views

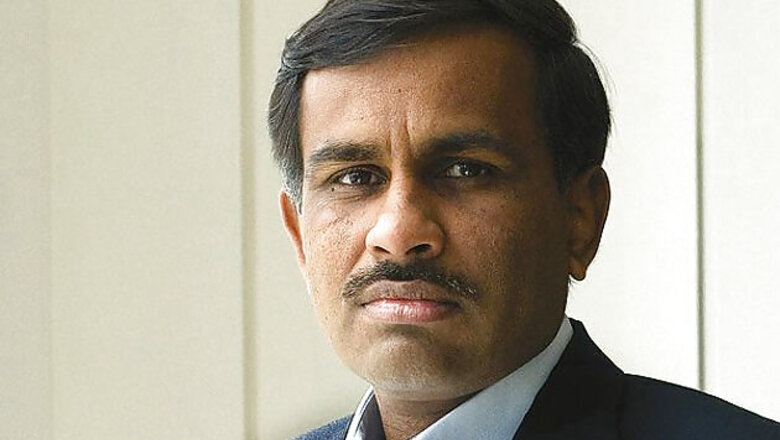

Vikram Limaye

Age: 45

Career: Joined IDFC in 2005; prior to that, was associated with Credit Suisse First Boston in the US

Education: CA, Mumbai University; MBA, Wharton

Interest: Likes playing tennis

Question: Where will the growth in infra-lending come from?

Vikram Limaye: There is not much growth in the environment. Yet, we are clear that IDFC will focus on disciplined, profitable growth with no compromise on asset quality. So, for instance, we are staying away from promoters who have won road projects through very aggressive bidding. To keep going—we are looking at disbursing loans from our existing project pipeline of Rs 17,000 crore. We are also refinancing debt for operating assets—these are a lower risk group because they have an income stream. We are also looking at a few new projects in the renewable [energy] and road spaces.

Question: Renewables are obviously a much smaller segment. What is the outlook on thermal power projects?

Vikram Limaye: Renewable power is very small. But I expect the uncertainty on thermal power to be sorted out in the next one or two quarters. There is absolutely no investment now in this segment. We have the world’s fifth largest coal reserves and yet there is a shortage of coal. There is uncertainty about reform, but if the government can focus on clearing some of these bottlenecks—sentiment can change quickly. Political opposition is least for power sector reforms. We are seeing some movement already on SEB [state electricity board] tariff reform and Coal India committing to supplies. I am clear on this one. You cannot be long on India and short on infrastructure. Growth is simply not sustainable without power and roads. This has to get better.

Question: IDFC's fee-based revenue stream is tanking. How do you plan to keep growing?

Vikram Limaye: Our balance sheet is now $12 billion; it was $1 billion when we went public seven years ago. Growth has been steady, though we have some stable revenue streams in our portfolio and some volatile ones. The stable streams are loans and asset management fees (project and private equity). We will be in the market in the next few months to raise funds and this will increase our assets under management. The volatile segments are investment banking and broking. Thirty per cent of our operating income comes from non-interest income. As we grow, it becomes difficult for the fee-based income to keep pace.

Question: Telecom loans are now up to 31 per cent of your portfolio. How are these companies doing with the latest turmoil in the business?

Vikram Limaye: Fortunately we have not lent to any of the operators whose licences were cancelled. We have high-quality, cash-generating companies with us. Of course, competitive pressures are severe on all the big players too. We intend to continue to focus on the large, established players. We have to be comfortable with the promoters.

Comments

0 comment