views

100 Envelope Savings Challenge

Label envelopes from 1 to 100 and put in that amount each week. Label 100 envelopes from 1 to 100 and pick one each week (either in order or randomly). For example, on week 50, you put $50 in the 50th envelope. By the time you get to week 100 (or roughly 2 years later), you’ll have $5,050 in savings. Raise the stakes: This harder version is the original viral TikTok savings challenge. Pick up an envelope every day (instead of every week) to save $5,050 after 100 days. Reduce the cost: Only number 50 envelopes and pick one up every other week to save a total of $1,275 in 100 weeks.

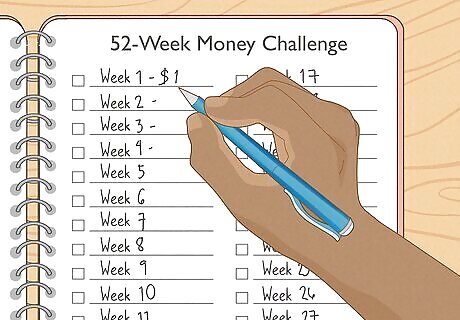

52 Week Savings Challenge

Put away $1 more each week to save $1,378 at the end of the year. The challenge begins with putting away $1 the first week, then $2 the second, $3 the third, and so on. By week 52, you’ll put away $52 and end up with $1,378, which can go towards whatever goal you’d like. Raise the stakes: Increase the amount saved by $1. Start at $10 the first week, then add $1 each following week. At the end of the year, you’ll have $1,612. Reduce the cost: Cut the time you’re saving in half so you only add $1 every other week. At the end of the challenge, you’ll have saved $1,053.

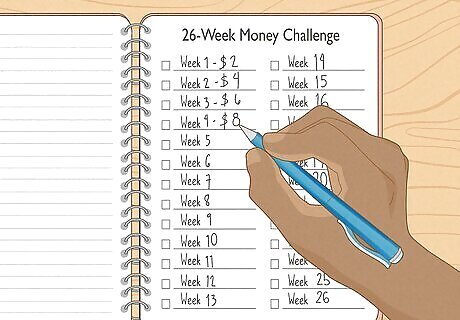

26 Week Savings Challenge

Save $4 every week to save a total of $1,378. In this challenge, you save the same amount of money as the 52-week challenge in half the time. You can also save bi-weekly if that’s when your paycheck comes in. Put away $3 the first week, then increase the value by $4 every week after that. By week 26, you’ll have $1,378. Raise the stakes: Alternate between saving $275 and $475 every other week until week 24. Then put away $425 on week 25 and $575 on week 26 to save $10,000 in total. Reduce the cost: Save $2 the first day, then increase each week by $2. On the second day, you’d save $4, then $6, then $8. At the end of the 26 weeks, you’ll have $702.

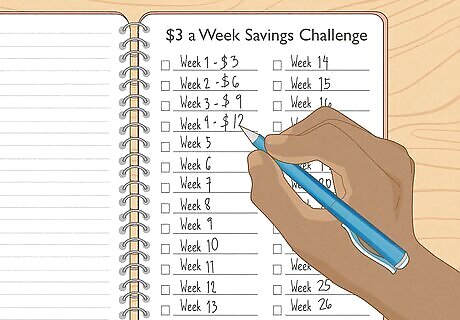

$3 a Week Savings Challenge

Put $3 more each week into a savings account until you reach $1,053. This challenge takes place over 26 weeks. Set aside $3 in the first week, then $6 in the second, $9 in the third, and so on. When you reach week 26, you’ll put in $78 for a total of $1,053. Raise the stakes: Multiply each week you’re saving by $5 instead of $3. On week 1, you’ll put away $5, and on week 26, you’ll deposit $130. At the end, you’ll have around $1,755. Reduce the cost: Increase the amount you put in savings by $2 a week. After 32 weeks, you’ll have $1,056.

$1000 in 3 Months Savings Challenge

Put $11 in savings daily to get $1,000 after 3 months. This means you’ll put $11 in your savings account each day, or $77 a week. On day 92 (about 3 months later), you’ll have about $1,012 to use for whatever you want! Raise the stakes: Deposit $22 a day into your savings account. After about 3 months, you’ll have $2,024. Reduce the cost: Put $6 away each day for 182 days (or about ½ a year) to save $1,092.

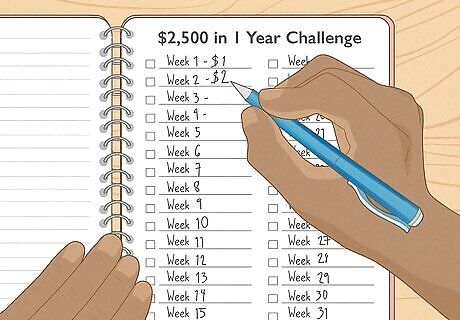

$2,500 in 1 Year Savings Challenge

Increase the amount you save by $2 weekly to save $2,500. This challenge includes 2 “freebie” weeks where you don’t have to save anything. Save $2 in the first week, $4 in the second, $6 in the third, and so on until you put away $98 on week 49. On the 50th week, you’ll only deposit $50 and have a total of $2,500 in your savings account. Raise the stakes: Increase the amount you save by $3 each week for 52 weeks. With this challenge, you’ll have saved about $4,134 at the end of the year. Reduce the cost: Increase how much you put in savings each week by $1.50 to save about $2,508 after 57 weeks (or a little over 1 year and 1 month).

Round-Up Challenge

Round up the amount you spend and put the extra cents in savings. When you spend money on coffee or a night out, round up the cost to the nearest dollar and put the rounded amount into savings. If you spend $2.57, round it to $3 and put the transfer the extra $0.43. By the end of the week, you’ll save money without even trying. Raise the stakes: Round up the amount that comes out of your account for your bills, rent, or mortgage, too. Reduce the cost: See if your bank offers an option to set “round-ups” on your account so you don’t have to do the math every time you spend money.

Penny-a-Day Challenge

Save $0.01 more each week and end up with $667.95 after a year. On the first day, put $0.01 into the bank, then put $0.02 in on the second day, and so on. Alternatively, put in $3.65 the first day and reduce the amount by a penny the next day. Raise the stakes: Double the amount you put in each day to get $1,335.90 by the end of the year. Reduce the cost: Stop your savings challenge in the middle of the year (about 182 days in) or put in money every other day to save $166.53.

No-Spend Money Challenge

Cut out non-essential spending for a week and save that amount. The week before, stock up on toiletries and groceries. During the no-spend week, try to only spend money on essentials, like rent, your mortgage, or utility bills, and find free ways to have fun, like going to free events or your local library. Raise the stakes: Mark every other week as a no-spend week. During your no-spend weeks, try to only spend money on things you have to. Reduce the cost: Instead of having an entire week of not spending, choose one day each week (like Mondays or Wednesdays).

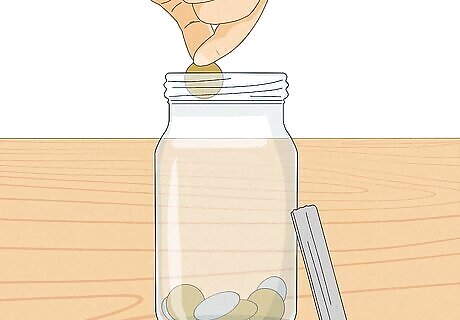

Change Jar Challenge

Throw all of your change into a jar until it’s full. If you use a lot of physical cash, this might be an easy way to save a little extra money weekly. All you need to do is throw your extra change into a change jar each day. After about 6 months (or whenever it’s full), take it to the bank or a coin machine and see how much you saved! Raise the stakes: Try putting all your dollar bills in the jar, too, or stick $1 into the jar each day and see how much you end up with after it’s full. Reduce the cost: If you need to keep some change around, take a little bit out of the change jar when you need it. Just try to put more in the jar than you take out!

Weather Report Challenge

Check the temperature each week and add that amount to savings. Pick a day each week (like Wednesdays or Sundays), look up the highest temperature for that day, and save the amount equivalent to the number of degrees. For example, if the temperature is 53 °F (12 °C), deposit $53 (or $11.66) into your savings account. Raise the stakes: If you live somewhere cold, turn any negative degrees into positive dollar amounts and multiply the temperature by 2. Reduce the cost: Live somewhere hot? Divide the amount you contribute by 2.

Subscription Cancellation Challenge

Cancel any subscriptions you don’t use and put that money in savings. Although monthly subscriptions can give you access to all kinds of streaming or entertainment services, they can also add up quickly. Cancel any subscriptions you don’t use regularly, then count the amount you aren’t spending and automatically transfer it to savings instead. Raise the stakes: Cancel all your subscriptions, or try to share the cost with others in your household who’d like to use them. Reduce the cost: Pause or cancel a few subscriptions you aren’t using only for a month or two. Even if you reactivate them later, you’ll save some money in the meantime.

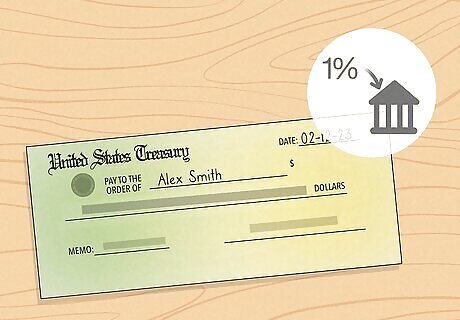

1% Retirement Challenge

Every time you get a paycheck, transfer 1% to your savings account. Saving for retirement can be difficult, especially if you’re living paycheck-to-paycheck. However, finding small ways to save each month can help you meet your goals. If you have access to a retirement savings plan like a 401k, try to contribute 1% more of your salary every year. Raise the stakes: Start by contributing 2% of your income, then increase that amount by 2% more every year after. Reduce the cost: If you don’t have access to a 401k, save 1% of each paycheck and use it to pay off any high-interest debt, like credit card bills.

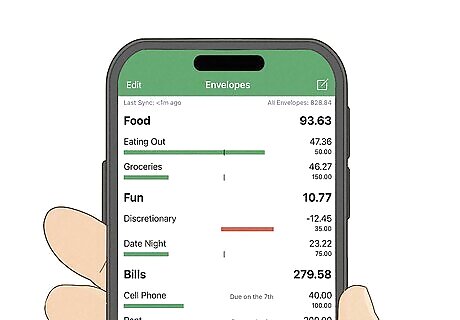

How to Save Money Each Week

Track how much you spend every month to avoid impulse buying. Financial planner Samantha Gorelick says the best way to cut back on wasteful spending is to take “a close look at your actual spending” and cut out the things you don’t remember buying. Try to track where your money is going with a spreadsheet or by using a free app like NerdWallet or Goodbudget. If you look at your statements and see a ton of online purchases without remembering what you bought, that may be a sign to stop purchasing items from those sites. Whenever you want to buy a non-essential item, wait 24 hours. If you still want the item after, then add it to your cart.

Compare grocery prices online before you shop. Financial executive Andrew Lokenauth says the “best way to save money is to compare prices.” Before shopping, check online to see each store’s prices and try to pick the one that will get you the best deals. Lokenauth recommends installing an app that can “let you scan the barcode of an item and [compare] it to other sites,” like Flipp or Grocery King.

Create a grocery list before you go and stick to store-brand items. Creating a grocery list and figuring out the cost of each meal can help you reduce hefty grocery bills. When you’re at the grocery store, try to buy less-expensive store-brand alternatives instead of reaching for the name-brand product.

Shop at discount or bulk stores. Discount and bulk stores like Aldi or Costco often have lower prices than traditional grocery stores. Some stores also run sales or offer coupons in the middle of the week.

Negotiate with your phone service and shop for better plans. If your phone bill is eating into your monthly spending, search for a cheaper phone plan and call up your current provider to ask them to change your plan. Some states and countries might also offer discounts on home and cell phone services to low-income households. You can also shop around for cheaper deals on your cable and internet bills.

Invite friends over to your house to reduce eating out too often. If you spend a ton of money each month going out or eating at restaurants with people you care about, try to invite them over to your house a couple of times instead. That way, you spend a little less going out, but you can still enjoy the company of your closest friends. Gorelick says, “Things like enjoying meals with people they care about… are usually the ones that I tell people not to worry as much about because they're having experiences that fulfill their livelihood.”

Prepare your meals on the weekend to save money on lunches out. During the weekend (or whenever you have time), plan out the menu for each meal and shop for each recipe. On meal prep day, cook the foods that take the longest to cook, like chicken or roasted vegetables. Make extra portions for an additional day or two of meals or freeze a batch of food to dethaw later.

Comments

0 comment