views

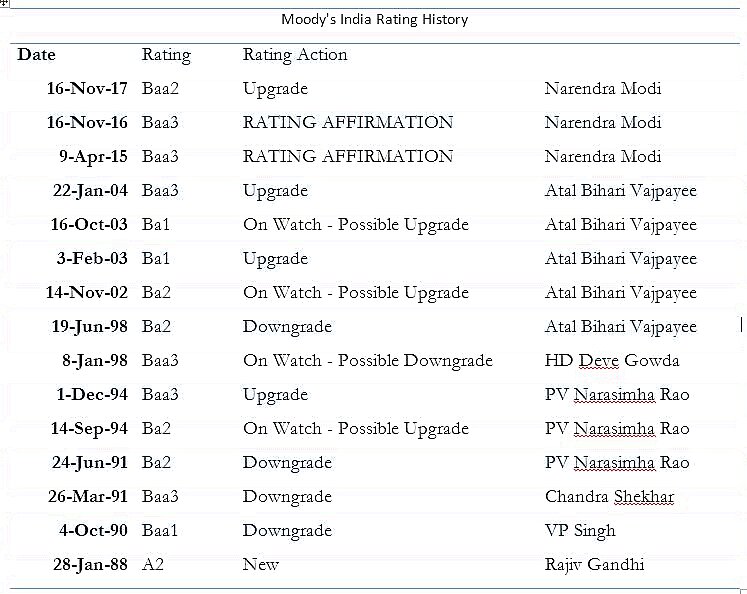

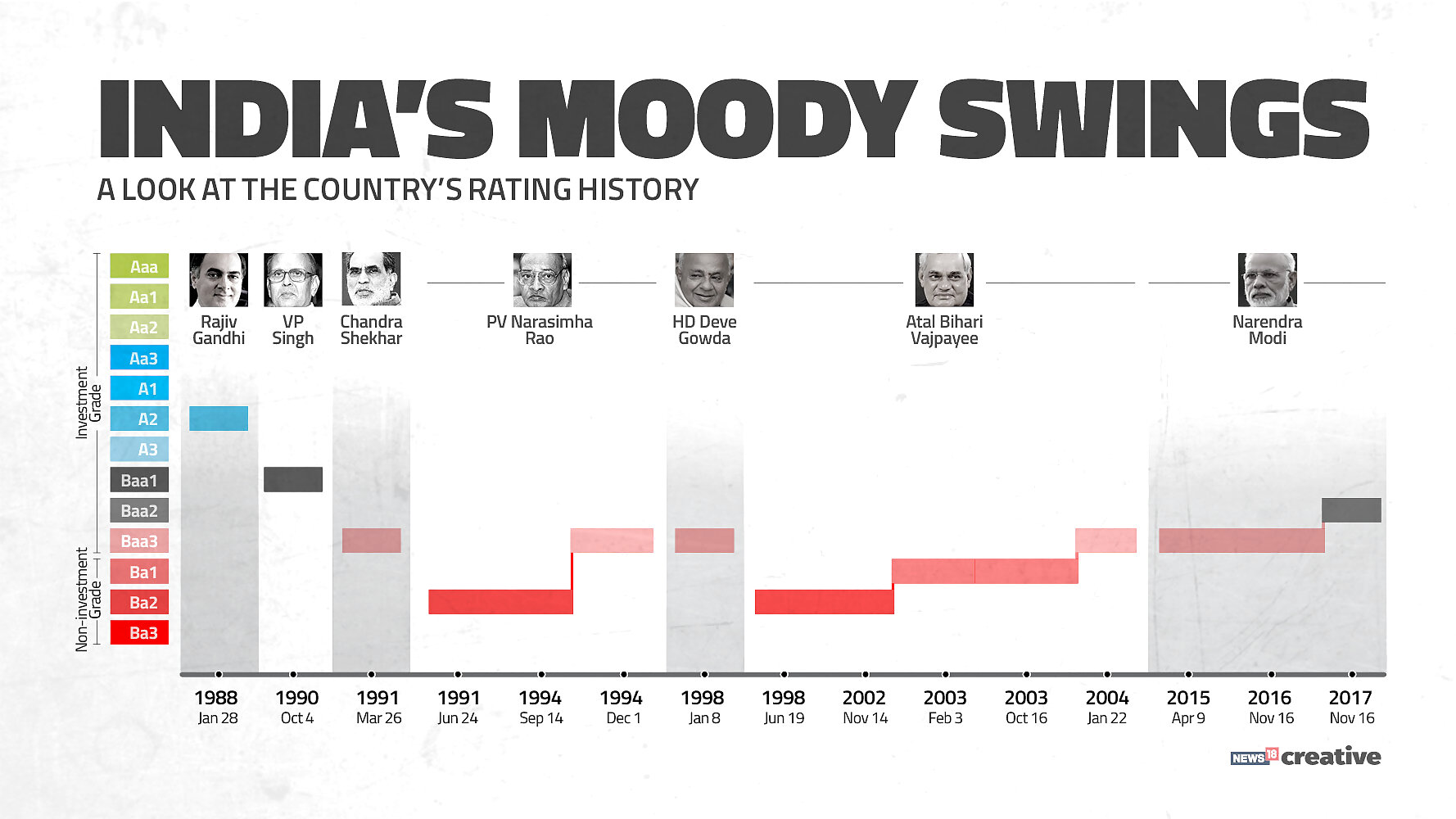

New Delhi: In a move that has already boosted the stock market, the US-based international rating agency, Moody's has upgraded India's local and foreign currency issuer ratings to Baa2 from Baa3 and changed the outlook on the rating to stable from positive.

The upgrade comes after 13 years when India was last upgraded to Baa3 in 2004.

While stock market and rupee surging are already expressing the cheer, here are the reasons why India made the jump.

Demonetisation and GST

The US rating agency has adjudged goods and services tax (GST) as one of the measures to not only improve the taxation system in place but widen the tax net as well, thus improving revenue.

"Reforms like Goods and Services Tax will promote productivity by removing barriers to interstate trade," said Moody's in a statement.

Demonetisation which has been facing severe criticism after most of the currency was returned to banks has also been viewed positively by Moody's.

"Government efforts to reduce corruption, formalize economic activity and improve tax collection and administration, including through demonetization and GST, both illustrate and should contribute to the further strengthening of India's institutions," the agency added.

GDP

Moody's in its report predicted a GDP growth of 7.5% in the financial year ending 2018 and further growth in the following years.

"Recent government measures to support SMEs and exporters with GST compliance, real GDP growth will rise to 7.5% in FY2018, with similarly robust levels of growth from FY2019 onward," said the rating agency.

The Narendra Modi-led government has been under the scanner for slumping GDP corresponding to previous years.

The rating agency also talked about plans in the pipeline, which if implemented, will further foster economic growth.

Monetory policies

While Moody's addresses the problem of non-performing assets and bad loans being a problem in the banking sector, it assesses that the measures taken to resolve those issues are positive

"Improvements to the monetary policy framework, measures to address the overhang of non-performing loans (NPLs) in the banking system are intended to reduce informality in the economy. "Adoption of a flexible inflation targeting regime and the formation of a Monetary Policy Committee (MPC) have already enhanced the transparency and efficiency of monetary policy in India. Inflation has declined markedly and foreign exchange reserves have increased to all-time highs, creating significant policy buffers to absorb potential shocks," Moody's said.

Aadhaar

Introduction of the Aadhaar card as a compulsory identifier and linking it with PAN accounts has acted as one of the reasons for the upgrade.

Moody's in its statement said that introduction of these reform measures not only boost business confidence in India but eliminate the idea of forgery.

Direct Benefit Transfer

According to Moody's, the direct benefit transfer scheme has provided respite to the consumers by lowering fund scatter and increasing subsidy allocation.

The rating agency described this move as "reducing informality in the economy."

Comments

0 comment