views

Signalling to the salaried class that the new Income Tax regime is the way forward, Finance Minister Nirmala Sitharaman announced hotly expected relief for taxpayers in her last full budget before 2024 Lok Sabha elections.

Delivering her Budget 2023 speech in Parliament on Wednesday, Sitharaman tweaked the Income Tax slabs to provide some relief to the middle class by announcing that no tax would be levied on annual income of up to Rs 7 lakh under the new tax regime. She also allowed standard deduction to taxpayers under the new regime. In the new regime, however, taxpayers cannot claim deductions or exemptions on their investments.

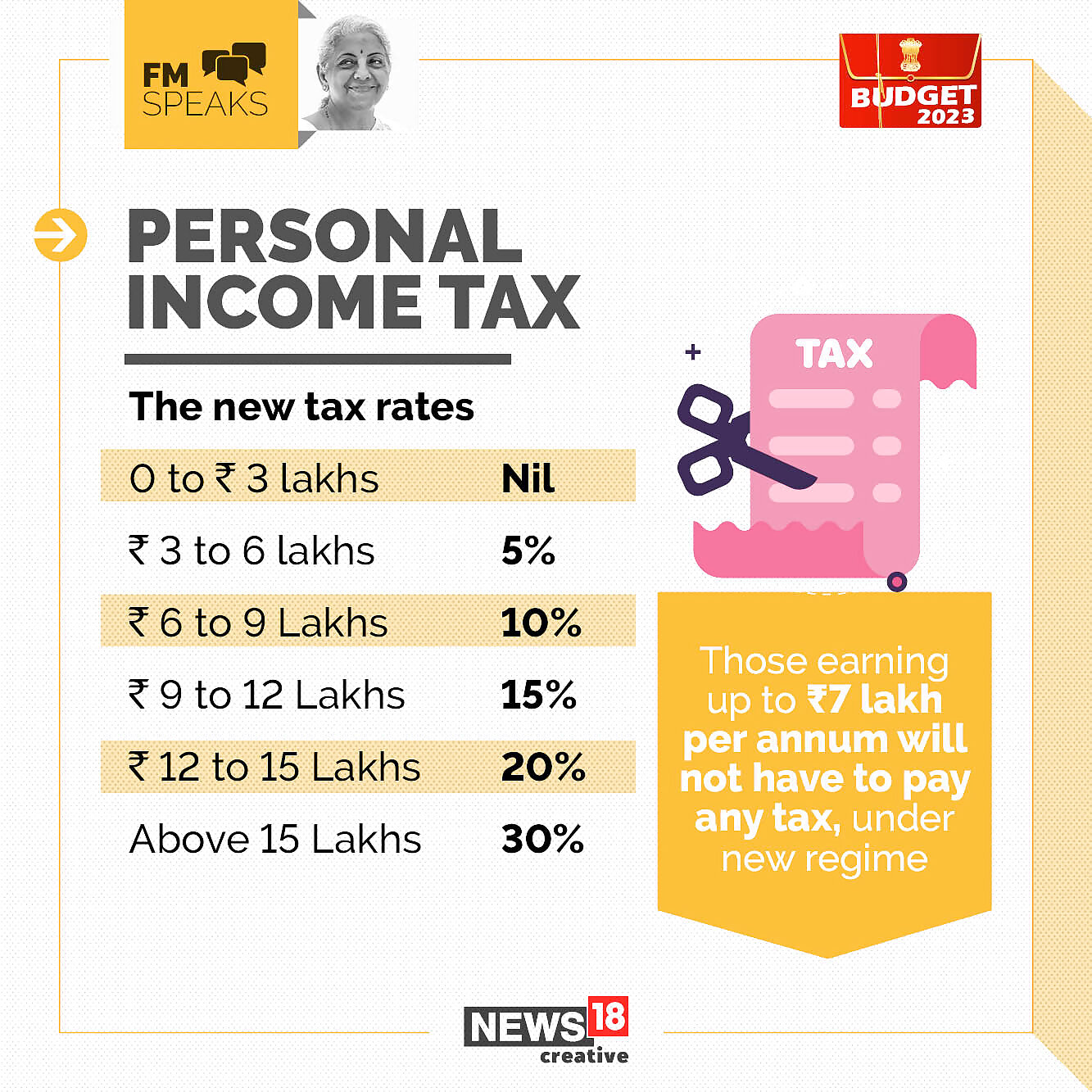

Sitharaman also tweaked the concessional tax regime, which was originally introduced in 2020-21, by hiking the tax exemption limit by Rs 50,000 to Rs 3 lakh and reducing the number of slabs to five.

Under the revamped concessional tax regime, no tax would be levied for income up to Rs 3 lakh. Income between Rs 3 lakh and Rs 6 lakh would be taxed at 5%; Rs 6 lakh and Rs 9 lakh at 10%, Rs 9 lakh and Rs 12 lakh at 15%, Rs 12 lakh and Rs 15 lakh at 20% and income of Rs 15 lakh and above will be taxed at 30%.

“I propose to extend the benefit of standard deduction to the new tax regime. Each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500,” Sitharaman said.

The government in Budget 2020-21 brought in an optional income tax regime, under which individuals and Hindu Undivided Families (HUFs) were to be taxed at lower rates if they did not avail specified exemptions and deductions, like house rent allowance (HRA), interest on home loan, investments made under Section 80C, 80D and 80CCD. Under this, total income up to Rs 2.5 lakh was tax exempt.

Currently, a 5% tax is levied on total income between Rs 2.5 lakh and Rs 5 lakh, 10% on Rs 5 lakh to Rs 7.5 lakh, 15% on Rs 7.5 lakh to Rs 10 lakh, 20% on Rs 10 lakh to Rs 12.5 lakh, 25% on Rs 12.5 lakh to Rs 15 lakh, and 30% on above Rs 15 lakh.

What is Standard Deduction?

Standard deduction is a base amount that is not subject to tax, in addition to the basic exemption limit. Deduction is different from a rebate, which is kind of a partial refund from tax payable. Income tax deductions are allowed to be claimed from the income, whereas rebate is allowed to be claimed from the tax payable.

It was removed in 2005 by the then UPA government but in 2018 then finance minister Arun Jaitley brought back a standard deduction of Rs 40,000 to replace the transport allowance of Rs 19,200 and medical expense of Rs 15,000. In 2019, standard deduction was raised to Rs 50,000 a year.

Read all the Latest Business News and Budget Live Updates here

Comments

0 comment