views

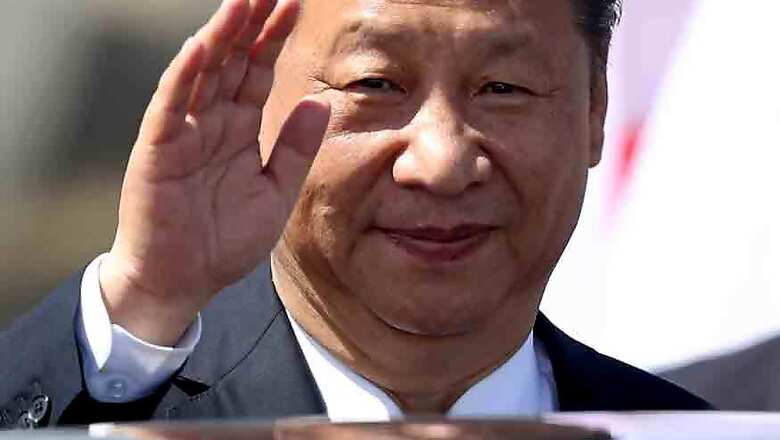

Beijing: As Chinese president Xi Jinping prepares to consolidate his power for a second five-year term at the 19th Communist Party Congress, beginning on October 18, he can point to another impressive period of growth for the nation's economy.

While the turbocharged days of double-digit annual expansion achieved in previous decades may be over, the Chinese economy still managed to expand more than 50 percent in yuan terms in the five years to the middle of 2017. Real gross domestic product has clocked an annual growth rate of 7.2 percent over that period.

The question he will need to address in the next five years is was this growth achieved on a sustainable basis or was it too reliant on surging housing prices and massive levels of borrowing. Two years ago, President Xi affirmed targets set in 2012 to double GDP and per capita income by 2020, and growth is on target to hit those goals.

The leadership has also vowed to rein in a rapid buildup in debt, and to shift the focus of the economy to domestic consumption from capital investment to put growth on a more sustainable long-term footing and avoid a painful adjustment later.

Economic growth accelerated to 6.9 percent in the first half of this year, thanks to a construction boom, well ahead of the government's target of around 6.5 percent. Still, disposable income growth had slowed for several years through the end of last year, though it picked up again in the first half of this year.

China's central bank governor Zhou Xiaochuan made a bullish and uncharacteristically explicit growth forecast over the weekend, saying growth could accelerate to 7 percent in the second half of the year.

COMPARISON TO US

China's economy is often measured against that of the United States, and is projected to become the largest economy in the world anywhere from between 2018 and 2030. It has continued to gain on the United States over the last five years, rising from 53 percent of the US economy in 2012 to 60 percent in 2016 based on US dollar figures, but on a per capita basis, US GDP is still seven times the size of China.

China's rapid economic progress has been a lightning rod for critics, led by US President Donald Trump, who claim it uses unfair practices to gain a trade advantage, stoking fears of a trade spat with the US.

REBALANCING ACT

A big reason for China's strong GDP growth is its abnormally large reliance on investment to backstop growth. Yet despite years of government rhetoric on rebalancing the growth drivers, progress has been slow as investment is still a bigger part of the economy than household spending.

HOUSEHOLD CONSUMPTION

Household consumption accounted for 39.3 percent of China's economy last year, according to data from the National Bureau of Statistics, up from 38.05 percent in 2015 and 36.7 percent in 2012. Despite last year's improvement for household consumption, the global average of over 200 countries was still much higher at 58 percent in 2015, according to data from the World Bank.

Government spending, meanwhile, has grown faster than personal spending as Beijing adopted an active fiscal policy to stabilize the economy.

CREDIT-DRIVEN GROWTH

High investment levels in China means credit growth is high. Indeed, outstanding bank loans have grown faster than GDP for decades.

DEBT BUILDUP

Reliance on ever increasing investment means its debt load is also rising. But even as policymakers have moved to wean the economy off its credit addiction, progress has been slow as debt continues to grow.

The ratio of total debt to GDP reached 257.8 percent in the first quarter of 2017, according to the Bank of International Settlement, from 187.5 percent five years ago.

There are some indications that debt in some parts of the economy has declined after the government stepped up efforts to reduce leverage, but it is too early to declare victory.

RELIANCE ON REAL ESTATE

Real estate has been a key growth driver, and is the main source of wealth for most Chinese citizens.

Authorities have announced a flurry of curbs to rein the red-hot property sector as home ownership has become increasingly unaffordable for a large portion of the population - gains in income have lagged house price growth in recent years.

The cooling measures appear to have dampened speculation as China’s new home prices in August rose at the slowest pace in seven months and fell or levelled off in more cities.

Comments

0 comment