views

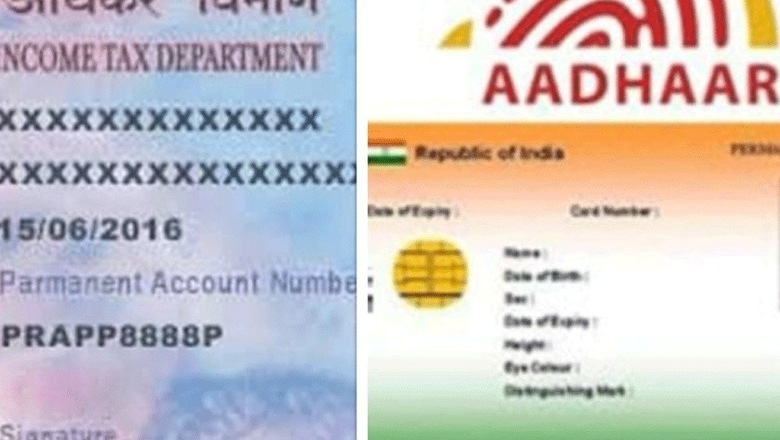

New Delhi: Finance Minister Nirmala Sitharaman on Friday declared that PAN (permanent account number) and Aadhaar documents have become interchangeable.

Those who have Aadhaar will not need to use their PAN details to file their income tax returns (ITR). Through this modification, the government has practically rendered the PAN useless since it does not serve any exclusive function anymore.

"Mr Speaker, more than 120 crore Indians now have Aadhaar. Therefore, for the ease and convenience of taxpayers, I propose to make PAN and Aadhaar interchangeable and allow those who do not have PAN to file their income tax returns by simply quoting their Aadhaar number and also use it wherever they are required to quote PAN,” Sitharaman said in her Budget speech.

Currently, it is mandatory to quote the PAN number for filing ITR.

The move is aimed at enabling individuals to use their Aadhaar cards instead of PAN to conduct financial transactions — for instance, mutual fund investments, buying gold, among others. The use of Aadhaar is expected to improve tax compliance and ease the process of tax payment.

Earlier in April, the government had amended the rule and made linkage of Aadhaar and PAN mandatory for filing ITR.

Comments

0 comment