views

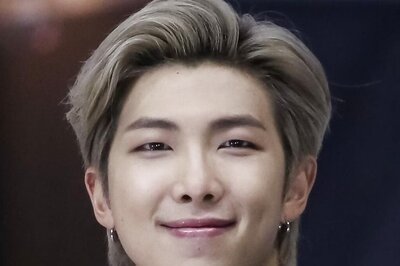

Pawan Munjal

Age: 57

Profile: Managing Director and CEO of Hero MotoCorp

Fast Facts:

- His father Brijmohan Lall Munjal is No 21 on the Rich List

- Keen on making Hero a global two-wheeler company

Pawan Munjal is the quintessential behind-the-scenes operator; the kind who’s more comfortable on the shop floor than at the launch of his latest motorbike. The shy, introverted 57-year-old elder son of Brijmohan Lall Munjal is today deeply involved in a closely guarded project to quickly chivvy up Hero’s technological capabilities. After parting with the Honda Motor Company, technology is Hero’s Achilles heel. Munjal and his top team are on a mission. In the past six months, the research and development team has already been beefed up with 250 engineers.

It’s a race against time

Come March 2012, industry buzz has it that Honda is preparing to launch a new 100 cc model that will strike at the centre of the Hero citadel. And that will kick-off a vigorous battle between the two erstwhile partners of one of the most successful joint ventures in recent times. The Hero MotoCorp stock was among the highest performers on the bourses, jumping from Rs 189 to Rs 2,028 in the past 10 years.

Munjal may have seen the writing on the wall for a while though. About four years ago, he brought together 40 executives from the Hero Group to plan new business opportunities. A consultancy was engaged to prepare a report on the Indian auto industry. With the benefit of hindsight, an industry insider says, “We didn’t know it then, but it is now clear he was planning for life after Honda.”

When Honda delivered its démarche last year, stating that they would enter the 100 cc space, the Munjals didn’t waste any time before swinging into action. Brijmohan Lall Munjal and his sons Pawan and Sunil immediately closed ranks to negotiate with Honda. For them, the only question was: How much do we have to pay Honda? In the end, Honda’s stake is believed to have been bought out at almost half the market price. (The final price was never disclosed.) Another sore point was the royalty Hero Honda had been paying. It had been increasing steadily over the years and last stood at 2.7 per cent of sales or Rs 530 crore - Rs 540 crore a year. The duo cleverly negotiated a lump sum payment of about Rs 187 crore per quarter that was not dependent on net sales, effectively reducing the outgo.

“They could very well have cashed out their stake like a lot of Indian promoters have done. But the thought never even occurred to them and that’s heartening to see,” says an industry executive who knows the family. He declined to be named.

Those who know Pawan say he believed the joint venture agreement constricted the Hero Group from expanding at a much faster clip. While it depended on technology from Honda, it could not set up its own research and development facilities. A bigger thorn in the flesh was the fact that the company couldn’t build an international presence.

On December 16, 2010, a few hours before he rose to make “the most important announcement in the last 25 years”, Pawan Munjal spoke about a bright future for the company, in an internal note sent to his employees. It’s a future that is filled with opportunity but also comes with a set of challenges.

The road ahead

The first big challenge the company faces is getting technology in place before June 2014 when Honda’s technological support runs out. Over the years, two-wheeler technology has evolved to a level where most changes are incremental. “It is now possible to buy them off the shelf. It is adapting the technology to Indian conditions that is the key challenge,” says Dilip Chenoy, former director general of the Society of Indian Automobile Manufacturers.

That seems to be part of Munjal’s game plan. At a recent gathering in London to announce the launch of their new brand identity, Pawan Munjal said that Hero is in talks with a few engine houses and design companies. However, company insiders say Pawan already has the tie-ups in place and that they will be announced in due course.

For now, Hero MotoCorp, as the new company is called, is working on beefing up its research and development team. The 250 new engineers are working on acclimatising the two-wheeler technology to Indian conditions. The Munjals regularly hold meetings to review its progress. The main focus remains the 100 cc segment where the company has a leadership position. Their 100 cc Splendor and Passion are the world’s top two selling models.

Meanwhile, Honda Motor Co is planning to launch its 100 cc bike at a price point lower than Hero MotoCorp. The Honda brand has top-of-the-mind recall among Indian consumers and if the price is right, Hero MotoCorp could find itself battling for survival. “We will do everything to defend market share. If we have to cut prices and reduce our margin, so be it,” says Ravi Sud, chief financial officer. With Rs 4,000 crore cash on its books, the company can afford to fight a few price wars.

The Munjals are also keen on making Hero a global company. In the past, their joint venture agreement with Honda prevented them from exporting to markets outside India — except to Colombia where the hot selling Splendor and Passion have made theirs the largest two-wheeler company in that country.

Tapping into Africa, Latin America and South East Asia, the three markets the company plans to get into, will be a tough challenge. First off, the company has decided that it will not play the price game there, which would bring it in direct competition with Chinese brands. So it is more likely that it will end up competing with homegrown Bajaj and erstwhile partner Honda in these markets. The belief inside Hero is that if Bajaj can export a million motorcycles, then there is no reason why they cannot, in time, notch up similar numbers.

Anil Dua, senior vice president sales and marketing, says that market studies are on and they plan to customise their offerings for each market. For instance, in Nigeria’s one-million-units-a-year market, 80 per cent of motorcycles are used as okadas or taxis. Accordingly, the motorcycles will come with longer seats. The pricing is yet to be decided.

Nine months after the Hero Group and Honda rode off in different directions, very little has changed on the ground. At its quarterly results announced last week, profits rose 20 per cent while sales were up 28 per cent. At 1.5 million, last quarter units sales growth was faster than rivals Bajaj and TVS. A day later its stock rose 4 per cent to Rs 2,066. It is up almost 20 per cent since the separation with Honda last December. With plenty of cash on their hands, there are even murmurs that the company is considering entering into the light truck segment. For now, the Munjals haven’t skipped a beat.

Comments

0 comment