views

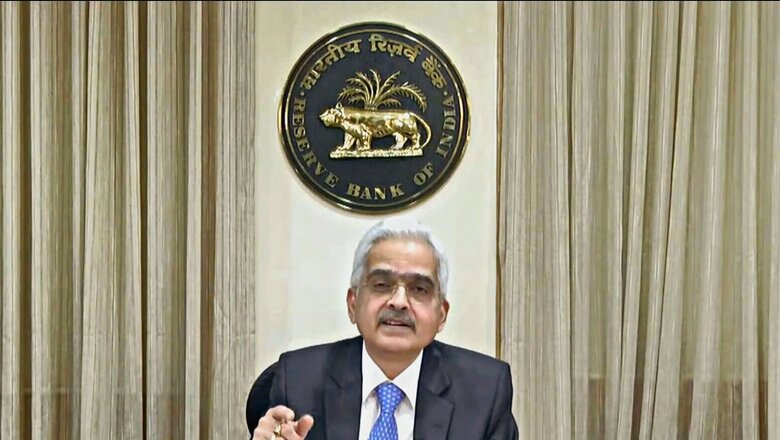

RBI MPC Decisions: The Reserve Bank of India governor Shaktikanta Das-led Monetary Policy Committee on Friday, August 5, announced that it had made the decision of hiking the benchmark repo rate — the rate at which RBI lends to banks — by 50 basis points. Following this hike, the RBI repo rate has increased to 5.40 per cent from the earlier 4.90 per cent. The RBI MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

RBI governor Shaktikanta Das signed off his bi-monthly MPC speech with a quote by Mahatma Gandhi: “For me the road to salvation lies through incessant toil in the service of my country and there through of humanity”.

“The Indian economy is holding steady and progressing in an ocean of turbulence and uncertainty. As we celebrate Azadi ka Amrit Mahotsav, this is a moment of reckoning, reflection and renewed resolve to work for the betterment of our economy. We, in the RBI, reiterate our commitment to maintain price and financial stability to place our economy on a sustainable path of growth. Our actions have helped the economy to tide over a series of shocks in the last two and half years. We are seized of our role at this critical juncture and will persevere in our efforts to ensure a safe and soft landing,” Das said in the concluding remarks of his speech.

The RBI governor said that the Indian economy has naturally been impacted by the global economic situation that has undergone successive shocks. ” We have witnessed large portfolio outflows to the tune of US$ 13.3 billion during the current financial year so far (up to August 3). Nevertheless, with strong and resilient fundamentals, India is expected to be amongst the fastest growing economies during 2022-23 according to the IMF, with signs of inflation moderating over the course of the year. Export of goods and services together with remittances are expected to keep the current account deficit within sustainable limits.”

“The decline in external debt to GDP ratio, net international investment position to GDP ratio and debt service ratio during 2021-22 impart resilience against external shocks1. The financial sector is well capitalised and sound. India’s foreign exchange reserves, supplemented by net forward assets, provide insurance against global spillovers. Our umbrella remains strong,” he said.

Against this background, the monetary policy committee (MPC) met on August 3 to 5 and reviewed the macroeconomic situation and its outlook, Das added. “The MPC decided unanimously to increase the policy repo rate by 50 basis points to 5.4 per cent, with immediate effect. Consequently, the standing deposit facility (SDF) rate stands adjusted to 5.15 per cent; and the marginal standing facility (MSF) rate and the Bank Rate to 5.65 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.”

“Consumer price inflation has eased from its surge in April but remains uncomfortably high and above the upper threshold of the target. Inflationary pressures are broad-based and core inflation remains at elevated levels. The volatility in global financial markets is impinging upon domestic financial markets, including the currency market, thereby leading to imported inflation,” said the RBI governor.

With inflation expected to remain above the upper threshold in Q2 and Q3, the MPC stressed that sustained high inflation could destabilise inflation expectations and harm growth in the medium term, he said. “The MPC, therefore, judged that further calibrated withdrawal of monetary accommodation is warranted to keep inflation expectations anchored and contain the second-round effects,” said RBI governor Shaktikanta Das.

Read the Latest News and Breaking News here

Comments

0 comment