views

The world has entered a third year of turmoil of a global character, which must be – at least it should be hoped so – a once in a generation situation.

The pandemic gobbled up the year 2020, and reared its fierce form again in 2021. It continues to create pockets of turbulence even now, with the hitherto zero-COVID chasing countries the latest to be hit. The year 2021 also saw huge supply chain disruptions, which weighed on global growth and delayed economic normalisation. Most countries also saw high level of inflation in 2021, which persists in 2022, as the after-effects of the policy response to pandemic gnaw at the economic recovery cycle.

If this was not enough already from a policy complexity standpoint, the world is now witnessing a geopolitical event with biggest global impact since the Second World War, despite the current geographically limited conflict theatre. The second order impact of the event are yet to fully play out. However, the immediate issue of energy prices is a big worry for India. The food grain supply shock, which will collectively feed into rather intransient global inflation, is also beginning to hurt parts of the world.

Perhaps the phrase VUCA – volatility, uncertainty, complexity, ambiguity – was coined exactly for a time like this. Amidst these VUCA times, India’s gross domestic product (GDP) data for the third quarter of the financial year 2021-22 was released on February 28. The quarterly GDP print came in at 5.4 per cent, lower than most estimates, but also against the backdrop of an upward revision of previous year’s GDP. The GDP for financial year 2020-21 contracted by 6.6 per cent, as against the earlier estimate of 7.3 per cent. Most estimates for the financial year 2021-22 GDP now fall in the 8.8 per cent to 9.2 per cent range.

The growth recovery after the debilitating pandemic-smothered financial year 2020-21 seems to be fatigued, with global factors weighing on the recovery. With India also witnessing a sharp but relatively short third wave of the COVID-19 pandemic led by the Omicron variant between December and February, the fourth quarter recovery still carries uncertainty.

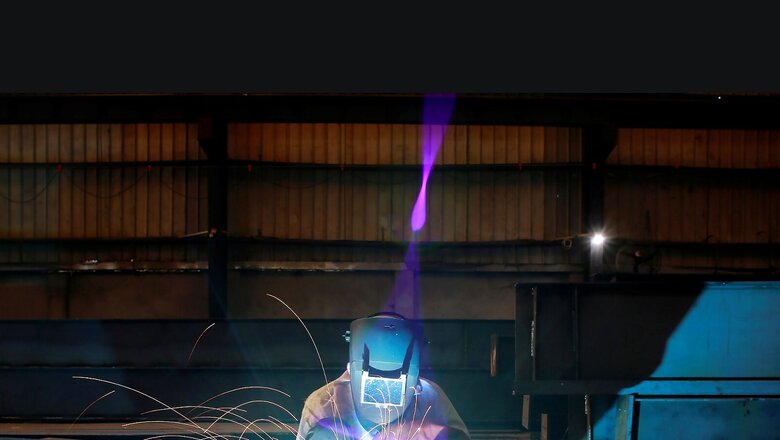

On the positive side, India’s manufacturing and services purchasing managers’ index (PMI) have been in the positive territory through the year. India will hit $400-billion in goods exports this financial year, first such year in the history. The goods exports have crossed $30-billion mark every month since March 2021, which until recently was seen as a psychological mark tough to breach.

The domestic non-food credit has hit the levels prevalent in the third quarter of 2019, though the growth levels remain some way off from the highs witnessed in financial year 2017-18. High frequency data such as the goods and services tax (GST) collection has been robust. Domestic airlines are now carrying almost three-fourth the number of passengers they did before the pandemic.

Much of the growth currently is coming from strong government spending, which has been the steady pillar of growth coming out of the pandemic. Services sector also witnessed a strong comeback in the October–December 2021 quarter, which also corresponds to the extended festive season demand.

However, this latest GDP data saw downward pressure from construction sector, which saw an anaemic growth. The growth in agriculture sector has levelled off, with unseasonal rain taking a toll not just on the economic activity but also feeding into food inflation. Rural stress continues to persist, which in turn is dampening the consumption demand. This is one area which is not fully past the pre-pandemic activity levels, which is the first aspect of recovery before the expectation of catching up with the growth trajectory itself.

The rural demand for two-wheelers remains weak, which is a drag on the auto industry, already embattled due to the global supply shortages. The auto sector is also a big part of India’s manufacturing and these compounding effects pose clear headwinds.

With these conflicting factors at play, India’s stable policy environment has anchored the short-term economic instabilities emanating from exogenous shocks. However, both fiscal and monetary policy environment has been predictable and forthcoming through the troubled times. There is increased financialisation of savings in the economy and foreign direct investments (FDI) have been robust. These conditions reflect in the state of the stock market, which has stayed resilient despite the global uncertainties.

The immediate worry for the economy is how the oil price behaves. The oil price has climbed over $100 after many years. India remains import dependent for its oil requirement. A growing economy needs more oil leading to even bigger import bill. With an annual import demand of 1.5 billion barrels a year, every dollar of price increase adds $1.5-billion to the import bill. Oil is now trading almost $40 per barrel over the average price seen between October and December.

A key policy question is how are these costs borne. Excise duties had already been cut once in this financial year, so the government has already absorbed some costs. But spiralling oil prices also have other impacts like higher global prices for commodities like coal, edible oil, natural gas and fertilisers, all areas of import dependence to varying degree. The slicing of additional costs between the government, industry and private consumers will define the impact on GDP for the next financial year.

The pathway to geopolitical normalcy remains unclear. But the macro picture for India has to start looking at the emerging lessons. Parts of the economy that can be weaponised have to be understood with self-sufficiency and not just self-reliance assessed for each of these areas. Certainly for defence and hi-technology areas like semiconductors and telecommunications among others, the case for self-sufficiency continues to become stronger.

Prime Minister Narendra Modi has done a series of talks after the February 1 Budget for the upcoming financial year 2022-23. In every talk, he has spoken about his vision for an Atmanirbhar Bharat. The world is increasingly wired not on the basis of transaction cost optimisation but on the basis of sovereign objectives.

While the short term uncertainty and negative externalities remain, the mid to long term path for the economy has to clearly keep the objective of Atmanirbhar Bharat front and centre.

Aashish Chandorkar is Counsellor at the Permanent Mission of India to the World Trade Organization, Geneva. The views expressed in this article are those of the author and do not represent the stand of this publication.

Read all the Latest Opinion News and Breaking News here

Comments

0 comment