views

After climbing dizzying heights, Indian stock market is crashing in the recent weeks. Lot of foreign investors are running away from the Indian stock markets triggering a fear of yet another economic slowdown. But a closer look at these investors reveals some ugly truths. Lot of ‘foreign’ money which comes to India through Participatory Notes or popularly known as P Notes may not be a foreign money at all. According to some black money researchers, it is actually Indian black money routed back to India through foreign tax havens in the name of P Notes. Here is one such shocking example.

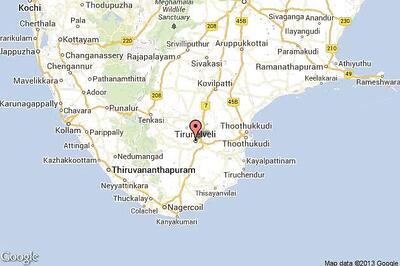

The Cayman Islands, a British overseas territory with a population about 50,000 people has invested Rs 85,000 crore in India. On an average, each citizen of Cayman island has invested Rs 1.75 crore or roughly $3,00,000 in the Indian stock market!

An unbelievable sum and a shocking story indeed. It has been revealed by the Special Investigation Team (SIT) on black money, says a report in leading English newspaper ‘Deccan Herald’.

What is P Note?

Stock markets in India are regulated by SEBI and all foreign institutional investors (FII), who invest in Indian stocks have to get registered with SEBI. The two broad categories of foreign Investments viz. FDI and FII are highly regulated and need several approvals from SEBI. On the other hand, Participatory Notes is the alternative by which any Foreign Institutional Investor can enter Indian Capital Markets without getting registered with SEBI and going through the prescribed approval process.

The reasons could include the desire of investors to keep their identity anonymous, which is possible also for the reason that PNs/ODIs can be freely traded and easily transferred without disclosing the identity of the actual beneficiaries.

As per the White Paper on Black Money, since PNs are issued from Offshore Financial Centres (OFCs) such as the Cayman Islands, British Virgin Islands, Switzerland, and Luxembourg, it is possible to hide the identity of the ultimate beneficiaries through multiple layers.

P Notes have helped the Indians with huge amount of black money to invest the same money in Indian stock markets showing it as a legitimate foreign investment.

Huge Investment through P Notes

According to a Deccan Herald report, SEBI has informed the Supreme Court-appointed SIT that the outstanding value of Offshore Derivative Instruments (ODIs) or P-Notes at the end of February 2015 stood at Rs 2.715 lakh crore.

In its report to the SC, the SIT said the top five locations of beneficial owners of P-Notes were the Cayman Islands, the US, the UK, Mauritius and Bermuda, contributing to 31.31%, 14.20%, 13.49%, 9.91% and 9.10%, respectively, of the total ODIs outstanding.

“It is clear from this that a major chunk of outstanding ODIs invested in India is from the Cayman Islands. This translates to roughly Rs 85,006 crore. The Cayman Islands had a population of roughly 54,397 in 2010. It does not seem conceivable that a jurisdiction with a population of less than 55,000 could invest Rs 85,000 crore in one country. The main point of this elaboration is it does not appear possible for the final beneficial owner of ODIs originating from the Cayman Islands to be from that jurisdiction,” said the report.

A PTI report also claims that the Union Government has admitted that the Participatory Notes is an instrument for overseas entities to invest in Indian stock market, is being used by Indian citizens to re-invest black money in the country.

"Investment in the Indian stock market through PNs is another way in which the black money generated by Indians is re-invested in India," the White Paper on black money tabled in the Parliament said.

CPI (M) study

According to a CPI (M) analysis of black money, the total amount held in the Indian deposits of Swiss Banks fell from Rs 23373 crore in 2006 to Rs. 9295 in 2010. The CPM laments that the government seems to have no clue as to where this amount has gone. There is no assessment of Indian deposits in other offshore financial centres. The paper suggests that much of illicit financial outflows are round-tripped into India through FDI via the Mauritius route or via FII investments through Participatory Notes. Yet there is no specific recommendation to ban Participatory Notes or to scrap the DTAA with Mauritius.

The paper cites the Global Financial Integrity study which estimated the current value of illicit financial flows from India between 1948 and 2008 to be around $462 billion (Rs 25 lakh crore approximately). The fact that these are not gross overestimates can be seen from the information provided by the white paper: in over the last two financial years (2010-2012) alone, the Directorate of Transfer Pricing has detected mispricing (such as over-invoicing and under-invoicing of imports and exports) to the tune of a whopping Rs 67768 crore in 1343 cases. Rs 48951 crore has also been collected by the Directorate of International Taxation in just two years, between 2010 and 2012. It is clear that these amounts detected or collected over the past two years still comprise the tip of the iceberg.

What Next

There has been a demand to ban the P Notes to prevent the flow of black money into Indian stock markets. But, it is not so easy as it can adversely affect the stock market and the genuine foreign investors will also affected from it.

The government is treading cautiously on the issue.

Comments

0 comment