views

Financial fraud is any type of deception or misrepresentation that is committed with the intent of obtaining money or other financial benefits from another person or entity. It can have a devastating impact on victims, both financially and emotionally. It can lead to financial losses, debt, and credit problems. It can also cause stress, anxiety, and depression.

It’s important to note that financial frauds are dynamic, and new cases emerge from time to time. If you think you may have been a victim of financial fraud, you should report it to the police and to the relevant financial institution/bank.

Here are some of the financial frauds that you must be aware of:

Investment fraud: This type of fraud involves deceiving investors about the risks and potential returns of an investment. For example, a scammer might sell a fake investment product or promise unrealistic returns.

Bank fraud: This type of fraud involves deceiving banks or other financial institutions in order to obtain loans, credit cards, or other financial services. For example, a scammer might use a stolen identity to open a bank account or apply for a loan.

Insurance: This type of fraud involves deceiving insurance companies in order to obtain insurance benefits. For example, a scammer might file a false insurance claim or exaggerate the extent of their losses.

Credit card: This type of fraud involves using stolen or counterfeit credit cards to make purchases or withdraw cash.

Identity theft: This type of fraud involves stealing a person’s personal information, such as their name, Social Security number, or credit card number, and then using it to commit fraud.

Ponzi schemes: These schemes promise high returns on investment with little to no risk. However, they are actually fraudulent and rely on new investors’ money to pay off old investors.

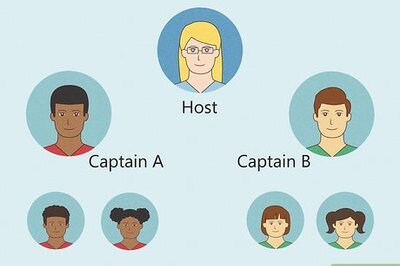

Pyramid schemes: These schemes involve recruiting new investors to join the scheme, who then recruit their own investors, and so on. The investors at the top of the pyramid make money from the money invested by the new investors at the bottom. However, as the scheme grows, it becomes increasingly difficult to recruit new investors, and the scheme eventually collapses.

Cryptocurrency scams: There have been a number of cryptocurrency scams in India, where people have been lured into investing in fake cryptocurrencies or cryptocurrency exchanges. In some cases, people have lost their entire life savings in these scams.

Identity theft: In identity theft, scammers steal a person’s personal information, such as their name, Social Security number, or credit card number, and then use it to commit fraud.

Phishing scams: In phishing scams, scammers send emails or text messages that appear to be from a legitimate company, such as a bank or credit card company. The emails or text messages will often contain a link that, when clicked, will take the victim to a fake website that looks like the real website. If the victim enters their personal information on the fake website, the scammers can steal it and use it to commit fraud.

Tips to protect yourself from financial fraud:

- Be wary of any investment opportunity that promises high returns with little to no risk.

- Do your research before investing in any stock or cryptocurrency.

- Never give out your personal information to anyone you don’t trust.

- Be careful about clicking on links in emails or text messages, even if they appear to be from a legitimate company.

- Keep your software up to date, including your operating system, antivirus software, and web browser.

Comments

0 comment