views

The Central has passed the Finance Bill 2023 with several amendments. A total of 20 Sections have also been added. Among the amendment is a proposal that will now bring the debt mutual fund on par with fixed deposits in terms of taxability, and no indexation benefits will be available for such MFs. Here’s everything you need to know about it:

What Is the Finance Bill 2023 Amendment?

The mutual fund-related amendment in the Finance Bill, 2023, also imposes the short-term capital gains tax on specified mutual funds (where not more than 35 per cent is invested in equity shares of domestic companies) that are bought on or after April 1, 2023.

What Are the Current Taxation Rules for Debt MF?

Currently, debt MFs are taxed based on the holding period. In case the debt mutual funds are held for more than three years, long-term capital gains tax is levied at 20 per cent with indexation benefits. However, if the debt MFs are held for a period less than three years, they are subject to short-term capital gains tax, which is levied as per the investor’s slab rate.

What Is Indexation?

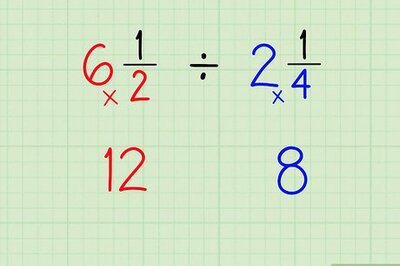

Indexation adjust the inflation impact on the investment. For example, if an investor invests Rs 10,000 in an asset and gets a total return of Rs 13,000 (including the original amount) after more than three years, the Rs 13,000 will be adjusted to the inflation impact and then taxed. The indexation reduces the tax liability. It is done through the Cost Inflation Index (CII), which adjusts the purchase price of an asset for inflation in the year of its sale.

How Will It Be On Par With Fixed Deposits?

Currently, fixed deposits (FDs) also don’t have the benefit of indexation. Now, the debt MF will also be treated like FDs.

What Will Be the Impact On Investors?

Gautam Kalia, senior vice-president at Sharekhan by BNP Paribas, said, “With the tax arbitrage gone, retail investors will stick to fixed deposits over debt funds. The potential for MTM (mark-to-market) gains at the cost of higher market and credit risk is just not enough of a premium for investors. They might as well stick to hybrid or equity schemes for their riskier allocations.”

Srikanth Subramanian, CEO of Kotak Cherry, said, “The amendment in the finance bill will have significant structural changes to the way we invest. For mutual funds to get investor interest, it will now have to purely be on their ability to add extra ‘risk-adjusted returns’ and not because of any tax arbitrage. The tax arbitrage that was available at an “instrument” level seems to be getting evened out across the board be debt MF or MLD.”

He added that however, this will benefit the corporate bond market where there will be renewed interest from retail investors, and this will also add depth to the liquidity which again will mean better pricing for the end customer.

Aniruddha Bose, chief business officer of FinEdge, said, “We view the move to remove LTCG benefits on debt funds as an overall negative. The mutual fund industry in India is already grossly underpenetrated, and the hitherto higher tax efficiency on debt funds served as an important lever for moving investors away from bank FDs into potentially higher wealth creators like mutual funds. Having wet their feet with debt funds, many of these investors eventually built up the risk tolerance for long-term compounders like equity funds as well.”

He added that retired people especially stood to benefit as debt funds like TMFs and FMPs could fill an important gap in their overall asset allocation due to their potential for providing FD+ tax adjusted returns over a 3+ year time frame. “The timing itself is inopportune because a lot of fixed income funds with potentially high YTMs are hitting the market right now. This move will hurt the ongoing financialization of retail investors in India and we hope it is rolled back.”

Lallit Tripathi, chairman and managing director of Vedant Asset, said “The proposal would take away the tax advantage on such funds (debt MFs) and plug a tax loophole used by high net-worth individuals and family offices. The impact on the mutual fund industry is slightly negative. It is estimated that non-liquid debt AUM is estimated at around Rs 8 lakh crore, which is roughly 19 per cent of total AUMs will be impacted as the relative attractiveness due to tax arbitrage goes away.”

Read all the Latest Business News here

Comments

0 comment