views

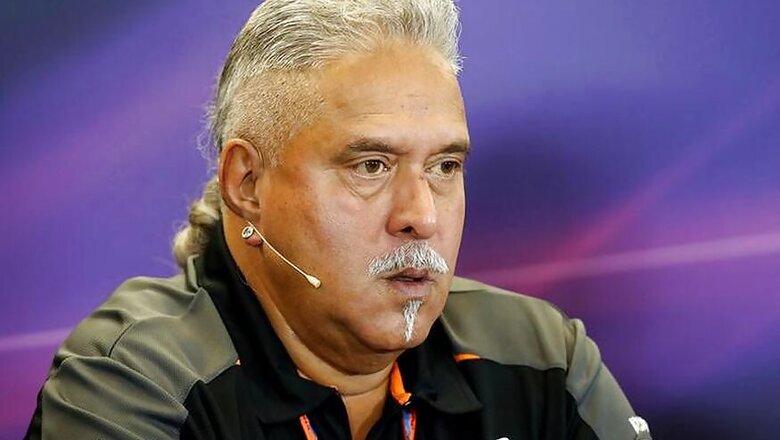

Hyderabad: Forcing beleaguered businessman Vijay Mallya, who owes over Rs 9,000 crore to several banks, to come back to India is a "bad strategy", says tech investor TV Mohandas Pai, who favours a negotiated settlement.

"I think it's a bad strategy to force him to come back because I don't think they have a strong case to do what they are doing," the former Chief Financial Officer of software major Infosys said.

Better strategy, he said, is to get the Debt Recovery Tribunal to pass an order invoking guarantee he has given to banks and attach his assets.

"Today, there is no proof for or against Vijay Mallya asking him to pay back any money. There is no court order. Dispute is in the court. Court has not given any order. Everybody is saying 'pay back, pay back' but pay back what? For paying back, you need a court order...exactly how much to pay and all that. I think it's being badly handled," said Pai.

Pai, co-founder of Aarin Capital, favoured requesting the Supreme Court to pass an order for negotiations with the liquor baron.

He noted that nobody has claimed that Mallya siphoned off money and indulged in money laundering till Enforcement Directorate (ED) went after him.

"Nobody knows what evidence ED has. None of the banks has found evidence, no body spoke about it. Now only ED is saying," said Pai, currently Chief Adviser to the Manipal Education and Medical Group.

He stressed the need for improving legal system in the country, noting that the case against Mallya was going on before DRT from the year 2013.

Pai said he was also against "naming and shaming" willful defaulters of bank loans.

"Once you lost money, there is no shame. Everybody knows you lost money, what is the shame? Shame is a middle class morality; shame is not there for business class or those who own business," he said.

"I don't think anybody's name should be made public. What should be done is: we need bankruptcy law to force them into bankruptcy, sell their assets and get back the money. Once there is bankruptcy law, they are forced into bankruptcy; it (their names) will automatically become public," Pai said.

Comments

0 comment