views

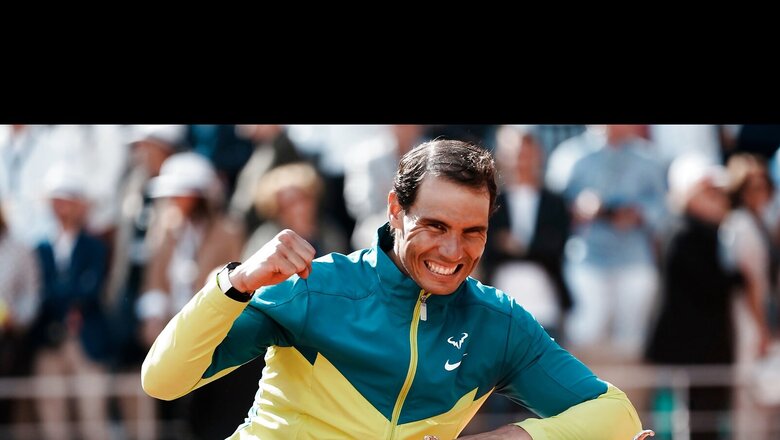

Last night, tennis legend Rafael Nadal clinched his 14th French Open win. Taking his Grand Slam streak to a record 22 titles, Nadal dominated the clay court against his Norwegian opponent Casper Rudd. The Spaniard was all of 19 years when he won his first French Open on the red court. And yesterday, this saga continued with an emphatic win of 6-3, 6-3, 6-0 over Rudd.

In general, Nadal’s life is a goldmine of iconic moments and memories for any sports enthusiast. But a closer look at Sunday’s Roland Garros 2022 final also presents a treasure trove of actionable financial insights for everyone. Read on.

Invest Time, Not Just Your Money

At 36, Rafael Nadal is the oldest player to win at the Roland Garros tournament. He began his A-list professional career almost 20 years ago, and that has been peppered with many highs and lows. Many thought he was done for after he failed to make it to the big leagues in 2015 and 2016. But six years down, Nadal is all firing and raring.

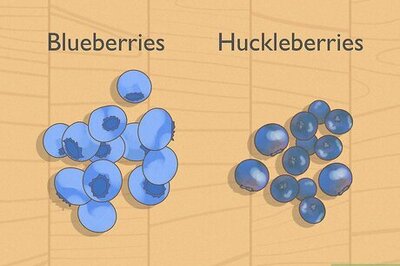

The temptation to earn quick fire, skyrocketing returns can disillusion even the very best. And that can lead us to invest heavily and only in very volatile and relatively new asset classes like cryptocurrencies. In comparison, staying invested in conventional, long-term wealth creation instruments like mutual funds, NPS, PPF and more can seem dull.

IN PICS | Rafael Nadal Oldest to Win Men’s Singles Title at Roland Garros

But don’t entirely let go of the Nadal-esque stocks and mutual fund units of your portfolio. These can be stocks of blue-chip, large companies that generate returns which are consistent, albeit not very high. Or they can be your mutual fund investments in index or large-cap funds. They’ll deliver, eventually. And with a bang.

Expertise Matters

Out of the 92 titles he’s earned in his career, 63 have been on clay. It’s no surprise he’s nicknamed the king of clay. He’s well-known and feared for his terrific forehand, which he used deftly during Sunday’s match. That’s what kept Rudd on the back-foot.

Expertise combined with experience is what makes a successful player. And if you want your portfolio to be one fine market player, it’s time to brush up on the expertise bit.

DIY investing is great, but consulting a financial planner on your portfolio can do you wonders. They’ll help you assess, reassess and align your financial goals. By giving you a clear breakdown of how you’re currently progressing and what changes you should make to reach your goals, they’ll give your investments the edge it needs.

Stay Put. Don’t Quit

Rafael Nadal’s career has been riddled with injuries. But most recently, there was much talk about the resurgence of his chronic, painful foot condition. On multiple occasions, Nadal had described the immeasurable pain he experiences because of this. And despite that, he managed to lift the coveted trophy on Sunday.

Staying invested in the markets is like swimming in choppy waters. It’s a test of your resilience. A quote, often ascribed to Roland Garros himself, reads “victory belongs to the most tenacious”. It’s very easy to panic and exit when the markets hit lows. You feel like you’re losing money. But in the long run, the markets, too, reward the most tenacious.

Don’t let a few reds and volatilities push you to entirely sell your investments and leave. Stay put. And in turn, you will see massive shoots of greens and handsome returns from your portfolio in the long run.

Read all the Latest Business News here

Comments

0 comment