views

Atlanta: With Wal-Mart Stores Inc. becoming the latest retailer to launch a mobile pay system, there are more places than ever to break out a digital wallet to pay for the things you want.

Apple, Rite Aid, Starbucks, KFC and others are now using some form of mobile payment system with a smartphone seemingly in every pocket and purse. Forrester predicts that money spent in stores by people using digital wallets will grow from the $4 billion of 2014, to $34 billion by 2019.

But not all digital wallets are the same. So which ones should you use and how safe are they? Here's a look at mobile payment systems and how they work.

I want to get mobile and I want stuff, so what do I use?

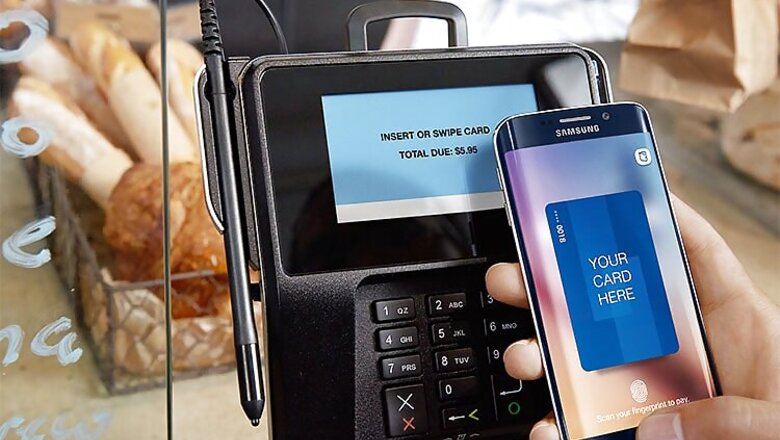

Smartphone owners can use Apple Pay, Android Pay and Samsung Pay, depending on what phone they have. All three services let people buy goods at participating stores by tapping their phones against the store's payment terminal. The user's debit or credit card on file then gets charged.

Merchant Customer Exchange, or MCX, set up a few years ago by a consortium of retailers and restaurants to create an industrywide mobile payment system, is currently testing its CurrentC wallet for iPhones and Android phones in Columbus, Ohio.

Of retailer-specific digital wallets, Starbucks and now Wal-Mart, are the biggest players. Starbucks' mobile app has more than 16 million users and accounts for 21 percent of its purchases. Wal-Mart's service won't debut until early next year, but 22 million customers already use the Wal-Mart app each month, and more than half of Wal-Mart's online orders are now coming from a mobile device.

Banks are jumping in, too. JPMorgan Chase is working on its own system for mobile payments expected to debut next year.

Why use mobile pay?

Sure, taking out a wad of cash or pulling a card from your pocket is not going to steal that much of your precious time. But compare that with sticking out your phone, not to mention with a cup of coffee in your second hand that is now free, and mobile pay will win the speed and convenience title every time.

Plus, have you seen those studies on the number of viruses and bacteria on your typical dollar bill? Gross.

Is it safe?

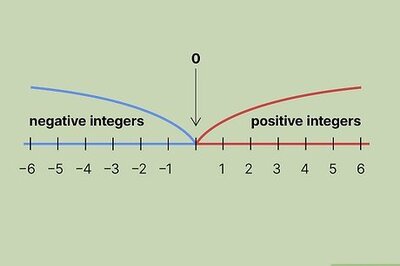

It's safer. With Apple, Samsung and Android Pay, you're assigned a substitute card number unique to the phone. The store gets this number, so if its system gets hacked, your main card number isn't compromised.

To work, the substitute number must be paired with a one-time code generated by that device. Hackers getting that number will also need physical possession of your phone.

Other services have different security methods. Wal-Mart, for example, says no card information is stored on the phone, but the real card number is still stored at what it says is a secure data center. But if that center gets hacked, your real number might get compromised.

Wal-Mart's app is hooked up to your debit or credit card. The Starbucks app is more like refilling a gift card, and the company doesn't store your card data.

How exactly do they work?

There are two main ways mobile wallets work in stores: by using wireless technology called NFC or by scanning a QR or other code.

Mobile-payment services from Apple, Google and Samsung all rely on NFC. After entering banking or credit card information to set up the service, the customer merely taps the phone next to a payment machine at the store and authorizes the purchase, usually with a fingerprint ID. But it works only in stores with newer, NFC equipment.

Samsung offers a backup: The phone can mimic the old-school magnetic signals produced by card swipes and work with most existing equipment. The CurrentC system and Wal-Mart's new mobile payment system use QR codes. For the Wal-Mart system, shoppers open up the app and then they activate the camera function to scan a QR code on the reader. That connects the phone to the basket of items they're checking out. Customers can put the phone away and an e-receipt application will be sent to the app. Chase Pay will also rely on QR scanned by a register when it debuts next year.

Comments

0 comment