly. Due to the lack of recognition by the federal government, domestic partners aren’t legally allowed to file their taxes jointly. This might be a disadvantage since the tax brackets are wider for married couples and some people end up paying less in taxes when they file jointly as opposed to filing separately. However, this could also give domestic partners a slight advantage over married couples since they can avoid the risk of paying higher taxes due to the marriage penalty. The marriage penalty is when a couple ends up paying more in joint taxes compared to when filing separately. This is usually the case for couples who earn similar incomes.

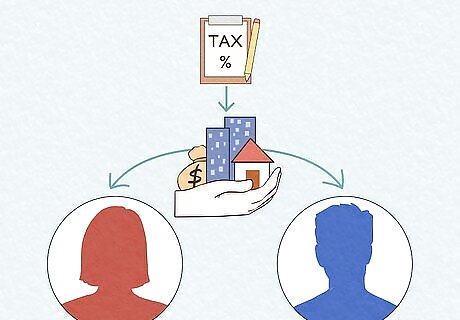

Domestic partners may be taxed when transferring assets. It’s also possible that a tax will be put on the transfer of assets between domestic partners either as income or a gift by the federal government. For married couples, this process is usually tax-free.

Domestic partners usually can’t inherit Social Security benefits. Unfortunately, in the case of the death of a person’s domestic partner, the surviving individual won’t be able to inherit their partner’s Social Security benefits. This is usually the same for benefits for veterans and disability benefits.

Similarities Between Marriage & Domestic Partnerships

Spouses and domestic partners can receive insurance benefits. Depending on where the couple is residing, domestic partners may be able to add each other to their insurance plans and claim one another as dependents just like married spouses would. Domestic partners may be able to receive medical, dental, vision, accident, and life insurance depending on their partner’s employer and their local or state laws. In many cases, domestic partners will have to provide proof of cohabitation and/or joint responsibility of finances in order to claim these benefits. Acceptable forms of proof may include a joint mortgage or lease agreement, joint ownership of a residence, or a joint insurance policy.

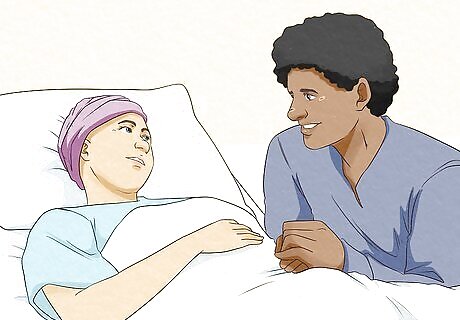

Domestic partners are also entitled to family and medical leave. Just like married spouses, domestic partners are also eligible to receive things like medical leave and family leave to take care of their partner’s medical needs. They may also be entitled to funeral and bereavement leave. When it comes to receiving family and medical leave, domestic partners may be recognized as each other’s “family” for legal purposes when filling out an FMLA form.

Domestic partners may have similar inheritance rights to spouses. Like married couples, domestic partners are usually entitled to inherit any jointly-owned property upon the death of one partner. They may also be protected against being disinherited just like married couples. In some states, even if one partner dies without a will, the other person may be able to inherit the couple’s community property and anywhere from ⅓ to all of their partner’s separate property. Unfortunately, this isn’t the case in all states, and oftentimes a domestic partner will only be able to inherit what’s specifically designated in the other person’s will.

Spouses and domestic partners have the same visitation rights. Typically, spouses and domestic partners have the right to visit their partner in the hospital, a nursing home, or another healthcare facility. These visitation rights are usually limited to people who are legally or biologically related to the patient or admitted person.

Both have similar rights for raising and adopting children. For both married couples and domestic partners, a person is usually able to adopt their partner’s biological child as their stepchild. In addition to that, both domestic partners will be recognized as the legal guardians of a child born between them while their domestic partnership is still active, just like a married couple. In the case of both a divorce and the dissolution of a domestic partnership, a partner can be awarded child support, custody, and visitation rights.

Domestic partners can receive alimony in the case of separation. Both spouses filing for divorce and domestic partners filing to terminate their partnership can usually file for spousal/domestic partner support. Split couples may pay alimony in order to make sure that their ex-partner’s quality of living doesn’t decrease drastically. The process of filing for divorce and terminating a domestic partnership is essentially the same, just with different titles.

Why a domestic partnership?

Domestic partnerships provide commitment without having to get married. The choice of whether to be in a domestic partnership or get married is completely up to each person, but domestic partnerships may be more appealing to people who want that sense of commitment and joint responsibility but don’t wish to get married. They can also still enjoy many benefits, such as some insurance benefits and visitation rights, but still maintain a kind of relationship that isn’t necessarily marriage. On the other hand, marriage may be more appealing to others since it’s a more widely recognized institution and has more benefits given by the federal government, such as being able to file taxes jointly.

Comments

0 comment