views

The Reserve Bank of India (RBI) on Wednesday did a U-turn on customers depositing demonetised notes over Rs 5,000 till December 30 by making it clear that there will be no questions asked either in case of one-time or repeat deposits if the accounts are KYC-compliant.

Such customers will also not be questioned by bank officials on why they had failed to deposit the old notes earlier. However, customers with non-KYC accounts will be subject to stiff conditions imposed by RBI on December 19 for deposit of old notes.

Here is an explainer on KYC:

THE KYC

- KYC or “Know Your Customer” is a process by which banks obtain information about the identity and address of the customers.

WHY KYC

- This process helps to ensure that banks’ services are not misused.

- The KYC procedure is to be completed by the banks while opening accounts.

- Banks are also required to periodically update their customers’ KYC details.

KYC REQUIREMENTS FOR OPENING A BANK ACCOUNT

- For opening a bank account, one needs to submit a ‘proof of identity and proof of address’ together with a recent photograph.

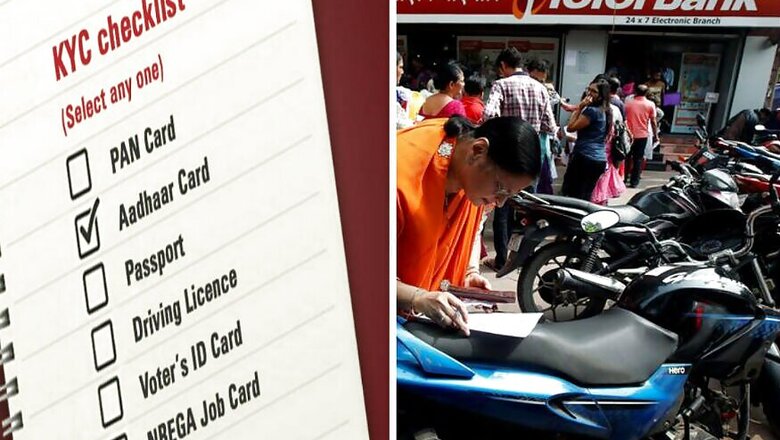

DOCUMENTS TO BE GIVEN AS ‘PROOF OF IDENTITY’ AND ‘PROOF OF ADDRESS’

- GOI has notified 6 documents as ‘Officially Valid Documents’ for the purpose of producing proof of identity - Passport, Driving Licence, Voters’ Identity Card, PAN Card, Aadhaar Card issued by UIDAI and NREGA Job Card. One needs to submit any one of these documents as proof of identity.

- If any of the above mention documents also contain your address details, then it would also be accepted as ‘proof of address’.

- If the document submitted by you for proof of identity does not contain address details, then you will have to submit another officially valid document which contains address details.

Source: RBI

Comments

0 comment