views

The Reserve Bank FAQs on digital lending guidelines will improve transparency, promote responsible practices and boost growth of the sector by prescribing strict upfront disclosure norms with regard to recovery processes, according to experts.

The RBI on Tuesday came out with 18 points frequently asked questions (FAQs) on Digital Lending Guidelines, which were issued in August last year, with an aim to prevent charging of exorbitant interest rates by certain entities and also check unethical loan recovery practices.

“Stating categorically that I as a lender have hired some company to recover my amount from the customer is extremely critical because the customer knows what is happening and now the accountability is directly linked to the lender.

“Now there is no place that a lender can hide and there is no place even the customer can hide because the customer has also been informed that you are going into a recovery mode,” said Kunal Jhunjhunwala, founder and MD, Airpay.

Also Read: Fintech-Driven Digital Lending To Bridge Credit Gap In India, Says Report

On recovery agents, the FAQs said that at the time of sanction of loan, the borrower may be conveyed the name of empanelled agents authorised to contact the borrower in case of loan default.

However, if the loan turns delinquent and the recovery agent has been assigned to the borrower, the particulars of such recovery agent assigned must be communicated to the borrower through email/SMS before the recovery agent contacts the borrower for recovery, the RBI said in the FAQs.

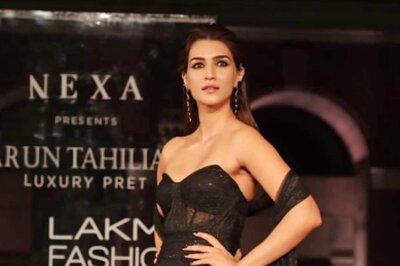

V Swaminathan, Executive Chairman, Andromeda loans and Apnapaisa.com opined that with the clarifications through FAQs released on February 14, the RBI is prioritising transparency in the digital lending ecosystem.

“This will further promote responsible practices in the industry along with borrower-centric innovation, thereby boosting growth of this sector,” he said.

Commenting on the FAQs, Rohit Arora, CEO and Co-Founder, Biz2Credit the digital lending norms that RBI has come out with is a step in the right direction as players who are offering digital lending offerings in India need clarity on this offering.

“In the last one year the issue with Chinese apps has created a lot of distress among the borrowers and concern among the regulators as it has led to a large number of borrowers being duped.

“This is a good move as future is in digital lending and these guidelines will help create forward looking norms for the industry and make it more formal,” he said.

The central bank’s FAQs also said the principle underlying the ‘Digital Lending Guidelines’ is that a LSP should not be involved in handling of funds flowing from the lender to the borrower or vice versa.

While entities offering only Payment Aggregators (PA) services shall remain out of the ambit of ‘Guidelines on Digital Lending’, any PA also performing the role of an LSP must comply with the guidelines.

Jhunjhunwala further said the FAQs have provided more clarity on the original digital lending norms.

For example, they had earlier stated that the flow of funds can only be between the borrower and the lender and no other intermediatory, he pointed out.

However, they have clarified that payment companies like Airpay or other such players can be a part of that transaction as pure facilitators, he said.

Issuing a detailed set of guidelines for digital lending, the RBI mentioned the concerns primarily related to unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices.

Read all the Latest Business News here

Comments

0 comment