views

Online shopping has taken the retail space by a storm. With more and more people preferring online shopping, the e-commerce sector has seen phenomenal growth. For a seamless online shopping experience, a robust payment gateway is a must. The success of an online business depends on the payment gateway that provides quick, easy and convenient for their customers to make payments online is imperative.

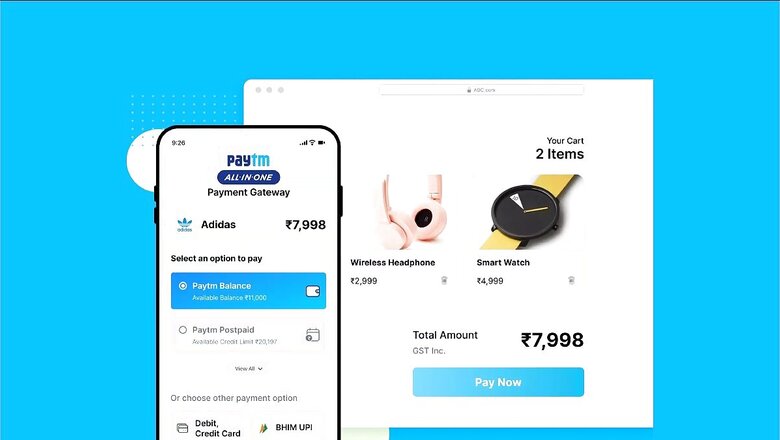

Paytm Payment Gateway offers all this and more to its merchants, ensuring that they can scale their business and widen their consumer base. Merchants can seamlessly integrate Paytm Payment Gateway ensuring superfast and secure payments for consumers.

Here is what makes Paytm Payment Gateway the most preferred option for India’s merchants:

Effortless and secure payment experience:

Ensuring customers experience a high-quality shopping experience that runs on the most effortless payment options is paramount. Paytm Payment Gateway provides a comprehensive range of payment options to users – UPI, Wallet, Paytm Postpaid, netbanking, debit and credit cards, EMIs. Other payment gateways limit their payment options to debit cards, credit cards and netbanking.

Quick and seamless checkout is the hallmark of a good payment gateway that eliminates redundancies by 50% and boosts conversions. On Paytm Payment Gateway, merchants can benefit from Express Payments feature that enables OTP-less and CVV-less secure payments for consumers, or the Saved Instruments feature, that enhances the checkout experience for customers by freeing them from the hassle of entering their payment details time and again.

Merchant Dashboard: For easy & powerful accessibility

One of the major pain points for small business owners is the reconciliation of payments. Paytm Payment Gateway‘s robust business dashboard is a single platform that gives a complete command over all the cash flows for a business. It empowers merchants to handle business transactions, initiate refunds, resolve disputes and receive same-day settlements through a single dashboard. Merchants can also download reports and get valuable insights in real-time.

Instant Refunds

Instant Refunds are central to a great customer experience. Paytm Payment Gateway has streamlined the refunds process for online businesses provides same day refunds that enhances user experience and trust in the brand.

Subscriptions: Seamless recurring payments solutions

With the Paytm Payment Gateway’s subscriptions functionality, online businesses can easily collect recurring payments while also providing their consumers with free trials. Additionally, merchants can secure an upfront fee and automate recurring payments in a single step, and charge customers a fixed value or as per their usage. It allows customers to set up an automated billing cycle.

Large Payment Collection: Collect & reconcile bank transfers efficiently

According to India Marketers, the average cart abandonment rate in India is 51%, but it can rise to 70-75%, resulting in enormous revenue loss. It means that any improvement that a mechant makes to the shopping experience can lead to dramatic changes in their bottom line. When a merchant handles their payments on-site, choosing a payment gateway that will help them understand their options and responsibilities is crucial.

Paytm’s Large Payment Collection enables businesses to collect and reconcile bank transfers while managing their collections and letting them concentrate on business growth. This feature allows businesses to generate custom virtual account numbers and start collecting payments from customers through NEFT, RTGS, or IMPS, thus enhancing the business’s productivity and shifting the massive workload to drive growth.

Settlements: Say goodbye to liquidity crunches

It is essential to have a merchant account to receive funds through an online payment gateway. When customers perform an online payment through a payment gateway, it transfers the money temporarily to a separate retailer account. This is the merchant account, which is different from the actual bank account of a merchant. In other cases, the money in a merchant account has to wait until it gets approved by the customer’s processing bank. But Paytm Payment Gateway eliminates this waiting period by upgrading the way a merchant gets customer payments settled with Paytm Settlements.

This feature helps businesses manage cash flows to handle daily operational expenses more efficiently. They can enjoy next-day settlements by enabling a T+1 settlement cycle at zero additional charges.

PCI-DSS level security

The security of payments is pertinent in any online transaction. Secure payment processing makes it easier to send online payments, customer data, and other sensitive information while also protecting against fraud and other security risks.

Paytm Payment Gateway uses the latest anti-fraud technology to keep things safe for online businesses. It has a dedicated team of 200 cybersecurity experts to ensure every user transaction is secure. It is also certified by the Payment Card Industry – Data Security Standards (PCI-DSS) with 128-bit encryption.

Brand Connect.

Comments

0 comment